-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Christopher Chiedozie Eze, Comfort Chikezie*, Mac-Anthony Chukwuka Onyema, Johnmartins Ndubuisi Agu and Esther Ugochukwu Nwachukwu

Corresponding Author: Comfort Chikezie, Department of Agricultural Economics, Federal University of Technology, Owerri, 460114, Nigeria.

Received: April 14, 2024 ; Revised: June 26, 2024 ; Accepted: June 29, 2024 ; Available Online: November 15, 2024

Citation: Eze CC, Chikezie C, Onyema M-AC, Agu JN & Nwachukwu EU. (2024) International Trade and Economic Growth in Nigeria (1981-2015): An Empirical Study. J Agric For Meterol Stud, 3(1): 1-11.

Copyrights: ©2024 Eze CC, Chikezie C, Onyema M-AC, Agu JN & Nwachukwu EU. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Views & Citations

Likes & Shares

International trade, on the whole, acts as an antidote for economies in a struggling state. This investigation examined the relationship between foreign commerce and growth in GDP in Nigeria between 1981 and 2015. The present inquiry looked at the tie between economic growth and international trade in the case of Nigeria, from 1981 to 2015. It analyzed various factors such as exchange rate, labour force, inflation, foreign investment, and open trade to determine their impact on the relationship. The Autoregressive Distributed Lag (ARDL) approach was the primary tool for data analysis. The findings demonstrate that, over the short and long terms, foreign direct investment considerably increased economic growth. The economy was negatively impacted by both inflation and the foreign exchange rate, indicating an unstable macroeconomic climate that inhibits Nigeria's progress. It was evident from the moderately negative significant effect of trade openness that Nigeria's open trade policy has not been properly regulated. In summary, the study finds that foreign trade has not notably boosted the Nigerian economy. It argues for a more result-oriented policy to drive to revamp the Nigerian domestic economy.

Keywords: The autoregressive distributed lagged model, Global trade, Nigeria, Growth

INTRODUCTION

Cross-national trade is vital to growing any economy and its overall development. Global trade, first, provides nations who engage in trade with the chance to expand their business activities and to acquire products and services that may be in short supply domestically. It is a big tent and a big opportunity. Trade fosters relationships between countries, particularly when one has a comparative advantage-that is, can make a product or offer a service at a lower cost than another place can. Adu-Gyamfi [1] have found that foreign trade promotes the spread of novice ideas and increases the otherwise limited area for efficient problem-solving within and between countries, thereby augmenting the global supply of 'common goods. In Barro and Sala-i-Martin [2], work shows that these symbiotic fruits of international trade are especially likely to enhance the economic development of resource-rich countries that, in turn, have ample supply chains for the finished products of their natural 'partnerships' [2].

Over the years, international trade has greatly amplified global interconnectedness, bringing with its substantial growth to both the developed and the emerging worlds. The essence of globalization is, in effect, the appearance of an international linked data system. STATISTA's 2023 dossier contains evidence supporting an important shift in global export trade over the past four decades. It documents that the average annual volume of foreign export commerce has increased, from $2.05 trillion in 1980 to around $22.9 trillion last year. Yet despite this huge overall increase, the nations of sub-Saharan Africa, including Nigeria, contribute only 3% to the world total. The Nigerian economy relied heavily on the export of agricultural products for both domestic use and foreign exchange before the move to crude oil exploration in the 1960s. These exports included cocoa, palm kernels, cotton lint and seeds, and rubber, which are all abundantly grown in Nigeria.

With the start of the oil boom in Nigeria, more foreign exchange earnings were available for the trade to grow, and to fuel the economy. In 2012, export earnings stood at US$97.46 billion, while import earnings were at US$70.58 billion-which resulted in a trade surplus of close to US$27 billion that year. The third quarter of 2013 saw a net export total of just over US$11 billion. (By comparison, the second quarter of the same year saw a net export total of US$11.7 billion, according to figures from the Central Bank of Nigeria [3]). Trade between the third quarter of 2013 and the third quarter of 2016 grew by over 19 percent, according to figures from the National Bureau of Statistics [4]).

However, Nigeria's total external debt did increase from just over $8 billion in 1980 to well over $32 billion in 2014 [5]. And in quarter two of 2022, the overall foreign debt of the country stood at $40.06 billion (or ₦16.61 trillion) [6]. At the end of quarter four of the year 2022, it rose to ₦44.06 trillion [7]. Indeed, there is a sense in which the increased domestic and external borrowing by Nigeria in recent years was bound to have some impact on the export trade of the country. And this is where some of the so-called "trade reforms" come in. Ugwuanyi [8] noted that the real purpose of these measures was to straighten up the international trade to achieve the much-desired economic growth. Typically, times of macroeconomic uncertainty are when this occurs. Trade changes serve as triggers in such instances, and private investors develop into significant economies. The reforms provide up new job chances by facilitating capital mobility for investment across borders worldwide.

In carrying out its national development plans, the Nigerian government has also pursued policy reforms. The Fourth Plan (1981 to 1985) and the Fifth Plan (1988 to 1992) were the first to represent this reform. While the Fourth Plan was a continuation of earlier plans, the period of the 1980s and early 1990s was a unique time in the privatization and public-sector enterprises of Nigeria. The number five strategy, according to Ugwuanyi [8], was designed to increase productivity of labor and privatize the public sector. Ugwuanyi [8] further explains that the fifth policy reform removed many of the restrictive trade policies of the previous decade, thereby creating a more open trade environment.

Conflicting outcomes of inflation-economic growth nexus in Nigeria have been reported in past research works. While some studies have found a direct link [9], others suggest that there is no direct correlation [10,11]. The present study aimed to bridge the gap in the literature caused by the divergent results. Given that price stability and a decline in exchange rate volatility was the main drivers of the plan during the period, it also sought to investigate the relationship between inflation in foreign exchange and economic growth in Nigeria.

The study is further divided into two sections: sub-division two evaluates the literature and tries to illustrate the relationship between growth and commerce, while sub-division three describes the models and methodologies used in the paper. The fourth subsection offers an interpretation of the study findings. Finally, the recommendations and conclusion are informed by the final part.

EMPIRICAL LITERATURE REVIEW

Open economies are believed, almost universally, to perform better than closed economies. In line with this belief, many research studies have tested the relationships between trade liberalization and growth [12,13]. Some of the authors Zahonogo [13] and Were [14] looked at these associations on a cross-country basis, while others examined individual countries [15-19]. Both approaches are valuable; the multi-country investigations allow the reader to compare practices and policies in different areas, and the case studies of a single country reveal unique insights into the condition of the national economy and the period under review. Across many of these analyses, one finds surprisingly consistent support for the proposition that open economies grow faster than closed ones.

A 2019 panel study by Ijirshir [20] looked at the long-term effects of trade openness from 1975 to 2017 and found that increased trade openness had a direct positive impact on economic growth that lasted over time. However, the short-term analysis of the same study revealed mixed results. More specifically, the vulnerability of an economy that is open to trade is limited if a recession looms in its trade partners. More recently, Oppong-Baah [21] and his co-authors in 2022 looked at how economic growth is affected by trade liberalization and the pathway of influence (as in comparative advantage and factor content) that leads to which using the pathway of currency exchange rates. Their findings showed that in Ghana and Nigeria, the positive effects on economic growth don’t last and are weak in short-term analysis.

The research of Adu-Gyamfi [1] delved into the economies of chosen nations in West Africa, seeking to understand the "driving effects" of inflation and trade on these economies from 1998 to 2017. They used panel data and performed what is called an Ordinary Least Squares analysis, along with some other techniques, and found that the only factor that really bore any weight on the growth of the economies studied was the exchange rate. And even there, the effect was not very large. Edoumiekumo and Opukri [22], as well, found that trade was not much of a stimulant to growth in Nigeria, even when the prices of oil rose sharply. They also performed an analysis called the Granger Causality Test and found out that, in no way, was there a connection between trade and growth, at least in the long run.

The current literature that has been reviewed tends to support the notion that trade liberalization promotes economic growth more than trade protectionism, and that it does so to varying extents. Omoju and Adesanya [23] as well as Oppong-Baah [21] are among the sources that back up this argument. However, the authors also came across several sources that dispute trade liberalization's growth benefits. Conflicting evidence was presented by Taylor cited in Babatunde [24], Zahonogo [13], and there is cause to consider the why behind these different results. Meanwhile, the results of the studies reviewed in the paper, for the most part, sided with the favoring of trade liberalization. The only real notable exception among them was the dispute presented by Kim [25] and Were [14]. Chia [12] asserts that disparate growth rates among industrialized and developing countries can be ascribed to the fact that the nations which are still developing depend massively on the export of primary commodities with which to earn foreign income. Put another way, countries that grow the fastest are also the ones that export the most, and the ones that export the most are also the ones in which the growth of the manufacturing sector is fastest. By contrast, where the export of primary commodities is the main means of foreign income growth, the industrial base is weak, and the growth rate is low.

Literature disputes the idea that trade is a chief engine of a nation's prosperity, as claimed by Zahonogo [13]; Kim & Lin [26] & Chia [12]. Numerous studies have compared countries that are more open to trade with those that are less open to figure out whether trade is a significant driver of growth. It is still unclear to what degree this is true, particularly in developing nations like Nigeria. Therefore, there is no proof in the literature that commerce with other countries has a beneficial and substantial impact on the progress of less developed countries. While Kim [25]; Herzer [27]; Yaya [2] citing Haussmann, Hwang, and Rodrik discovered that trade has a negative impact on growth in less developed countries, Muhammad, Neelam, and Muhammad [28], as well as Chia [12], found a positive and significant impact of trade on the economic growth of less developed countries.

The methodology utilized [29], the analytical tools, the explanatory variables included, as well as the many proxies used for international commerce, may be to blame for the diverse results from the literature reviewed about the impact of trade on economic growth. For example, Adu-Gyamfi [1] looked at the relationship between growth, inflation, and free trade in a few West African nations between 1998 and 2017 using various methodologies, and they came to a variety of conclusions. However, the fixed effect test did not show that there is a significant relationship between inflation and GDP. In the case of trade openness, the pooled OLS estimation yields a negative and statistically significant estimate, while the fixed and random effects estimations yield a small estimate.

Different tools invariably lead to different results; the selection of a tool is almost as critical as the finding of the result to the credibility of the work done. Nonetheless, the work is also persuasive when it is based on good theory and a framework that reflects how the factors relating to the part in a more predictable and controlled setting are arrayed. The model used in this study, ARDL was preferred due to the following reasons. Onyeneke [30] noted that the model considers immediate and distant effects of explanatory variables. Moreover, the ARDL is used when variables are integrated of order one or when some are stationary and others are integrated of order one.

Furthermore, a number of earlier studies [31-33] examined the impact of technological diffusion on national growth, while several others [2,34-36] concentrated on the role of capital depth on economic growth. However, the amount of literature focused on labor is extremely limited, with only a few studies [28,19] having been published to examine the impact of the working population on the Nigerian economy. As far as literature review is concerned, it can be critiqued that the investigation of how workforce impacts the economic growth of Nigeria has not been researched much empirically. This paper was also partly designed to also look at the effect of labour force on the rate of economic growth in Nigeria.

Given the above, the current article - effects of international trade on the economic growth of Nigeria therefore seeks to examine the extent of effects of some of the macro-economic variables such as investment, open trade, inflation, and exchange rate and labour force on Nigeria’s economic growth between the years 1981 and 2015. It also examined how these macroeconomic factors affect the economy as a whole and demonstrated the long-term effects of trade on the Nigerian economy. It is believed that the study's conclusions would shed more light on the on-going discussions about whether or not a country's growing integration into the global trade system will result in higher growth.

ESTIMATION TECHNIQUES

Data/Sources

Table 1 presents data (1981-2015) used for the study and their sources. We collected real gross domestic product data from the Apex Bank of Nigeria and Macro Trends data base. Labour force, foreign investment, interest rate and open trade data, contrarily, were obtained from Macro Trends. For Nigeria, we were able to locate exchange rate information from the Sparkgist online database. On the other hand, real gross domestic product was stated in values in absolute terms, whereas inflation, workforce, and inflation were all expressed in percent.

Analytical Methods

To assess the direct and indirect effects of macroeconomic estimators on Nigeria’s economy from 1981 to 2015, autoregressive weighted lagged method was applied. The model consists of the previous numeric of the explanatory variables and those of the dependent variables. The autoregressive weighted lagged technique was used to evaluate the direct and indirect effects of macroeconomic estimators on the Nigerian economy between 1981 and 2015. The ARDL procedures are useful when there is a requirement to make strategic decisions concerning previous values of both dependent and independent variables. This is because the dependent variable is likely to be correlated with values from previous periods [37]. The use of the model was further justified by the likelihood of the variable being connected to values from previous periods [37]. This is due to the likelihood that the variable being described can be connected to values from previous periods [37]. Simply put, when the series are I(0), I(1), or a combination of the two, the ARDL model specification is especially applicable [38].

The present investigation's ARDL is provided as follows:

Where

: Real Gross Domestic Product (proxy for economic growth); : Previous values of explained variables; : Explanatory factors include: (EXCR: Exchange rate; LAB: Workforce; INFL: Inflation; FDI: Foreign Investment; TOPN: Open Trade (Net-Export)); : Previous values of regressors; : Optimum preceding value order for explained variable (years); : Optimum preceding order for explanatory variables (years); : Constant; : Lag weight for response factors (short term coefficient); : Lag weight for explanatory factors (long-run effect coefficient); : Stochastic random term

If the mean, covariance, and variance of a time-indexed data collection remain constant throughout time, it is considered stationary. A pre-test utilizing the Augmented Dicker Fuller test was carried out to make sure that no variable is integrated of order I(2). Additional pre-estimation tests in the research included the optimal lag order selection, the ARDL Bounds test, and post-estimation tests for normality, autocorrelation, heteroscedasticity, and parameter stability (CUSUM graph). As advised by Magaji, Muhammad, and Aliyu [39], the natural log form of the study's variables is helpful in transforming highly skewed variables into an approximation form.

RESULTS AND DISCUSSION

This segment of the paper displays and interprets the results of the pre-tests and the main tests conducted for assessing the impact of the selected macroeconomic variables on growth in Nigeria.

Diagnostic Test of Data

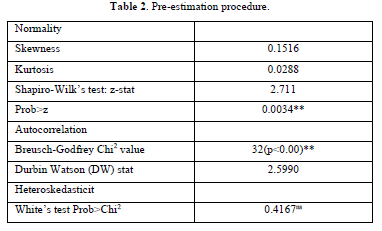

Normality test: A z-statistic of 2.711 (p<0.005) from Table 2's Shapiro-Walk's test indicated that the samples' distribution is significantly different from the normal distribution, which is why uniform log transformation was used. The kurtosis and lopsidedness values were 0.1516 and 0.0288, respectively.

Auto-correction test: As demonstrated by the significance of the Chi2 value of 32 in the Breusch-Godfrey serial correlation LM test, there is a serial correlation present in the model. The likelihood value of the F-Statistic attests to the serial correlation of the residuals. Since the model's DW statistics (2.05), which are between 1.5 and 2.5, indicate that it possesses first-order serial correlation. By incorporating the variables' lag term, the issue was resolved.

Unit Root Test of Factors

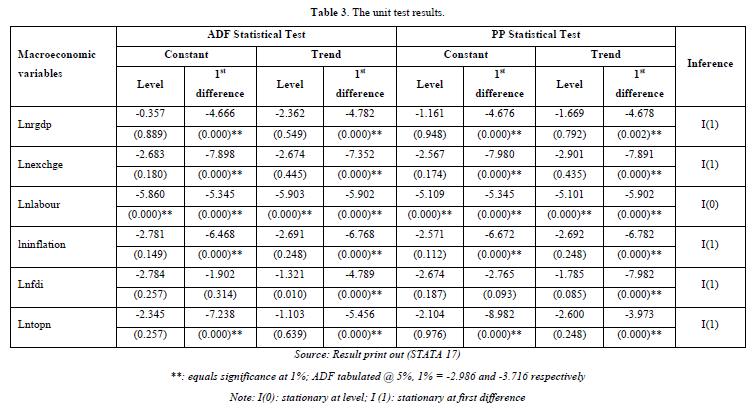

The unit root tests results are shown in Table 3.

Dickey Fuller and Phillips Perron t-statistics indicate that at initial differencing, the unit-root derived from the model indicates that all the variables included were stationary, with the exception of the workforce, which was stationary at level. This suggests that the ARDL model should be used because the model has mixed orders of integration [39].

Optimal Lag Selection

Table 4 displays the findings at both the upper 1(1) and lower 1(0) critical bounds. Lag 4 is shown to be the ideal lag in Table 5’s results for the Hanna-Quinn Information Criterion, the Akaike Information Criterion, and the Schwartz Bayelsian Information Criterion. Following the identification of the ideal lag, the Bound Co-integration test was performed to ascertain whether co-integration existed between the model’s variable components.

The findings showed that the F-statistic value was higher than the upper critical bound value, indicating that the variables had a long-term relationship. Testing the null hypothesis, which asserts that there is no co-integration among the variables, was done under the requirement that the F-value be smaller than the lower critical bound I(0). However, if the F-value is greater than the upper critical bound I(1), the alternative hypothesis is confirmed.

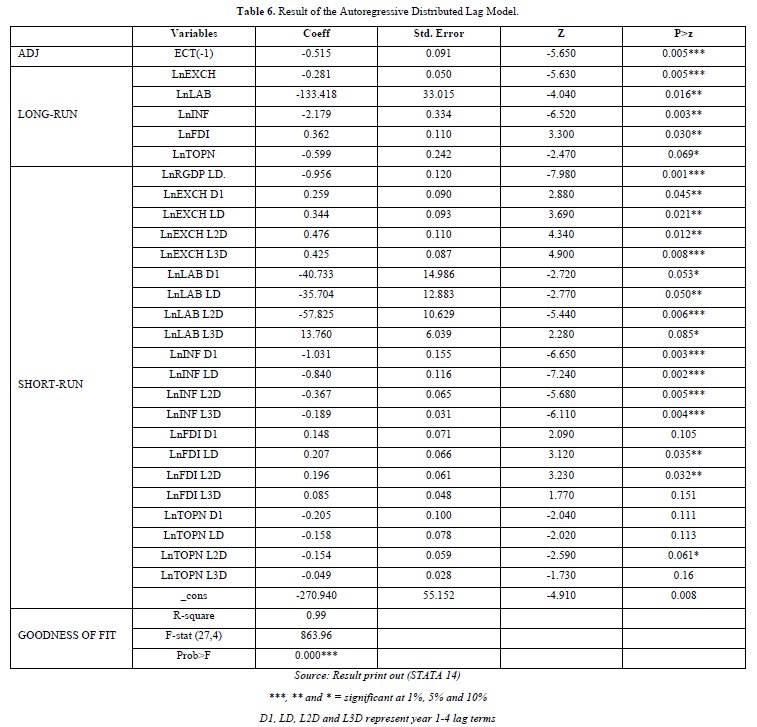

As previously mentioned, the unique quality of the ARDL lies in its capacity to facilitate simultaneous estimation of the model's long-term and immediate response coefficients and so in accordance with the model shown in Table 6, ECT(-1)-which determines how quickly the real gross domestic product (RGDP) returns to equilibrium in the event of a disturbance in the model-was 0.515 (p 0.00). This means that the random residual processes that were generated and their time-varying adjustments are rectified at a rate of 51.5%, resulting in an adjustment of the RGDP's 51.5% disequilibrium from the previous year the year after. The ECT meets the theoretical criteria as its absolute value is less than one and it is negatively significant. Moreover, it confirms the co-integration link.

The Table 6’s results demonstrate that the exogenous factors account for about 99% of the variability in the endogenous variables, suggesting a well-fitting model. Furthermore, a shared significant impact of the factors on RGDP is indicated by the F-statistics, p-value (0.000<0.05). As seen in the Table, every variable that was included-aside from FDI-had an indirect statistically significant long-term effect on the RGDP. Therefore, over time, ceteris paribus, a 1% increase in EXCH, LAB, INF, and TOPN will cause the RGDP to decrease by 28.1%, 13341%, 21.8%, and 59.9%, respectively, but a 1% increase in FDI will cause the RGDP to increase by 36.2%. The coefficients for TOPN, LAB, FDI, LAB, and EXCH were -0.599, -0.281, -133.418, -2.179, and 0.362, in that order.

The result further revealed that as exchange rate increased by a 1% RGDP fell by 28.1%, in the long run indicating an inverse relationship. This conforms to Hafidh and Soud [40] who investigating on Tanzanian economy found that exchange rate negatively impacted it. Other works which revealed indirect relationships include Ariccia [41]; Kang and Dagli [42] and Taresenco [43]. For fear of possible loses as noted by Senadza and Diaba [44], some investors may not promptly invest in an atmosphere of exchange rate rise, and this could be a plausible explanation of the negative sign of the parameter estimate. Contrasting findings from related works on exchange rate and economic growth have also been documented. For example, Senadza and Diaba [44] found a positive significant effect of exchange rate on trade in selected Sub-Saharan countries.

The research outcome follows the inverted form of J curve first introduced by Megee (1973) as cited in Crookes [45] and this indicates a nonlinear relationship between exchange rate and growth. Crookes [45] further explains that J curve shows an initial trade deficit resulting from currency depreciation and then followed by trade improvement after sometime. Contrarily, this current result shows a positively significant effect on economic growth in the short term and a negatively significant effect in the long term.

Additionally, the result shows inflation significantly decreased growth both at the immediate term and over time. The long-run result shows one unit increase in inflation decreased economic growth by 2.18 units. The negative significant result conforms to the results of Adenomon & Ojo [46] which indicated an indirect connection of growth and inflation in which 1% increase inflation leads to 0.003% decrease in growth. Other previous works which found indirect relationship with growth include Adamu and Bawuru [10] and Bashir [11]. The negative connection can be attributed to depreciation of currency and in the words of Ijirshar [20] explains why importation of finished goods is relatively highly prices for ailing economy reducing their overdependence on imports through the policy of trade restriction. Notably, inflation lowers investment levels as well as the effectiveness with which production components are employed. High level of inflation signifies a loss in the rate at which Nigeria compete with other foreign business partners but with proper trade policy in place, more foreign investors could be attracted and the nation will be on top speed to economy recovery.

Additionally, the workforce effect on Nigeria's economy reveals that, over time, the GDP fell by 133% for every unit increase in the working population. The outcome, however, opposes the prediction made by Magaji, Muhammad, and Aliyu [39] that a larger working population would spur economic expansion. According to a related study, Ogundipe and Adenikan [19] found a direct correlation between growth and labor force participation, with an increase of 0.4%. The findings of our current study may be related to the nation's rising unemployment rate, which has left a large portion of the working population unemployed and poses an economic threat to the nation because of young unrest and other vices tied to unemployment.

Additionally, the workforce effect on Nigeria's economy reveals that, over time, the GDP fell by 133% for every unit increase in the working population. The outcome, however, opposes the prediction made by Magaji, Muhammad, and Aliyu [39] that a larger working population would spur economic expansion. According to a related study, Ogundipe and Adenikan [19] found a direct correlation between growth and labor force participation, with an increase of 0.4%. The findings of our current study may be related to the nation's rising unemployment rate, which has left a large portion of the working population unemployed and poses an economic threat to the nation because of young unrest and other vices tied to unemployment.

Furthermore, a striking and indirect correlation was observed between free trade and growth. The findings showed that economic growth dropped by 0.6 for every 1% hike. The unstable state of the economy, which leaves it susceptible to a continuous trade deficit-a drawback of trade openness-are responsible for the negative significance of the RGDP's trade openness. The result also suggests poor growth in Nigerian economy resulting from unrestricted trade openness proposing the need for an appropriate trade policy supported by an improved institutional quality to enhanced Nigerians deals with trading partners. This result is consistent with studies conducted by Wani [47], Kalu, Mgbemena and Ewurum [48], and Degu, Bekele, Ayenew, and Abete [49] that show that open trade reduces the economic wealth of emerging economies such as Nigeria due to unfavorable trade terms and the continuous depletion of foreign reserves. This finding on the other hand, contradicts Ijirshir [20] who found a positive significant effect on growth for selected ECOWAS countries. Kong [18] also found a significantly positive effect of open trade on China’s economy. Similarly, Oppong-Baah [21] found a direct link where a unit rise in free trade resulted in 0.001 unit increase in economic wealth.

The result also shows that FDI significantly increased growth over time. Showing that for a 1unit rise in FDI economic growth rose by 0.362%. This finding supports the result of Zahonoga [13] whose result indicated that a 1 % increase in foreign investment increased growth in selected developing countries by 0.42%. The result also is conforming to earlier works done by Chikeziem [20]; Ismaila [51] and Ani, Ojiya, and Abdulwahab [52].

Table 6 shows that the short-term coefficients were determined after the long-run coefficients were estimated. In order to reflect the dynamism of the bound integration technique, the short-run model included up to 4-year lagged exogenous variable lagged and a year lagged endogenous variable lagged, based on the lag selection criteria presented in Table 4. With the exception of LnFDID1, LnFDIL3D, LnTOPND1, LnTOPNLD, and LnTOPNL3D, the coefficients of all the included explanatory variables had notable short-run effects on the RGDP at the 10% level of significance. It was found that the RGDP, a measure of economic performance, has a substantial inverse correlation with a year's lag. There is a positive and significant short-term influence of all the lagged exchange rate values (LnEXCHD1, LnEXCHLD, LnEXCHL2D, and LnEXCHL3D) on the RGDP. There is a positive and significant short-term influence of all the lagged exchange rate values (LnEXCHD1, LnEXCHLD, LnEXCHL2D, and LnEXCHL3D) on the RGDP. Likewise, for foreign direct investment, the labor value is lagged by two years (LnFDILD), three years (LnFDIL2D), and four years (LnLABL3D). However, the one-year lagged (LnLABD1), two-year lagged (LnLABLD), and three-year lagged (LnLABL2D) worker populations, along with all of the lagged inflation values (LnINFD1, LnINFLD, InINFL2D, and LnINFL3D) and the three-year lagged trade openness value (LnTOPNL2D), have a negative short-term impact on the RGDP of the entire nation.

According to Karahan [52], the general conventional view posits a direct connection between the foreign exchange rate and economic affluence. The theory asserts that a rise in the exchange rate translates to a rise in net-export; however, the study found that this relationship is more noticeable in developed nations. The opposite is true for emerging economies where imported capital goods account for the majority of manufacturing inputs. An increase in the foreign exchange rate has an adverse effect on economic growth in this case.

Similarly, and typical of nations that are developing, exchange rates can have a negative effect over time on the GDP growth of Nigeria. In line with classical economist, this study also found that inflation negatively affected economic growth. In conclusion, key results point to workforce, inflation, trade openness, foreign investment, exchange rate, and inflation as significant long-term predictors of economic growth. Additionally, it is thought that the country's economic boom could be considered adversely affected by a dropping exchange rate, a labor force that is in decline, rising inflation, and an uncontrolled open trade policy.

Post-estimation

Following Kaukab and Anggara [53] and Adenomon and Ojo [46] CUSUM technique was used to ascertain the stability of parameter estimates. The outcome revealed as highlighted in Figure 1 shows that the model was unperturbed till 2010 when the graph lied between the extreme bound at the 5% level of significance. We therefore conclude the growth model is stable.

CONCLUSION AND RECOMMENDATIONS

The study has investigated the impact of different macroeconomic variables on the Nigerian economy. The result's non-linearity explains why the exchange rate fluctuates, and since a weak currency puts pressure on the economy, stricter monetary policy is required to stop the volatility of the exchange rate. Nevertheless, the non-linear results still propose that exchange rate may impact growth favorably in the long run. Furthermore, whereas foreign direct investment had positive significant long- and short-term benefits on the growth of the economy, the workforce, inflation, and open trade indicated negative and significant long- and short-term effects on Nigeria's economic growth. This suggests that Nigeria's inflation rate is rising, unemployment is rising, and the value of the naira is declining. In general, the study finds that commerce with other countries has an effect on Nigeria's economy. This lends credence to the widely held belief that trade liberalization is the best way to revive a flagging economy.

The study's conclusions lead to the following recommendations:

FUNDING

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

INSTITUTIONAL REVIEW BOARD STATEMENT

Not applicable.

INFORMED CONSENT STATEMENT

Not applicable.

DATA AVAILABILITY STATEMENT

All data used in this paper are publicly available.

CONFLICT OF INTEREST STATEMENT

The authors declare that they have no known conflict of interests.

No Files Found

Share Your Publication :