-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

D D Nigade* and P R Deshmukh

Corresponding Author: D D Nigade, Ph D, Research Scholar, Department of Extension Education, College of Agriculture, Vasantrao Naik Marathwada Krishi Vidyapeeth, Parbhani, Maharashtra, India.

Received: July 29, 2023 ; Revised: August 08, 2023 ; Accepted: August 11, 2023 ; Available Online: September 06, 2023

Citation: Nigade DD & Deshmukh PR. (2023) Socio-economic Profile of the Kisan Credit Card Scheme Beneficiary and Non-beneficiary Farmers of Marathwada Region. J Agric For Meterol Stud, 2(2): 1-5.

Copyrights: ©2023 Nigade DD & Deshmukh PR. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Views & Citations

Likes & Shares

The present investigation “Socio-economic profile of the Kisan credit card scheme beneficiary and non-beneficiary farmers of Marathwada region” was conducted in Latur and Osmanabad district of the Marathwada region during the year 2020 and 2021 which was selected purposively on the basis of maximum number of Kisan Credit Card Scheme beneficiary farmers. 5 KCC Scheme beneficiary farmers and 5 non-beneficiary farmers were selected purposively. Thus total 240 respondents were selected out of that 120 KCC Scheme beneficiary farmers and 120 non-beneficiary farmers. Ex-post-facto research design was adopted in this study. The data were collected with the help of pretested interview schedule from the respondents as per their convenience at their home or farm. The study had shown the results as under, nearly three fifth (i.e. 59.17 %) of the KCC scheme beneficiaries and 60.00 per cent of the non-beneficiaries were from middle age group, 29.17 per cent of the beneficiaries educated up to middle level and graduation and one fourth (i.e. 25.00 %) of the non-beneficiaries educated up to middle level, 71.66 per cent of the beneficiaries and nearly three fourth (i.e. 74.17 %) of the non-beneficiaries belonged to medium size of family, 70.00 per cent of the beneficiaries and 66.67 per cent of the non-beneficiaries belonged to nuclear family, two third (i.e. 66.67 %) of the beneficiaries belonged to medium annual income and 47.50 per cent of the non-beneficiaries belonged to low annual income, majority (i.e. 91.67 %) of the beneficiaries and majority (i.e. 92.50 %) of the non-beneficiaries had cultivation as their occupation, 41.67 per cent of the beneficiaries belonged to small land holding category and 45.83 per cent of the non-beneficiaries belonged to marginal land holding category.

Keywords: Kisan credit card scheme, Beneficiary farmers, Non-beneficiary farmers, Socio-economic profile, Ex-post-facto research design

INTRODUCTION

Agriculture is a key sector of Indian economy as its contribution to gross domestic product and employment. The majority of our country’s population depends upon agriculture. Indian agriculture and allied sector broadly cover four activities, viz., crop, livestock, forestry and fisheries. Hence, there is need of financial support to rural people. Credit is most crucial in agriculture to increase agriculture productivity. Agricultural credit plays a vital role in farm sector development and facilitates adoption of new technologies. It helps in maintaining agricultural production by allowing producers to meet their comprehensive credit requirement during the entire cycle of crop production and at the same time provides funds for investment purposes. However, any amount of credit even at the most reasonable rates cannot guarantee higher productivity or adequate income among the farmers, as the success depends upon many other supporting factors including the availability of agricultural inputs, services and remunerative markets for the products.

Kisan Credit Card (KCC) scheme was first proposed by the Finance Minister Yashwant Sinha in the financial year 1998-99 Budget, with the objective of providing short term credit to farmers to meet their immediate credit needs during the crop season. Consequent to this a Model KCC scheme was prepared by the NABARD on the recommendations of R. V. Gupta committee to provide term loans for agricultural needs. According to need of credit for agriculture and allied sector development, KCC scheme was launched in August 1998 by GOI, RBI and NABARD to simplify credit delivery mechanism with the aim of providing short term formal credit to farmers on the basis of their land holding, cropping pattern and scale of finance, so that the farmers may use them for purchase of agriculture inputs such as seeds, fertilizers and pesticides etc. and also drawn cash for their production needs. The government of India gives KCC loans up to Rs. 1.6 lakh without guarantee to small farmers having KCC. Now a days KCC not limited to farming only. The scheme was further extended for the investment credit requirement viz. allied activities and non-farm activities in 2004 and by 2019 for fisheries and animal husbandry giving financial support up to Rs. 2 lakhs to farmers.

In the present situation low production and productivity of agriculture is more serious problem due to poor socio-economic endowed of the farmer. Without adequate credit farmers are unable to buy inputs for high production. Production will be increased if timely provision of credit. In this situation KCC plays an important role. KCC linked with health and crop insurance. KCC become one of the innovative credit tools to enhance the flow of institutional agricultural credit in the state. In Maharashtra lack of availability finance due to this farmers suicide situation arises. In this situation KCC loan facility help to farmers by providing loan amount in low interest rate but so many farmers are unaware about KCC scheme and those farmers who are using KCC face many problems. Hence present study has been carried out to know about the socio-economic profile of the beneficiary farmers and non-beneficiary farmers of KCC Scheme. The present study will be useful for farmers, administrators, policy makers, researchers and banking or financial institutions for making future strategies and also explore the weakness of the ongoing implementations of the KCC.

MATERIALS AND METHODS

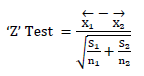

The present study was conducted in Latur and Osmanabad district of the Marathwada region during the year 2020 and 2021 which was selected purposively on the basis of maximum number of Kisan Credit Card Scheme beneficiary farmers. From these two districts six talukas i.e. three talukas from each district were selected purposively on the basis of maximum number of Kisan Credit Card Scheme beneficiary farmers. From these six talukas total 24 villages i.e. four villages from each taluka were selected purposively on the basis of list obtained from bank and co-operative society having KCC Scheme beneficiary farmers. From each selected village 5 KCC Scheme beneficiary farmers and 5 non-beneficiary farmers were selected purposively. Thus total 240 respondents were selected out of that 120 KCC Scheme beneficiary farmers and 120 non-beneficiary farmers. Ex-post-facto research design was adopted in this study. The data were collected with the help of pretested interview schedule from the respondents as per their convenience at their home or farm. The statistical methods and tests such as mean, standard deviation, frequency and percentage and ‘Z’ test were used for the analysis of data.

‘Z’ test was used for knowing significance of difference between mean of beneficiary and non-beneficiary of KCC scheme.

Where,

S1 = Variance of first series

S2 = Variance of second series

n1 = Total number of first sample

n2 = Total number of second sample

RESULTS AND DISCUSSION

The study of socio-economic profile of KCC Scheme beneficiary farmers and non-beneficiary farmers were made with reference to age, education, size of family, type of family, annual income, occupation and land holding. Dependent variable i.e. Impact of KCC Scheme was measured. Correlation analysis between socio-economic profile of KCC Scheme beneficiary farmers and Impact of KCC Scheme was measured. The result of data collected from the beneficiaries and non-beneficiaries with respect to above listed variables have been tabulated, analyzed, discussed and presented below:

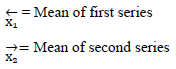

It was revealed from Table 1 that, nearly three fifth (i.e. 59.17 %) of the KCC scheme beneficiaries were from middle age group, followed by 20.83 per cent of the KCC scheme beneficiaries were from young age group and 20.00 per cent of the KCC scheme beneficiaries were from old age group. While 60.00 per cent of the KCC scheme non-beneficiaries were from middle age group, followed by followed by 20.83 per cent of the KCC scheme non-beneficiaries were from young age group and 19.17 per cent of the KCC scheme non-beneficiaries were from old age group.

The findings from the above table shows that, majority of the respondents belongs to middle age group. The middle age respondents were more enthusiastic, have ability to work more than old age respondents and have more experience than young age respondents. They always ready to accept new schemes and innovative technologies to maximize production.

It was observed that, there was no significant difference between age of beneficiaries and non-beneficiaries according to calculated ‘Z’ value (1.69). It is because of age not contributed in adoption of KCC Scheme as compared to non-beneficiaries.

The findings are similar to Dhaka [1] and Bhosale [2].

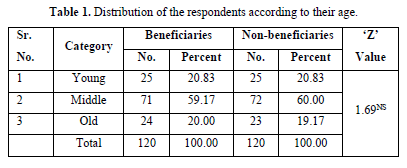

It was revealed from Table 2 that, 29.17 per cent of the beneficiaries educated up to middle level and graduation, followed by 15.83 per cent of the beneficiaries educated up to high school level, 10.83 per cent of the beneficiaries can read only, 10.00 per cent of the beneficiaries can read and write, 05.00 per cent of the beneficiaries educated up to primary level and no any beneficiary illiterate. While one fourth (i.e. 25.00 %) of the non-beneficiaries educated up to middle level, 20.83 per cent of the non-beneficiaries can read and write, 14.17 per cent of the non-beneficiaries were illiterate, 12.50 per cent of the non-beneficiaries educated up to high school, 10.00 per cent of the non-beneficiaries can read only, 09.17 per cent of the non-beneficiaries educated up to graduate level and 08.33 per cent of the non-beneficiaries educated up to primary level.

It was observed from above table that, maximum number of beneficiaries educated up to middle level i.e. 5th to 10th standard and graduate. While non-beneficiaries educated up to middle level i.e. 5th to 10th standard. Education is very important key to success and plays important role in motivating individuals to accept the new schemes. It helps to get information and knowledge about new schemes. Majority of the non-beneficiaries was low level of education due to their family income is low as compared to beneficiaries.

The calculated ‘Z’ value 2.47 significant at 0.05 % level of probability indicating that there was significant difference in education of beneficiaries and non-beneficiaries of KCC Scheme.

The findings are similar to Keshri [3] and Gottemukkula [4].

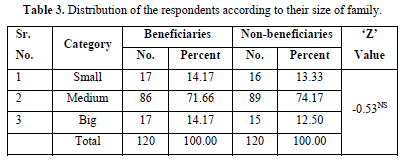

It was revealed from Table 3 that, 71.66 per cent of the beneficiaries belonged to medium size of family, followed by 14.17 per cent of the beneficiaries belonged to small and big size of family. While nearly three fourth (i.e. 74.17 %) of the non-beneficiaries belonged to medium size of family, followed by 13.33 per cent of the non-beneficiaries belonged to small size of family and 12.50 per cent of the non-beneficiaries belonged to big size of family.

It was observed from above table that, majority of the respondents belonged to medium size of family. The probable reason is the fragmentation of joint families into nuclear families. Another reason might be that the family planning which results in lesser members in the family. Medium size of family creates more employment opportunities to the family labor.

The ‘Z’ value -0.53 is non-significant, indicate that there was no significant difference in size of family of beneficiaries and non-beneficiaries of KCC Scheme.

The findings are similar to Rameshkumar & Alexpandi [5].

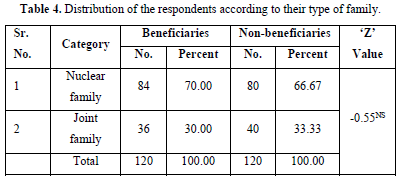

It was revealed from Table 4 that, 70.00 per cent of the beneficiaries belonged to nuclear family and 30.00 per cent of the beneficiaries belonged to joint family. While 66.67 per cent of the non-beneficiaries belonged to nuclear family and 33.33 per cent of the non-beneficiaries belonged to joint family.

It was observed from above table that, the majority of the respondents belonged to nuclear family. The reason might be that the people of present generation have tendency to separate from joint family after marriage. The people are preferring nuclear families over joint families.

The ‘Z’ value -0.55 is non-significant, indicate that there was no significant difference in type of family of beneficiaries and non-beneficiaries of KCC Scheme.

The findings are similar to Murmu [6].

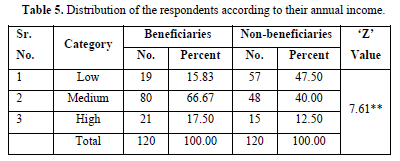

It was revealed from Table 5 that, two third (i.e. 66.67 %) of the beneficiaries belonged to medium annual income followed by 17.50 per cent of the beneficiaries belonged to high annual income and 15.83 per cent of the beneficiaries belonged to low annual income. While 47.50 per cent of the non-beneficiaries belonged to low annual income followed by 40.00 per cent of the non-beneficiaries belonged to medium annual income and 12.50 per cent of the non-beneficiaries belonged to high annual income.

It was observed from above table that, majority of the beneficiaries were from medium annual income group. While majority of the non-beneficiaries were from low annual income group. Such findings are due to the majority of the beneficiaries belonged to small and semi-medium land holding category and non-beneficiaries belonged to marginal land holding category. Due to financial support from KCC Scheme to the beneficiaries for cultivation needs helps to increase the crop production resulted in increase in annual income.

The ‘Z’ value 7.61 significant at 0.01 % level of probability indicating that there was significant difference in annual income of beneficiaries and non-beneficiaries.

The findings are similar to Bhosale [2] and Murmu [6].

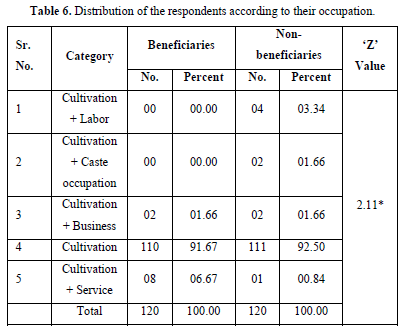

It was revealed from Table 6 that, majority (i.e. 91.67 %) of the beneficiaries had cultivation as their occupation, 06.67 per cent of the beneficiaries had cultivation + service as their occupation, 01.66 per cent of the beneficiaries had cultivation + business as their occupation and no any beneficiaries had cultivation + labor or cultivation + caste occupation as their occupation. While majority (i.e. 92.50 %) of the non-beneficiaries had cultivation as their occupation, 03.34 per cent of the non-beneficiaries had cultivation + labor as their occupation, 01.66 per cent of the non-beneficiaries had cultivation + caste occupation and cultivation + business as their occupation and 00.84 per cent of the non-beneficiaries had cultivation + service as their occupation.

It was observed from above table that, majority of the respondents had cultivation as their main occupation. It might be due to ancestral traditional occupation and financial support from KCC Scheme for the cultivation needs.

The ‘Z’ value 2.11 significant at 0.05 % level of probability indicating that there was significant difference in occupation of beneficiaries and non-beneficiaries of KCC Scheme.

The findings are similar to Parwate and Sharma [7].

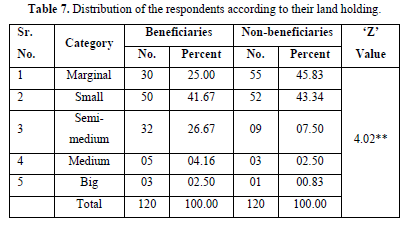

It was revealed from Table 7 that, 41.67 per cent of the beneficiaries belonged to small land holding category, followed by 26.67 per cent of the beneficiaries belonged to semi-medium land holding category, one fourth (i.e. 25.00 %) of the beneficiaries belonged to marginal land holding category, 04.16 per cent of the beneficiaries belonged to medium land holding category and 02.50 per cent of the beneficiaries belonged to big land holding category. While 45.83 per cent of the non-beneficiaries belonged to marginal land holding category, 43.34 per cent of the non-beneficiaries belonged to small land holding category, 07.50 per cent of the non-beneficiaries belonged to semi-medium land holding category, 02.50 per cent of the non-beneficiaries belonged to medium land holding category and 00.83 per cent of the non-beneficiaries belonged to big land holding category.

It was observed from above table that, majority of the beneficiaries had small and semi-medium land holding and non-beneficiaries had marginal land holding. The probable reason might be that size of land holding reduced day by day due to fragmentation of land as separation of families from joint to nuclear families.

The ‘Z’ value 4.02 significant at 0.01 % level of probability indicating that there was significant difference in land holding of beneficiaries and non-beneficiaries of KCC Scheme.

The findings are similar to Verma [8], Gottemukkula [4] and Bhosale [2].

CONCLUSION

It was concluded that there is significant difference between socio-economic profile of the KCC Scheme beneficiary farmers and non-beneficiary farmers. Therefore, KCC scheme is beneficial for the farmers to enhance their livelihood.

IMPLICATION

It is implied that; banking personnel and policy makers try to promote the use and benefits of KCC Scheme for better farming so as to ensure maximize crop production and returns.

ACKNOWLEDGEMENT

I express my deepest sense of gratitude towards my honorable research guide Dr. P. R. Deshmukh for his intellectual inspiration, constructive criticism, valuable suggestions, constant guidance, cooperative attitude and willing help throughout the course of investigation and preparation of the manuscript.

I express my deep sense of gratitude and indebtedness to Chhatrapati Shahu Maharaj Research Training and Human Development Institute (SARTHI), Pune for providing financial assistance in the form “CSMNRF-2019” for the completion of my Ph.D. degree programme.

No Files Found

Share Your Publication :