-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Sagar Sharma*

Corresponding Author: Sagar Sharma, Department of Applied Business Economics Dayalbagh Educational Institute (Deemed to be University), Dayalbagh, Agra, India.

Received: August 21, 2025 ; Revised: September 18, 2025 ; Accepted: September 21, 2025 ; Available Online: September 26, 2025

Citation:

Copyrights:

Views & Citations

Likes & Shares

This study examines long-term trends in social sector expenditure in India, with a focus on Uttar Pradesh, covering education, healthcare, nutrition, sanitation, housing, and welfare programs. It underscores the importance of public spending in fostering inclusive growth and human capital development. Based on secondary data from 2006-07 to 2024-25, the analysis shows significant increases in social sector allocations by both Union and state governments, with states consistently accounting for 60-65% of total spending. Uttar Pradesh’s expenditure trajectory broadly aligns with national trends but remains below the average for states, reflecting fiscal constraints and prioritization challenges. Revenue spending on education and health has grown nearly nine-fold, while capital investment surged post-2021-22, especially in infrastructure and system resilience following COVID-19. Statistical analysis indicates no significant difference in growth rates between Uttar Pradesh and other states, despite short-term volatility. The study highlights structural barriers such as reliance on centrally sponsored schemes, limited tax autonomy under GST, fiscal imbalances, and forecasting challenges. Policy recommendations include strengthening states’ own-source revenue, rationalizing allocations, reforming intergovernmental transfers, and adopting outcome-based budgeting and participatory governance. Addressing these issues is vital to translating fiscal inputs into tangible human development outcomes, particularly in high-population states like Uttar Pradesh.

Keywords: Fiscal decentralization, Social-sector expenditure, Inter-state disparities, Fiscal autonomy, Human development

JEL Codes: H72, H75, H77, I22, I18, O15

INTRODUCTION

Public expenditure on the social sector, covering education, healthcare, nutrition, sanitation, housing, and welfare programs for marginalized communities, is fundamental to promoting inclusive growth and human development. These investments build human capital, disrupt intergenerational poverty, and expand access to essential social rights and entitlements. Government spending priorities in these areas serve as indicators of developmental focus and political commitment. Over the past two decades, India has witnessed substantial growth and structural transformation in social sector expenditures, propelled by flagship programs such as the National Rural Health Mission (2005), Sarva Shiksha Abhiyan, and the National Health Policy (2017). However, these advancements have taken place within a challenging fiscal environment marked by limited resources, an increase in centrally sponsored schemes, and evolving fiscal responsibilities among government tiers. The implementation of the Goods and Services Tax (GST) and recommendations from the Fourteenth Finance Commission have reshaped India’s fiscal framework, intensifying competition for finite resources and heightening the states’ responsibility for prudent fiscal management and strategic prioritization.

The sectoral breakdown of social sector expenditure is crucial for understanding government responsiveness to demographic changes, economic development, and public health needs. The choices to emphasize education, preventive healthcare, or critical infrastructure such as drinking water and sanitation influence the immediate delivery of services and the long-term direction of human development. Tracking these spending patterns over time and across sectors is essential to assess policy effectiveness and design future strategies that foster equitable and impactful investments.

India’s economic reforms over the past three decades have propelled significant national growth and influenced the global economic stage. Nevertheless, the distribution of growth benefits, particularly in crucial social sectors like education and healthcare, remains contested. Endogenous growth theorists, including Romer and Lucas, highlight human capital, knowledge, and innovation as key drivers of economic progress alongside labour and physical capital. Within this framework, investing in education and health is imperative to enhance workforce productivity, strengthen national competitiveness, and leverage India’s demographic dividend.

Despite these theoretical and policy commitments, empirical data reveal that India’s social sector remains underfunded and unevenly developed. For example, in 2020, India’s per capita health expenditure was ₹190.74, significantly lower than China’s ₹962.29 and the United States’ ₹11,702.41 (WHO Global Health Expenditure Database). While the proportion of social sector spending allocated to education and healthcare modestly increased, education rising from 39.8% in 2014-15 to 42.5% in 2022-23, and healthcare from 41% to 42.4%, major regional inequities persist. States such as Kerala and Tamil Nadu consistently exceed the social service spending of states like Bihar, Madhya Pradesh, and Uttar Pradesh. This analysis addresses these disparities, focusing on Uttar Pradesh as a critical case study, and offers policy recommendations to mitigate imbalances.

In nutshell, India’s social sector expenditure spans a broad portfolio of programs targeting human capital development and poverty alleviation. Its scale and pattern reflect political priorities and developmental focus, shaped by significant policy interventions amid evolving fiscal pressures and responsibilities. Understanding the allocation across sectors is pivotal for evaluating past policies and shaping equitable, effective investment strategies going forward.

LITERATURE REVIEW

Public expenditure on the social sector including education, healthcare, and social welfare, is a vital driver of human capital development and sustainable economic growth. Endogenous growth theory, particularly as developed by Romer and Lucas, posits that investments in human capital generate positive externalities that enhance productivity and innovation. These externalities enable developing countries like India to overcome poverty traps and optimally utilize their demographic dividend.

Empirical research on India’s social sector spending indicates persistent inadequacy relative to global standards. Mahendra Dev and Mooij found that although social sector expenditure increased as a proportion of total government spending following economic reforms in the mid-1990s, it stagnated or declined when measured as a share of GDP. During the 1990s, India’s social spending hovered around 6–8% of GDP, substantially below United Nations Development Programme (UNDP) recommendations and trailing East Asian economies. Despite policy commitments to inclusive development, social sector budgets are frequently among the first to be curtailed during fiscal tightening. Furthermore, India’s centralized budgeting processes limit responsiveness to local needs.

More recent econometric studies, such as those by Keshrawani and Srivastava and Begum and Yaqub, use sophisticated techniques, including Johansen cointegration and Vector Error Correction Models (VECM)to establish a robust, long-term positive relationship between investments in social sectors (education, health, labour, and housing) and economic growth in India. While these investments materially improve per capita income and development outcomes over time, short-term effects can be variable, influenced by prevailing macroeconomic contexts.

Significant inter-state disparities exist in social sector allocation and outcomes. According to reports from the Indian Council for Research on International Economic Relations (ICRIER, 2024) and NITI Aayog (2022), states like Kerala, Tamil Nadu, and Maharashtra allocate higher per capita resources to social sectors and correspondingly enjoy superior literacy and health indicators. In contrast, populous states such as Uttar Pradesh, Bihar, and Madhya Pradesh continue to lag due to persistent fiscal and governance challenges. Dev and Mooij (2002) note that states contribute approximately 80-85% of total social sector expenditures, yet fiscal limitations in lower-income states deepen inequities.

Uttar Pradesh, specifically, faces chronic challenges, as documented by multiple studies and Comptroller and Auditor General (CAG) audits. Underfunding and inefficiencies in education and health sectors result in adverse indicators, including high infant and maternal mortality rates, low literacy, especially in rural and female populations and inadequate school infrastructure. The literature emphasizes that increasing budgets alone is insufficient; improvements in allocation efficiency, transparency, and participatory governance are essential. Enhanced data-driven targeting, greater local empowerment, and civil society involvement are critical to maximizing the impact and accountability of social sector spending.

Fiscal decentralization and states’ own revenue generation capacity also significantly influence social sector financing. Research demonstrates that states with diverse and effectively mobilized own-source revenues tend to have greater fiscal stability and growth potential [1,2]. However, persistent challenges, such as inefficiencies in tax administration, vertical and horizontal fiscal imbalances, and constraints from Centrally Sponsored Schemes restrict state fiscal autonomy and exacerbate interstate disparities [3,4]. The introduction of the Goods and Services Tax (GST) centralized indirect tax revenues, further limiting states’ fiscal flexibility and increasing reliance on central compensation.

Globally, organizations such as the Organization for Economic Co-operation and Development caution that fiscal decentralization, when combined with strong accountability mechanisms, can promote inclusive development. However, without adequate institutional capacity, decentralization may lead to macroeconomic instability [5]. Furthermore, discrepancies between budget estimates, revised figures, and actual expenditures generate fiscal uncertainty, disproportionately affecting states with weaker administrative capacities [6].

In conclusion, the literature converges on several key points: India’s social sector expenditure remains below international benchmarks with wide state-level inequalities; investments in health and education are crucial for sustained economic growth and improved human development; and Uttar Pradesh exemplifies systemic challenges that extend beyond funding deficits to include governance reforms, improved allocation efficiency, and enhanced public accountability. Addressing these multifaceted barriers is essential for leveraging India’s demographic potential and achieving equitable development.

JUSTIFICATION OF STUDY

Public expenditure on the social sector is pivotal to fostering inclusive growth and building human capital, which ultimately drives sustainable economic development. Given India’s vast demographic and socio-economic diversity, understanding the patterns, dynamics, and efficiency of social sector spending becomes critical, especially in populous and socioeconomically challenged states like Uttar Pradesh. Despite India's notable macroeconomic growth over the past three decades, disparities in social investment and outcomes persist, raising concerns about equitable development and the effectiveness of public policy. This study, therefore, aims to analyze long-term trends and growth dynamics of social sector expenditure with a focus on Uttar Pradesh within the national context, thereby contributing to policy discourse on resource allocation, fiscal decentralization, and human development [7-10].

SOURCES AND METHODOLOGY

The study employs secondary data drawn primarily from official government publications, including State Finances: A Study of Budgets, the Economic Survey of India, and budget documents from Union and State governments spanning the period from 2006-07 to 2024-25. Analytical methods include descriptive statistical analysis, year-on-year growth rate computation, and compound annual growth rate (CAGR) estimation to identify trends and volatility in social sector expenditure. Comparative analyses are conducted between Uttar Pradesh and all Indian states to assess relative performance and growth patterns. Additionally, a two-sample t-test is applied to determine the statistical significance of differences in expenditure growth rates. The sectors analyzed include education, sports, art and culture, and medical and public health, with fiscal data disaggregated to enable sectoral evaluation and intergovernmental comparisons.

RESULTS AND DISCUSSION

Trend in Social Sector Expenditure of Union Government vis-à-vis Indian States

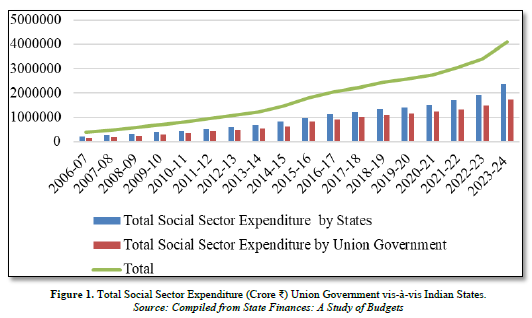

An examination of social sector expenditure in India between 2006-07 and 2023-24 reveals a sustained upward trajectory in allocations by both the Union and State governments. Over the 18-year period, total social sector spending increased more than tenfold from ₹3.98 lakh crore in 2006-07 to ₹41.04 lakh crore in 2023-24 (Figure 1). Throughout this period, state governments consistently accounted for 60-65% of total expenditure, reaffirming their predominance in delivering social services. State-level spending rose from ₹2.23 lakh crore to ₹23.67 lakh crore, signaling strengthened sub-national fiscal commitment to social development. Central expenditure also expanded substantially, from ₹1.75 lakh crore to ₹17.37 lakh crore, reflecting enhanced support through centrally sponsored schemes and flagship programmes [11-15].

The steady growth pattern demonstrates the increasing policy recognition of social sector investment as a cornerstone of inclusive growth and human development. However, the sustained predominance of state spending underscores the importance of inter-state comparative assessments to evaluate fiscal efficiency and developmental outcomes.

Growth Dynamics and Cyclical Trends in Social Sector Expenditure of Union Government vis-à-vis Indian States

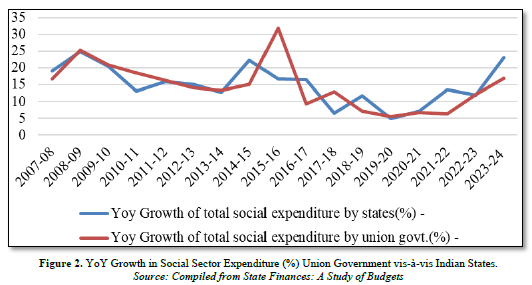

An analysis of Year-on-Year (YoY) growth indicates dynamic but uneven growth patterns. The Compound Annual Growth Rate (CAGR) for states was 14.91%, which was marginally higher than the 14.47% recorded for the Union government. States experienced significant expenditure spikes in 2008-09 (24.89%), 2014-15 (22.21%), and 2023-24 (23.11%), likely driven by factors such as decentralization measures, heightened developmental needs, and electoral cycles. The Union government's growth peaked at 31.95% in 2015-16, a surge that likely reflected an expansion of centrally sponsored schemes and fiscal transfer adjustments (Figure 2).

Both tiers of government experienced a growth slowdown in the post-2016 period, particularly in 2019-20 and 2020-21, due to fiscal stress induced by the COVID-19 pandemic. This was followed by a modest recovery in 2022-23 and 2023-24. The parallel growth patterns observed during the period reinforce the shared fiscal responsibility in social development. However, the relatively higher and steadier growth by states highlights their central role in the last-mile delivery of welfare services.

SOCIAL SECTOR EXPENDITURE OF INDIAN STATES VIS-À-VIS UTTAR PRADESH

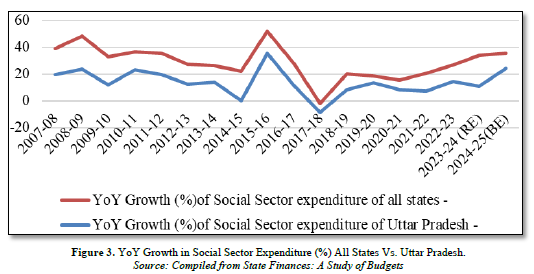

A comparative analysis between Uttar Pradesh (UP) and all states from 2006–07 to 2024–25 reveals that UP’s Compound Annual Growth Rate (CAGR) for social sector expenditure was 13.61%, which is slightly lower than the 14.69% for all states. While UP experienced some years of exceptionally high growth 23.4% in 2010-11 and 35.43% in 2015-16, its spending patterns were also more volatile. The state encountered stagnation with a growth rate of 0.25% in 2014-15 and even a contraction of -8.28% in 2017-18. In contrast, the national aggregate of all states showed greater stability with fewer negative or near-zero growth years (Figure 3).

In recent years (2022-23 and 2023-24), UP's growth in social sector spending was positive, but it remained consistently below the all-states average. This suggests that UP faced constraints related to fiscal capacity or a lack of prioritization in social sector spending during this period. However, a significant turnaround is projected in the 2024-25 budget estimates, where UP's growth is expected to reach 24.41% compared to the national average of 11.07%. This notable increase signals a potential renewed fiscal focus on the social sector within the state.

STATISTICAL TEST OF GROWTH DIFFERENTIALS IN SOCIAL SECTOR EXPENDITURE OF INDIAN STATES VIS-À-VIS UTTAR PRADESH

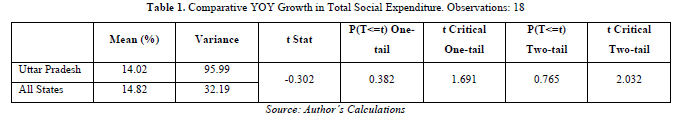

To assess whether Uttar Pradesh’s growth trajectory in social sector expenditure differs significantly from the overall all-States average, a two-sample t-test was performed. The null hypotheses(H₀) is “There is no statistically significant difference in the mean year-on-year (YoY) growth rate of social sector expenditure between Uttar Pradesh and the average across all States” (μ_UP = μ_All States). The test results are presented in Table 1.

The mean YoY growth rate of social expenditure for Uttar Pradesh over the study period was 14.02%, compared to 14.82% for all States (Table 1). Based on 18 observations, the calculated t-statistic was –0.30 with an associated two-tailed p-value of 0.765. The critical value of t at the 5% significance level (two-tailed) is ±2.032. As the absolute value of the calculated t falls well below the critical threshold, and the p-value substantially exceeds 0.05, the null hypothesis cannot be rejected.

The test results suggest that Uttar Pradesh’s average growth rate in social sector expenditure is not statistically different from the national average across States. In other words, while annual fluctuations and short-term volatility in allocations may exist, Uttar Pradesh’s long-term growth trajectory in social expenditure aligns broadly with the national trend [16-20].

GOVERNMENT SPENDING IN KEY SOCIAL SECTORS

Public expenditure on education, sports, art and culture, and medical and public health in India and Uttar Pradesh has steadily increased over the past two decades. However, detailed year-by-year and category-specific data remain fragmented due to varied reporting formats, sector classifications, and decentralized data sources. Despite these challenges, aggregate budget data and policy analyses offer valuable insights into spending patterns and fiscal priorities across central and state governments.

Government Spending on Education, Sports, Art, and Culture: State governments are the primary funders of education and related cultural activities, with their budgetary share and Gross State Domestic Product (GSDP) allocations generally rising over the last decade. Most expenditures are recurrent, covering salaries, pensions, and operational costs. The 14th Finance Commission reforms in 2015 enhanced states’ fiscal autonomy, enabling more flexible sectoral budgeting. The Union Government plays a supplementary role, primarily funding flagship schemes, national institutions, and regulatory frameworks. In 2023–24, the central allocation for education, sports, and culture reached ₹1,12,899 crore, about 2.8–2.9% of GDP, reflecting increasing support for programs like SamagraShiksha. Uttar Pradesh’s education budget rose from 13% of its total expenditure in 2018-19 to over 14% in 2022-23, although its per-capita spending remains below the national average due to demographic and fiscal factors.

Medical and Public Health: State governments lead public financing in medical and public health, with expenditures increasing in response to centrally sponsored programs like the National Health Mission (NHM). Nonetheless, state health spending often falls short of the 8% budgetary target suggested by the National Health Policy 2017. The Union Government’s health allocations have significantly increased since 2018–19, particularly through the Ayushman Bharat initiative. In 2023–24, health ministry funding amounted to ₹89,155 crore, with nearly one-third directed toward the NHM. Uttar Pradesh has boosted its health spending but continues to lag behind national per-capita averages, and high out-of-pocket expenses persist, highlighting ongoing gaps in public healthcare coverage.

Long-Term Fiscal Trends: Between 2006–07 and 2024–25, revenue expenditure on education, sports, art, and culture increased nearly nine-fold, from ₹89,578.3 crore to ₹8,03,010 crore, driven by rising personnel and operational costs. Capital expenditure in this area grew substantially post-2021-22, reflecting stronger emphasis on infrastructure. Health sector spending rose even more sharply, with revenue expenditure climbing from ₹19,161.8 crore to ₹2,59,734.5 crore, and capital expenditure growing over thirteen-fold to ₹43,552.6 crore. The post-2020 acceleration aligns with strategic efforts to strengthen health system resilience, especially in response to the COVID-19 pandemic. These patterns indicate a growing prioritization of social sector investment across government levels, though challenges in data transparency and fiscal capacity persist, particularly in populous states like Uttar Pradesh [21-23].

CONCLUSION AND POLICY IMPLICATIONS

This study demonstrates that social sector expenditures in India have grown substantially over the past two decades, with both Union and State governments expanding allocations significantly. States continue to bear the majority responsibility, accounting for 60–65% of total social sector spending. Uttar Pradesh exhibits a broadly comparable growth trajectory to national averages, though its spending levels remain below the all-states mean, reflecting constraints in fiscal capacity and prioritization.

Notably, revenue expenditure on social sectors in Uttar Pradesh has increased nearly nine-fold since 2006-07, underscoring sustained investment in operational costs. Concurrently, capital expenditure has surged post-2021-22, signaling renewed focus on infrastructure and institutional strengthening. Despite these gains, challenges, such as reliance on centrally sponsored schemes, limited state tax autonomy under GST, persistent fiscal imbalances, and revenue forecasting uncertainties impede effective service delivery and human development outcomes.

To enhance fiscal space and the effectiveness of social spending, several policy priorities emerge: strengthening states’ own-source revenue mobilization through expanded tax bases and improved administration; rationalizing expenditure to balance operational costs with infrastructure investment; reforming intergovernmental fiscal transfers to incentivize performance; and integrating outcome-based budgeting to improve accountability and impact. Moreover, improving the accuracy of fiscal forecasting and ensuring participatory governance will be vital for stabilizing expenditures and reinforcing developmental objectives. For populous states like Uttar Pradesh, addressing these structural constraints is essential to translate fiscal commitments into measurable improvements in human capital and inclusive development.

No Files Found

Share Your Publication :