-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Muhammad Abdul Abubakar* and Shamaki Aranpu Rimamshung

Corresponding Author: Muhammad Abdul Abubakar, Department of Accountancy Faculty of Social and Management Sciences, Modibbo Adama University, University in Yola, Nigeria.

Received: July 31, 2025 ; Revised: September 18, 2025 ; Accepted: September 21, 2025 ; Available Online: September 26, 2025

Citation:

Copyrights:

Views & Citations

Likes & Shares

The paper examines how ethical business practices and transparency influence the financial information quality (FIQ) of consumer goods firms listed on the Nigerian Exchange Group. Using stakeholder and signaling theories as theoretical anchors, the study underscores the importance of corporate culture in ensuring reliable financial disclosure. Employing an ex-post facto research design, data were collected from audited financial statements of 20 listed consumer goods firms for the period 2018-2022. Business conduct and ethics were proxied through IFRS-based mandatory and voluntary disclosure indices, while transparency was assessed using the proportion of disclosures aligned with the Corporate Governance Code. Financial information quality was measured using absolute residuals values model. The empirical analysis was conducted using panel data regression models and diagnostic robustness tests in STATA. Findings indicate that both ethical conduct and transparency have statistically significant positive impacts on FIQ. The study concludes that beyond structural governance, normative governance elements such as corporate values and openness play crucial roles in enhancing financial statement credibility. These results have practical implications for corporate regulators, boards, and stakeholders in the Nigerian business landscape, emphasizing the need for enforcing integrity-driven governance codes. The paper advocates for institutional strengthening of disclosure requirements and ethical frameworks to improve financial reporting quality and corporate accountability.

Keywords: Corporate governance, Business ethics, Transparency, Disclosure, Financial information quality, Nigeria, Modified Jones Model

INTRODUCTION

Corporate governance in emerging markets has evolved beyond structural mechanisms, with increasing attention paid to corporate values and disclosure integrity. In Nigeria, the adoption of the Nigerian Code of Corporate Governance (NCCG) 2018 emphasizes business ethics and transparency as crucial to restoring investor confidence and ensuring quality financial reporting. This study investigates the role of business conduct and transparency in shaping financial information quality among listed consumer goods firms, where reputational risks and regulatory scrutiny are high.

Financial information quality (FIQ), financial information is information about the financial transactions of a person or business. This information is used by lenders and borrowers to assess credit risk [1]. The quality of financial information is very important because financial reports are important to investors because they can provide outstanding information about a company's revenues, costs, profits, debt burden and its ability to meet short-term and long-term financial obligations. Corporate governance mechanisms play a pivotal role in shaping the operational framework and transparency standards of listed non-financial services firms in Nigeria. These mechanisms are designed to enhance the overall governance structure of organizations, ensuring they adhere to ethical practices, accountability, and transparency. In the context of financial information quality, the impact of governance mechanisms is profound. Adherence to corporate governance mechanisms encourages listed firms to adopt robust internal controls and financial reporting standards. By implementing these mechanisms1qsx, firms are compelled to maintain accurate and reliable financial records, thereby improving the quality and reliability of financial information disclosed to stakeholders, including investors, regulators, policy makers and the public.

Governance mechanism has received much attention in the finance and economics literature. This increased focus is caused by several high-profile corporate failures in several developed and developing countries [2,3]. Accounting cases from the famous companies such as Enron Corporation, World Com, Tyco International in the USA, Parmalat in Italy and HIH Insurance in Australia provide current information on the best mechanisms to protect stakeholder interests and maximize shareholder wealth. Global history is full of corporate failures such as Enron, America’s seventh largest company, suffered reputational damage due to accounting fraud, lost shareholders $74 billion and went bankrupt. This is due to the inadequate role played by the board of various companies and the failure of corporate governance practices [4,5]. In addition, the failure of companies in the financial services sector in Nigeria in the 1990s was most visible. The collapse of Abacus Merchant Bank Nigeria Limited, Royal Merchant Bank Limited, Rims Merchant Bank Limited, Financial Merchant Bank Limited, Progress Merchant Bank Plc and Republic Merchant Bank Limited is still fresh in the minds of financial sector observers and analysts. The crisis in the banking sector has highlighted the need for corporate governance reform [6].

In Nigeria, the failure of various financial institutions, including PHB Bank, Spring Bank Plc, Oceanic Bank Plc, Intercontinental Bank Plc, Bank failure undermines public trust [7]. Resulting in the dismissal of eight (8) bank executives by the Governor of the Central Bank of Nigeria and a call for an investigation into the effectiveness of monitoring and controlling managerial and financial behavior of managers [8]. The failure of non-financial institutions including Africa Oil Corporation, Levers Brothers, and Cadbury Bank Plc, aggravated the situation. An investigation into the case revealed serious, fundamental problems in account preparation and intentional misconduct by management, Africa Petroleum PLC (AP), has concealed debts of over N20 billion due to the fraudulent sale of shares in Lever Brothers (Unilever), Lever Brothers (Unilever), Bonkolans Securities and others. Abubakar [9], fraudulent financial statement as reported in Cadbury Nigeria Plc.

The Financial Reporting Council of Nigeria (FRCN) is empowered by relevant sections of the Act such as section 11c and 51c to provide for corporate governance practices and issue corporate governance mechanisms in the public and private sectors of the Nigerian economy and instructions. Corporate governance is to ensure that the business is run well and the investors get a fair return. Furthermore, they assert that corporate governance can be viewed as a directed and controlled system of business corporations. The corporate governance structure defines the distribution among the various participants of the corporation, such as management, managers, shareholders, and other stakeholders and describes the rules and procedures for making decisions about corporate matters. While there is widespread adoption of the code, its effectiveness in improving financial information quality varies. Factors such as regulatory enforcement, board diversity, and ethical leadership were identified as critical determinants of governance effectiveness [10]. For the purpose of this study corporate governance mechanism under consideration are business conduct and ethics and transparency.

It should be noted that from the point of view of business conduct with ethics, it is also considered a code of conduct depending on the company. A set of principles that guide employees to conduct themselves with honesty and integrity in all actions that represent the company. Establishing a code of ethics and ethics reflects the company's values to maintain and improve the company's reputation, while improving the company's behavior and investor confidence [11]. Nigeria adopted International Financial Reporting Standard (IFRS) on 31st December, 2012. Therefore, every company listed in the Nigerian exchange group (NGX) is expected to prepare their financial report in accordance to IFRS, with effect from the time of the adoption [12]. Nigeria adopted international financial reporting standard in 2012, therefore it is expected any organization that complied with the standard of the disclosure requirements of both mandatory and voluntary would enhance the financial information quality of the organization of which it is the dependent variable of the study.

Openness in terms of transparency means that companies are willing to provide clear information to shareholders and other stakeholders. For example, transparency refers to the disclosure and preparation of true and accurate financial statements, communication and engagement with stakeholders, who are interested in the company's business and help in making informed decisions [13]. In this research, transparency is all about corporate governance disclosure requirements.

In a nutshell, this study examines the symbiotic relationship between business conduct, ethics transparency and financial information quality, with an emphasis on the unique difficulties and opportunities confronting Nigeria consumer goods firms. Understanding the particular elements of this connection is crucial not just for the stakeholders directly involved, but also for furthering the broader conversation on corporate governance, financial reporting, and economic development in emerging nations as the business world evolves.

Despite the implementation of corporate governance mechanisms in Nigeria, there remains a gap in understanding how effectively these mechanisms improve the financial information quality of listed non-financial firms. While the Nigerian Code of Corporate Governance (2018) and other regulatory frameworks emphasize transparency, accountability, and ethical standards, the practical impact on financial reporting practices and information quality merits further investigation. Quality and Reliability of Financial Reporting is of paramount importance to stakeholders, hence the concerns about the consistency, accuracy, and transparency of financial disclosures among listed non-financial firms.

Some studies on governance focus on the relationship between corporate governance mechanisms and financial performance such as [14], It is also worth noting that most of the research on governance mechanism has been done in developed countries. This study mainly focuses on governance mechanism (business conduct ethics and transparency) and financial information quality (absolute residuals values of Collins model. More so, despite the existence of research on various attributes of corporate governance and firm performance, empirical evidence is often inconclusive, conflicting and unresolved. Some studies, for example, have found a positive relationship between management characteristics and financial performance. Others have found, a significant negative relationship between corporate governance characteristics and financial performance, still other studies have found no relationship between corporate governance characteristics and financial performance [15-17]. Therefore, with mixed findings, this mixed finding could be associated to methodological, domain and variables. Therefore, this area of research on the governance mechanism warrants further research as such this study aims at examining the effect of business conduct, ethics and transparency on financial information disclosure of listed consumer goods firms in Nigeria.

RESEARCH QUESTION

In tandem with the objectives of the study, the following hypotheses have been formulated in a null form:

HO1 Business conduct with has no significant impact on the financial information quality of listed consumer goods firms in Nigeria.

HO2 Transparency has no significant impact on financial information quality of listed consumer goods firms in Nigeria.

Business conduct with ethics and transparency has been employed as the independent variables of the study while financial information quality (FIQ) was used as the outcome (dependent) variable of the study. The study covered a period of five (5) years spanning from 2018 to 2022. The choice of the five (5) years period was because of the fact that the researcher restricted the study to Nigerian Code of Corporate Governance 2018.

LITERATURE REVIEW

Business Conduct and Ethics

Business ethics is defined as the code of rules and regulations used to conduct the business of a company [18]. It is an instruction to the employees to conduct themselves sincerely and honestly in all matters related to the company's organization. Business ethics is a matter of ethics and good governance. Companies are expected to meet higher standards and engage in certain social activities. Business ethics deals with critical strategies and systems of practice that support the legal and ethical responsibilities of a company. In particular, they examine what is good and bad for companies and their employees, and recommend broader standards of conduct. There are seven basic principles of business ethics, namely responsibility, care and compliance, integrity, fair competition, loyalty, transparency, and compliance with rules and regulations [19].

Business ethics refers to the attitude of entrepreneurs to business by observing decency in their actions. Corporate organizations prevent employees and managers from providing confidential or personal information without prior approval during recruitment or after employment. This code of conduct describes what participants must do as a recognized organization. This Code of Conduct applies to all employees at all levels - senior, mid-level, junior (casual) employees, permanent employees, contract employees, third party contractors and relevant stakeholders.

Transparency

Transparency means excellence, disclosure and accountability [20]. Transparency is implemented by business firms, institutions, governments and communities [21]. For example, payments in business transactions are first verified by a known agent to avoid complications. The level of information available to external users allows them to inform decisions and/or evaluate decisions made by internal users. Transparency is generally considered a key principle of good governance. Transparency means that information is available and behavior is transparent. Unrestricted access to data is an important part of promoting transparency. Transparency increases accountability and provides users with information about their business organization. Transparency is the only class that is considered when transparency in business or management refers to honesty and transparency [22]. As part of best corporate governance standards, companies require others to report all relevant information so that others can make informed decisions [23].

Transparency means being honest with others, no matter how difficult it may seem or be [24]. Transparency helps build friendly relationships with customers and employees. Because employees know exactly what is happening and why, they would have more confidence in management and company decisions. Transparency in planning, participation and equity concerns the full and open record of all relevant information, facts and context to ensure a lawful, informed and fair decision-making process [25].

Business Conduct with Ethics and Financial Information Quality

Gardi examined the impact of corporate governance on financial reporting quality the mediating impact of international financial reporting standard. The study employ survey research design and data was collected through the use of questionnaire. The sample size of the research constitute private banks, IS banks, vakif banks, RT banks bank of Iraq and TD banks all listed in Iraq. The result of the study reveals that international financial reporting standard (IFRS) mediate the relationship between corporate governance and financial reporting quality. This is study is pertinent; however, the study did not consider non-financial firms and it only concentrated on banks in Iraq. Hence this present study seeks to provide evidence from the Nigeria consumer goods firms.

Similarly, Apochi [26] investigated the influence of IFRS adoption and financial reporting quality in Nigeria. This study is adopted a conceptual approach with mixed method. The study examined the impact of IFRS adoption on financial reporting quality before the IFRS adoption and after the adoption. However, the study found a mixed finding. This study though relevant and it was conducted in Nigeria, did not examine the empirical impact of the IFRS adoption in relation to financial reporting quality.

In another claims, Umar [27] examined the effect of international financial reporting standard on financial reporting quality of listed insurance companies in Nigeria. The study employed correlational research design and data for the study was collected for two periods 2006 to 2010 pre IFRS adoption and 2011 to 2015 post IFRS adoption. The sample size of the study encompasses thirteen (13) listed insurance companies in Nigeria. The result of the study reveals that IFRS adoption increases the quality of financial reporting in Nigeria. This study is relevant, it considered IFRS adoption in the both the pre and post era, however the study concentrated on only insurance company. Whereas this present study provide evidence in the non-financial sector putting into consideration the newly revise code of corporate governance issued in 2018.

Transparency and Financial Information Quality

Hassan [28] investigated the influence of corporate governance practices on financial reporting quality in Nigerian listed firms. It was found that a positive relationship between transparency and financial information quality. The study emphasized the role of board independence, audit committee effectiveness, and disclosure practices in enhancing financial information quality.

Amasiatuet, examines the corporate reputation and earnings quality of listed firms in Nigeria, using an Ex-Post Facto research design for 21 firms selected from the consumer sector of manufacturing companies. The regression results show that there is no significant positive relationship between corporate reputation and earnings quality of listed firms in Nigeria. Makhlouf [29], investigated the role of information asymmetry as a moderating variable in enhancing or weakening the effect of information quality, conservatism and real earnings management on the performance of listed companies. The research used data from Indonesia and Singapore from 2004 to 2013. The results showed that the quality of earnings has a positive effect on the company's performance. Other aspects of corporate governance, such as shareholder relations, conduct and ethics have not been examined. Examining recent empirical studies related to the impact of corporate governance mechanisms on financial information quality of listed non-financial firms in Nigeria reveals several key findings and insights:

Khuong [30] showed that there was a positive relationship between corporate governance and accounting quality. Although both studies lacked consistency and external validity, the data for the study is up to 2017 and 2014, respectively. Finally, the findings cannot be generalized to other parts of the African continent and Nigeria as the two studies are limited to Nigeria and Rivers State respectively. Therefore, more reliable empirical evidence can be documented.

Buallay [31] explored the impact of transparency on earnings management practices in Nigerian listed firms. It revealed that firms with stronger governance structures, including robust internal controls and transparent disclosure policies, are less likely to engage in earnings management. The study emphasized the role of regulatory reforms and institutional support in promoting ethical financial reporting practices.

These studies provide a comprehensive understanding of how governance mechanisms influence financial information quality in listed non-financial firms in Nigeria. Common themes include the importance of regulatory compliance, board independence, audit committee effectiveness, ethical leadership, and transparency in enhancing financial reporting integrity. However, challenges such as weak enforcement mechanisms and varying levels of governance implementation across firms suggest areas for further research and policy intervention to strengthen corporate governance practices and promote sustainable business growth in Nigeria.

On the other hand, Fitri [32] considered the effect of Corporate Governance on the quality of financial reporting of 30 commercial banks registered in Indonesia from 2012 to 2016. OLS was used to test. The research results show that transparency has a negative effect on financial reporting quality, while the control committee has an effect on financial reporting quality.

METHODOLOGY

This research adopts the Ex-post facto design because it allows the researcher to explain the variables by collecting secondary data through audited financial report. The population of this study consists of 20 listed consumer goods firms with complete data from 2018 to 2022.

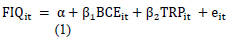

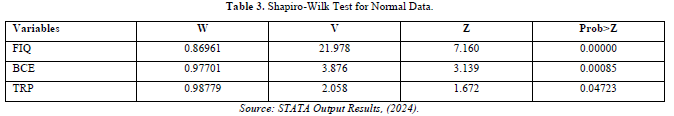

Model:

Where; FIQ: Financial Information Quality; α: The intercepts; β1-β: Coefficients of the explanatory variables; BCE: Business Conduct and Ethics of firm “i” at time “t”; TRP: Transparency (The degree of openness) of firm “i” at time “t”; eit: Stochastic error term (Stochastic error term)

VARIABLES AND DEFINITIONS (TABLE 1)

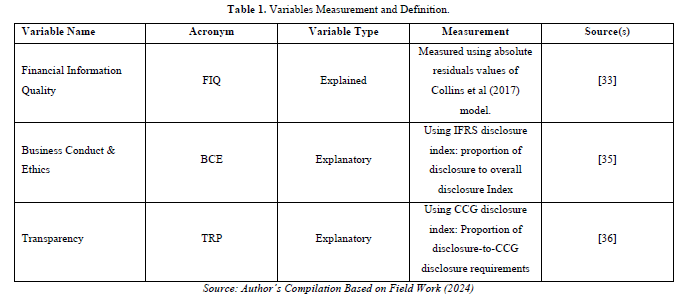

RESULTS AND DISCUSSION (TABLE 2)

The descriptive statistics in respect of Business Conduct and Ethics (BCE) reveals a value of 0.25 and 0.95 as the minimum and maximum values for the study respectively. This is followed by the mean and standard deviation values of 0.7119 and 0.1410 respectively. From the average perspective, it signifies that the listed non-financial firms in Nigeria have recorded 71 percent (71%) overall disclosure from the International Financial Reporting Standards (IFRS), the implication is that the listed firms have reported 71 percent (71%) of the total IFRS disclosure comprising mandatory and voluntary disclosures. The change in the average, IFRS overall disclosure was 14 percent (14%) approximately. This implies that the listed consumer goods firms adequately disclosed the adoption of IFRS.

With regards to transparency (TRP), the descriptive statistics shows 0.45 and 0.95 as the minimum and maximum values respectively. This is followed by the mean and standard deviation values of 0.7250 and 0.1289 respectively. This shows that the least proportion of transparency by the listed non-financial firms during the period was 45 percent (45%) while the maximum transparency level of the listed firms was 95 percent (95%) respectively. The listed consumer goods firms in Nigeria have complied with code of corporate governance disclosure requirements. The change in the average transparency level was 13 percent (13%). The statistics shows that the listed consumer goods firms complied with the code of corporate governance disclosure requirements.

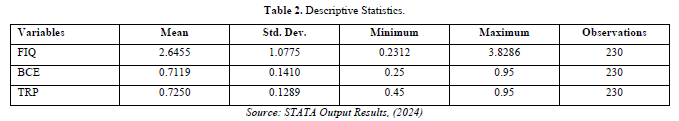

NORMALITY TEST (TABLE 3)

From the result in Table 3, it presents the normality test in respect of all the variables of the study as given by (Financial Information Quality, Business Conduct and Ethics, Transparency) Specifically, the null hypothesis of the normality principle state that the data are normally distributed. Based on the result of the t-statistics (Z-Scores) are statistically significant at one percent (1%) level of significance. By exception, only transparency (TRP) is statistically significant at 5 percent (5%) level of significance. The implication of this is that all the variables were normally distributed.

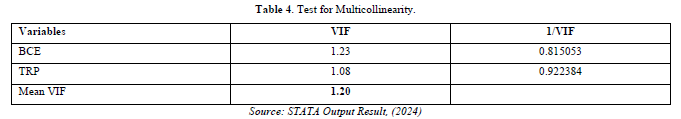

MULTICOLLINEARITY TEST

This is a test conducted to examine whether or not there is presence of multicollinearity amongst the variables of the study. This is show under Table 4 as follows:

From the Table 3, it shows the multicollinearity results in respect of all the explanatory variables of the study which were analyzed based on Variance Inflation Factors (VIF) and tolerance values (1/VIF) as the two major parameters of measuring the collinearity of a specific data. Reference to the result, the VIF values for all the variables are greater than 1 but less than 10. This notion is supported by the value of the average VIF of 1.20. From the other perspective, the tolerance values indicate values that are bigger than 0 but less than 1 across all variables. This signifies the absence of multicollinearity among all the explanatory variables of the study.

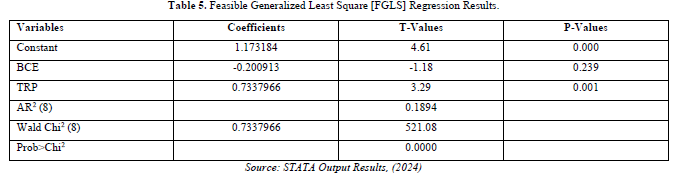

FEASIBLE GENERALIZED LEAST SQUARE [FGLS] REGRESSION (TABLE 5)

Based on the regression results in Table 5 it clearly shows the adjusted R2 value of 0.1894. This signifies that the coefficient of determination has a cumulative explanatory power of 19 percent (19%) approximately. By implication, the total impact or changes in the financial information quality of listed consumer goods firms in Nigeria is caused by the Code of Corporate Governance proxied by Business Conduct and Ethics (BCE), and Transparency (TRP) during the period of the study. The result also implies that 81 percent (81%) of the total changes in financial information quality was caused by other variables not captured in the econometric model of the study. Even though, the 19 percent AR2 was considered to be moderate for (having large impact) as advocated by Cohen (1988). On the contrary, it is highly interesting that same AR2 value was considered “Adequate” by Falk and Miller (1988). The regression results also show a Wald Chi2 value of 521.08 signifying that the explanatory variables are properly selected combined and used. The result also implies that the model is good, adequate and well-fitted for the study. This is confirmed by the prob>Chi2 value of 0.0000 which signifies that it is statistically significant at 1 percent (1%) level of significance.

BUSINESS CONDUCT/ETHICS AND FINANCIAL INFORMATION QUALITY

From the perspective of business conduct and ethics, the regression results show a coefficient value of -0.200913. This is followed with the corresponding t and p values of -0.87 and 0.382 respectively. This signifies that business conduct/ethics is negatively and insignificantly impacting on financial information quality of listed non-financial firms in Nigeria. The implication of this is that business conduct and ethics is not a good driver of financial information quality of listed consumer goods firms in Nigeria. It has further demonstrated the fact that firms with poor or declining level of compliance with the IFRS overall disclosure index (both mandatory and voluntary) are likely to have poor financial information quality and vice versa. More explicitly, there was a declining level of compliance with the IFRS mandatory and voluntary disclosure requirements by the listed consumer goods firms in Nigeria during the period of the study.

TRANSPARENCY AND FINANCIAL INFORMATION QUALITY

From the regression result in Table 5, it shows the coefficient value of transparency (TRP) as 0.7337966 with a corresponding t and p values of 3.29 and 0.001 respectively. This signifies that transparency is statistically, positively, and significantly affecting the financial information quality of consumer goods firms in Nigeria at 1 percent (1%) level of significance. By implication, transparency is a veritable instrument impacting on the quality of financial information of the listed consumer goods firms in Nigeria. Hence, the higher the proportion of the disclosure relative to code of corporate governance requirements, the better the financial information quality of the listed consumer goods firms in Nigeria.

CONCLUSION AND RECOMMENDATIONS

The findings affirm the critical role of ethical conduct and transparency in improving financial information quality. Nigerian regulators should enforce mandatory disclosure frameworks and promote corporate ethical culture through training and compliance audits. Boards should internalize ethical governance as a strategic asset, not merely a regulatory requirement. Future research could explore interactions between normative and structural governance mechanisms across various sectors.

No Files Found

Share Your Publication :