-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Raphael Louis*

Corresponding Author: Raphael Louis, Prime Minister Office Liaison Officer, The National Coalition Party of Canada (NCPC), Canada.

Received: August 19, 2025 ; Revised: September 18, 2025 ; Accepted: September 21, 2025 ; Available Online: September 26, 2025

Citation:

Copyrights:

Views & Citations

Likes & Shares

Global trade the combined export and import of goods and services has reached unprecedented levels. In 2024, world trade in goods and commercial services rose to approximately USD $32.2 trillion, a 4% increase from the previous year (World Trade Organization, WTO), with complementary United Nations data projecting it could approach USD $33 trillion, driven largely by strong growth in services. Trade blocs, as formal agreements among countries to promote economic integration and reduce trade barriers, are a defining feature of the contemporary global economy. They shape trade flows, investment patterns, and political alliances, fundamentally influencing the structure of global markets. This paper examines the role of trade blocs in the international economic system, analyzing their economic benefits, geopolitical implications, and potential risks. It reviews theoretical perspectives on regional integration, explores case studies such as the European Union (EU), the United States-Mexico-Canada Agreement (USMCA), and the African Continental Free Trade Area (AfCFTA), and assesses interactions with global institutions like the WTO. The discussion concludes by considering how trade blocs can be designed to support sustainable development, equitable growth, and long-term global economic prosperity.

Trade blocs are central to the structure of the global economic system, promoting regional integration, enhancing collective bargaining power, and bolstering economic resilience among member states. By lowering trade barriers, harmonizing regulations, and encouraging cross-border investment, they generate economies of scale that strengthen competitiveness in global markets. Serving as strategic platforms for policy coordination and addressing transnational challenges, trade blocs deepen economic interdependence and reduce the potential for conflict. For advanced academic research, their study provides critical insights into the dynamics of economic globalization, the interplay between regionalism and multilateralism, and the broader implications for global governance, sustainable development, and geopolitical stability in an increasingly interconnected world.

For PhD and postdoctoral researchers, the study of trade blocs provides a critical lens for examining the structural and functional dynamics of the global economic system. Beyond facilitating regional integration through tariff reduction and regulatory harmonization, trade blocs serve as testing grounds for theories of economic interdependence, governance, and institutional design. Their influence on global trade flows, multilateral negotiations, and sustainable development agendas creates rich opportunities for advanced, interdisciplinary research. Engaging with this field enables scholars to contribute to high-level debates on the interplay between regionalism and globalization, the shifting balance of power in international relations, and the evolving mechanisms of economic cooperation in an increasingly interconnected world.

Keywords: Trade blocs, Economic integration, Globalization, Regional cooperation, Global trade system, General economics, Microeconomics, Consumer economics, International economics, Financial economics, Monetary economics, Macroeconomics, Econometrics, International trade, Economic methodology, Financial econometrics, Monetary systems, Central banking

SCIENTIFIC RESEARCH METHODOLOGY

Econometrics research on trade blocs requires a multidisciplinary approach that integrates both qualitative and quantitative methods to capture their economic, political, and social dimensions. Quantitative techniques, including econometric modeling, gravity trade models, and panel data analysis, are employed to evaluate the effects of trade blocs on trade flows, GDP growth, investment patterns, and employment, while qualitative methods such as comparative case studies, institutional analysis, and elite interviews offer insights into governance structures, policy negotiations, and the geopolitical context shaping bloc formation and evolution. Mixed-methods designs enhance validity by triangulating statistical evidence with contextual interpretation, with longitudinal studies revealing the dynamic effects of membership over time and network analysis illuminating interdependence patterns among states. For PhD and postdoctoral research, methodological rigor entails precise operationalization of variables, critical assessment of data sources, and a clear theoretical framework connecting empirical findings to broader debates in international political economy and global governance.

INTRODUCTION

Trade blocs represent a vital area of study in advanced economic and political research, providing PhD and postdoctoral scholars with opportunities to explore the complex interactions between regional integration and the global economic system. Fundamentally, trade blocs are structured agreements among sovereign states aimed at facilitating economic cooperation by reducing or eliminating trade barriers. Yet their significance extends beyond tariff reductions, encompassing institutional frameworks that shape economic development, industrial competitiveness, capital mobility, and geopolitical strategy. Doctoral-level research moves beyond descriptive analysis, employing rigorous theoretical modeling, econometric evaluation, and comparative case studies grounded in classical, neoclassical, and contemporary trade theories to assess how blocs reshape global commerce. Notably, the Regional Comprehensive Economic Partnership (RCEP) exemplifies this influence, with member economies accounting for roughly 30% of global GDP, or about USD $29.7 trillion.

Trade blocs play a central role in the global economic system by establishing Preferential Trade Agreements (PTAs) through which member states lower tariffs, harmonize regulations, and facilitate the free movement of goods, services, and capital. These arrangements ranging from free trade areas to customs unions and economic unions vary in their depth of integration. The proliferation of trade blocs since the mid-20th century has both driven and reflected globalization, promoting regional cooperation and economic growth while also raising concerns about the fragmentation of global trade and the potential weakening of multilateralism under the World Trade Organization (WTO).

For PhD and postdoctoral researchers, examining trade blocs within the global economic system offers opportunities to address both foundational and emerging research questions with high policy relevance. Key areas include assessing the welfare effects of regional agreements, analyzing dynamic interdependencies between bloc members and non-members, and investigating how technological change, digital trade, and environmental standards are reshaping patterns of integration. This research requires interdisciplinary approaches, drawing on international law, political science, and development economics to capture the multi-dimensional impacts of trade blocs. By employing advanced quantitative methods, simulation modeling, and cross-regional comparative analyses, scholars can contribute to refining global trade theories and informing the design of more equitable and resilient economic integration frameworks. Preliminary estimates of trade volumes across major blocs suggest roughly USD $63 trillion in combined exports and imports, though this figure is conservative, as it does not account for overlapping memberships (e.g., countries in both APEC and RCEP) or detailed trade among smaller and emerging blocs.

THEORETICAL PERSPECTIVES ON TRADE BLOCS

The study of trade blocs within the global economic system draws on a diverse array of theoretical perspectives, each providing distinct explanatory frameworks and analytical tools. These perspectives shape both the conceptualization of trade blocs and the methodological approaches employed in empirical research. By engaging with multiple theories, PhD and post-doctoral researchers can cultivate a multidimensional understanding that integrates economic, political, and sociological aspects of regional integration. From a neoclassical perspective, trade blocs are primarily assessed through Viner’s trade creation, trade diversion framework, grounded in Ricardo’s principle of comparative advantage, focusing on welfare outcomes derived from market efficiency while often overlooking dynamic and strategic factors. New trade theory, advanced by Krugman and Helpman, broadens this analysis by incorporating imperfect competition, economies of scale, and product differentiation, demonstrating how blocs can foster competitiveness and innovation. Endogenous growth theory further enriches the perspective by linking long-term growth to knowledge spillovers, human capital development, and technological diffusion, positioning trade blocs as catalysts for sustained economic transformation.

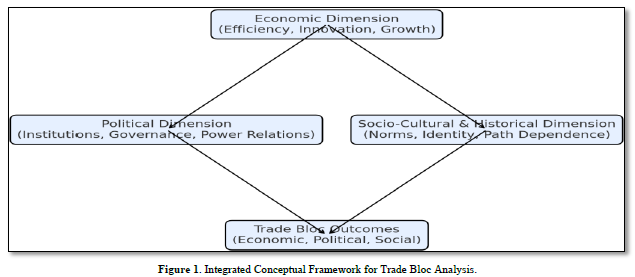

Beyond purely economic perspectives, liberal institutionalism interprets trade blocs as institutional mechanisms that lower transaction costs, harmonize policies, and manage interdependence, whereas realist theory views them as strategic alliances advancing geopolitical and security interests. Constructivist approaches shift the focus to shared norms, identities, and historical narratives that shape bloc cohesion and political commitment, while historical institutionalism highlights path dependence and incremental change, explaining why certain blocs endure and evolve gradually despite shifting global conditions (Figure 1).

CLASSICAL AND NEOCLASSICAL TRADE THEORY

Classical trade theory, rooted in the works of Adam Smith and David Ricardo, lays the foundation for international economics. Smith’s theory of absolute advantage argues that countries should specialize in producing goods they can produce more efficiently, enabling mutual gains from trade, while Ricardo’s theory of comparative advantage demonstrates that trade remains beneficial even when one country is less efficient in all goods, provided relative opportunity costs differ. Grounded in labor productivity and the labor theory of value, these principles highlight how specialization and exchange enhance overall welfare. Applied to trade blocs, classical theory underpins regional specialization and the removal of internal trade barriers, promoting efficiency and mutual gains, though it relies on assumptions of perfect competition, constant returns to scale, and negligible transportation costs conditions rarely met in practice.

Neoclassical trade theory, developed in the late 19th and early 20th centuries by economists such as Alfred Marshall, Eli Heckscher, and Bertil Ohlin, extended classical insights by incorporating marginal analysis, factor endowments, and relative factor prices. Central to this approach, the Heckscher-Ohlin (H-O) model asserts that countries export goods that intensively use their abundant factors and import those that rely on scarce factors. The theory further integrates diminishing marginal returns and general equilibrium analysis. Applied to trade blocs, the H–O framework suggests that integration amplifies trade according to members’ comparative factor advantages, potentially fostering income convergence among similarly endowed states while also inducing factor price equalization, which may generate distributional tensions.

Classical and neoclassical trade theories share the normative assumption that trade liberalization, whether unilateral, bilateral, or within a bloc enhances efficiency and welfare. However, their inability to account for intra-industry trade, economies of scale, and the strategic formation of trade blocs has led to the emergence of new trade theory and other contemporary frameworks. For PhD and post-doctoral research, these foundational theories remain crucial for developing baseline hypotheses on the welfare effects and structural dynamics of trade integration, even as they are complemented by more nuanced and realistic models of global economic interaction.

NEW TRADE THEORY

New Trade Theory offers a nuanced perspective on trade bloc dynamics, emphasizing how economies of scale, product differentiation, and expanded market size foster intra-industry trade and strategic advantages for member countries. Beyond enhancing efficiency, it highlights how trade blocs strengthen structural competitiveness, enabling member nations to innovate, specialize, and secure a more influential position in global markets.

Introduced in the 1980s, New Trade Theory (NTT) emphasizes economies of scale and network effects, providing a critical framework for understanding the economic rationale behind trade blocs. Unlike classical trade theories, which focus solely on comparative advantage, NTT highlights the importance of economies of scale, product differentiation, and imperfect competition. By creating large integrated markets, trade blocs allow firms to exploit increasing returns to scale, reduce costs, specialize within industries, and engage in intra-industry trade to meet consumer demand for diverse, differentiated products. Strategic advantages, such as first-mover effects and coordinated innovation, further enhance the global competitiveness of firms operating within a bloc. Consequently, New Trade Theory (NTT) frames trade blocs not merely as mechanisms for tariff reduction but as platforms for structural economic gains, industrial policy coordination, and long-term strategic advantage (Krugman, 1979; 1980; 1981).

New Trade Theory (NTT) elucidates how trade blocs impact the global economy by highlighting economies of scale, product differentiation, and imperfect competition. By expanding markets, trade blocs allow firms to exploit increasing returns to scale, participate in intra-industry trade, and secure strategic advantages such as first-mover benefits and technological innovation. New Trade Theory (NTT) demonstrates that trade blocs function not merely as instruments for tariff reduction but as catalysts for structural economic gains, regional integration, and sustained global competitiveness (Krugman, 1979; 1980; 1981).

POLITICAL ECONOMY OF REGIONALISM

The political economy of regionalism explores how political and economic interests intersect to shape the formation and operation of trade blocs. Blocs such as the European Union (EU), NAFTA/USMCA, and the Association of Southeast Asian Nations (ASEAN) are not purely economic entities; they also function as political instruments reflecting the strategic, diplomatic, and domestic policy priorities of member states. By fostering regional market integration, countries seek to maximize economic gains while maintaining political influence over their neighbors. The Association of Southeast Asian Nations (ASEAN), comprising ten-member states, constitutes a dynamic and increasingly integrated economic region, with a combined merchandise trade volume of approximately USD $3.5 trillion in 2024. This total, covering both exports and imports, highlights ASEAN’s key role in global supply chains, particularly in electronics, machinery, and commodity trade. From a scientific trade perspective, ASEAN offers a compelling case for analyzing regional integration, trade facilitation, and economic interdependence in a rapidly industrializing context. Despite challenges such as supply chain disruptions and global inflationary pressures, the bloc’s collective economic weight underscores its significance in shaping international trade flows and investment patterns, making it a critical subject for empirical research on regional trade agreements.

Economic considerations are central to regionalism, as trade blocs reduce tariffs and non-tariff barriers, expand market size, and enable economies of scale. According to New Trade Theory, such integration allows firms to exploit increasing returns to scale, specialize, and participate in intra-industry trade of differentiated goods. Beyond efficiency gains, trade blocs can generate strategic economic advantages, including access to technology, first-mover benefits, and coordinated industrial policies, all of which enhance the global competitiveness of member nations.

Political objectives often complement economic incentives in regionalism, as trade blocs can strengthen political alliances, stabilize conflict-prone regions, and enhance bargaining power in global negotiations. Governments may support blocs to protect domestic industries, shape regional regulatory standards, or project soft power internationally, while domestic factors such as interest group influence, lobbying by export-oriented sectors, and electoral considerations further shape bloc design and policies. Although trade blocs promote internal integration, they can also cause trade diversion, favoring member countries over more efficient external producers, highlighting the interplay between economic efficiency and political strategy. Additionally, regionalism often serves as a stepping stone toward broader multilateral agreements, influencing global governance structures and reinforcing global economic interdependence. Understanding the political economy of regionalism requires recognizing the interplay between economic and political motivations behind trade blocs. While economic theory, particularly New Trade Theory, explains the gains from scale and market integration, political considerations influence the scope, design, and sustainability of regional arrangements. Together, these factors shape regional prosperity and contribute to the broader structure and dynamics of the global economy.

ECONOMIC FUNCTIONS OF TRADE BLOCS

Economic Integration and Market Expansion

Trade blocs are essential for promoting economic integration among member states by reducing tariffs, harmonizing regulations, and facilitating the free flow of goods, services, and capital. By creating larger integrated markets, they allow firms to exploit economies of scale, lower production costs, and specialize in niche industries. This market expansion also encourages intra-industry trade, enabling countries to exchange similar but differentiated products, enhancing consumer choice and driving innovation. The resulting economic integration strengthens regional competitiveness, improves resource allocation, and generates efficiency gains across member nations.

Strategic Economic Advantages and Growth

Beyond enhancing efficiency, trade blocs provide strategic economic benefits to member countries by granting firms access to larger markets, promoting investment, and facilitating technology transfer and knowledge sharing. They also serve as platforms for coordinated industrial and innovation policies, strengthening the global competitiveness of regional industries. By fostering structural economic development, reducing transaction costs, and encouraging collaborative growth strategies, trade blocs support regional prosperity and reinforce member countries’ long-term integration into the global economy.

TRADE CREATION AND DIVERSION

Trade Creation

Trade creation occurs when a trade bloc enables member countries to shift from higher-cost domestic production to lower-cost imports from fellow members, boosting economic efficiency. For instance, within the European Union (EU), tariff reductions have allowed countries like Poland to import competitively priced machinery from Germany instead of producing less efficient alternatives domestically. Similarly, under NAFTA/USMCA, Mexico’s access to U.S. agricultural products replaced higher-cost domestic production, benefiting consumers and encouraging investment. By fostering specialization according to comparative advantage, trade creation reduces costs, increases output, and strengthens intra-bloc economic integration.

In 2024, the European Union (EU) remained a leading global economic entity, with total trade including exports and imports reaching approximately USD $5.5 trillion. This highlights the EU’s pivotal role in international commerce, driven by its integrated single market and comprehensive trade agreements. Its trade portfolio is diverse, featuring exports such as machinery, chemicals, and vehicles, alongside imports from major partners including China and the United States. Despite challenges from global supply chain disruptions and geopolitical tensions, the EU’s 2024 trade performance underscores its resilience and strategic significance within the global economic system.

Trade Diversion

Trade diversion occurs when trade blocs prompt countries to import from less efficient member states rather than more efficient external producers due to preferential treatment. For example, some EU members may purchase goods from fellow EU countries at higher prices instead of sourcing cheaper alternatives from outside Europe, while within ASEAN, intra-bloc procurement rules often favor member products even when non-members offer more competitive prices. Although trade diversion strengthens internal trade links, it can result in suboptimal resource allocation and potential welfare losses compared with open global trade, underscoring the trade-offs inherent in regional integration.

Trade blocs are powerful instruments of regional economic integration, generating efficiency gains through trade creation while also presenting challenges such as trade diversion, which can distort global trade patterns. By expanding markets, enabling economies of scale, and fostering strategic industrial collaboration, trade blocs enhance the global competitiveness of member nations. Realizing their full potential requires careful policy design that balances intra-bloc advantages with broader global efficiency, ensuring that regional integration complements rather than undermines the international trading system.

INVESTMENT FLOWS

Enhancing Intra-Bloc Investment

Trade blocs promote increased investment flows among member countries by reducing trade barriers, harmonizing regulations, and enhancing market predictability. Firms are more likely to invest in other member states when they gain preferential access to larger integrated markets, lower transaction costs, and reduced political or regulatory risk. For example, foreign direct investment (FDI) within the European Union has surged as companies capitalize on the single market, unified standards, and streamlined cross-border operations. Similarly, in ASEAN, regional investment agreements have encouraged firms to expand manufacturing and service operations across member countries, strengthening regional economic integration and demonstrating how larger integrated markets attract FDI through reduced costs and regulatory harmonization.

Attracting External Investment

Trade blocs enhance the attractiveness of member countries to external investors by providing access to larger, integrated markets. By forming a bloc, countries signal economic stability, policy coordination, and growth potential, drawing multinational corporations and capital inflows. For example, NAFTA/USMCA encouraged foreign firms to establish operations in Mexico and Canada to gain preferential access to the U.S. market. These investment flows promote industrial development, technology transfer, job creation, infrastructure expansion, and long-term regional economic growth.

LABOR MOBILITY AND KNOWLEDGE TRANSFER

Labor Mobility and Economies of Scale

Trade blocs enhance labor mobility, allowing workers to move freely across member countries and align their skills with regional demand. In line with New Trade Theory (NTT), larger integrated markets enable firms to exploit increasing returns to scale, with labor mobility ensuring the efficient allocation of human capital. For example, the European Union benefits from the cross-border movement of skilled workers, which alleviates regional labor shortages while boosting the productivity and competitiveness of industries dependent on specialized expertise.

Knowledge Transfer and Intra-Industry Trade

Trade blocs also promote knowledge transfer, a central driver of intra-industry trade highlighted by New Trade Theory (NTT). Cross-border collaboration among workers and firms facilitates technology diffusion, innovation, and product differentiation, reinforcing economies of scale. Within NAFTA/USMCA, partnerships among U.S., Canadian, and Mexican companies have advanced manufacturing and logistics capabilities, demonstrating how labor mobility and knowledge exchange within a trade bloc strengthen regional specialization and support long-term global competitiveness.

Trade blocs enhance regional economic integration by enabling the free movement of labor and facilitating knowledge transfer, allowing industries to fully exploit economies of scale and improve productivity. By promoting skill alignment, innovation, and technology diffusion, they support intra-industry trade and product differentiation, strengthening the competitiveness of member states. These dynamics underscore the strategic role of trade blocs in fostering sustainable economic growth and long-term engagement in the global economy. In 2024, trade between Canada and the United States the two largest partners in North American commerce reached approximately USD $1.1 trillion in combined exports and imports. This bilateral trade, spanning key sectors such as energy, automobiles, machinery, and agriculture, reflects the deep integration fostered by the USMCA agreement and highlights the Canada–U.S. trade relationship as one of the largest and most dynamic globally, driving investment, employment, and supply chain connectivity across both nations.

CASE STUDIES

Trade bloc case studies analyze specific regional or international agreements to assess their economic, political, and social impacts. The European Union (EU) illustrates how deep economic and political integration including the free movement of goods, labor, and capital can enhance intra-industry trade and regional competitiveness. NAFTA/USMCA demonstrates how trade liberalization among the U.S., Canada, and Mexico stimulates investment flows, technology transfer, and supply chain integration. ASEAN highlights the complexities of integrating diverse economies through phased tariff reductions, labor mobility initiatives, and regional cooperation. Collectively, these case studies offer valuable insights into the functioning of trade blocs, the benefits they provide, and the trade-offs between regional integration and global trade efficiency.

EUROPEAN UNION (EU)

The European Union (EU) is among the world’s largest trading entities, representing a substantial share of global goods and services exchange. As a single market of 27-member states, it facilitates the free movement of goods, services, capital, and labor internally, while collectively negotiating trade agreements with external partners to enhance its global economic influence. The European Union (EU) constitutes one of the most significant actors in the global trading system, with aggregate trade in goods and services exceeding €9 trillion annually. According to Eurostat data, intra-EU trade in goods was approximately €4 trillion in 2024, complemented by extra-EU goods exports of around €2.6 trillion. In parallel, services trade contributed more than €3 trillion, underscoring the growing role of intangible sectors in European economic integration. Taken together, these figures illustrate the EU’s structural position as a central hub of international commerce, reflecting both the scale of its internal market and its extensive external trade networks.

Overview of the European Union (EU) Trade Bloc

The European Union (EU) stands as one of the most advanced examples of regional economic integration globally. Initially established to promote peace, stability, and economic cooperation among European nations, it has evolved into a single market comprising 27-member states. Its trade bloc framework ensures the free movement of goods, services, capital, and labor, underpinned by harmonized regulations and common external tariffs. This structure enables member countries to capitalize on economies of scale, specialization, and greater market efficiency, while simultaneously fostering deeper political and economic cohesion across the region.

Trade Creation within the European Union (EU)

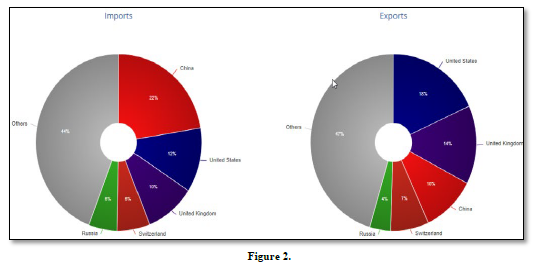

The European Union (EU) demonstrates substantial trade creation, as member countries shift from higher-cost domestic production to lower-cost imports from fellow members. By eliminating tariffs and harmonizing standards, the EU enables specialization according to comparative advantage, enhancing efficiency and reducing consumer prices. For instance, Central and Eastern European countries, upon joining the European Union (EU), imported machinery and technology from more advanced members such as Germany and France, replacing less efficient local production and stimulating regional economic growth (Figure 2).

Economic Integration and Market Functioning

Within the European Union (EU), trade liberalization and regulatory harmonization have boosted intra-industry trade and enhanced competitiveness. Firms can operate across borders with minimal barriers, allowing them to exploit increasing returns to scale, as described by New Trade Theory (NTT). The single market also attracts investment from both within and outside the European Union (EU), while facilitating knowledge transfer and innovation across industries. For example, German manufacturing and French technology firms benefit from access to a wide consumer base and a skilled European labor pool, reinforcing regional industrial specialization and economic efficiency.

Policy Framework and Strategic Advantages

The European Union (EU) trade bloc serves as a platform for coordinated industrial, trade, and monetary policies, with initiatives such as the Common Agricultural Policy (CAP) and digital market regulations designed to reduce economic disparities and enhance collective competitiveness. Membership in the European Union (EU) also provides smaller economies with strategic advantages, enabling them to participate in a larger integrated market and benefit from shared technological expertise, infrastructure development, and investment incentives.

Global Implications

The European Union (EU) trade bloc not only drives regional economic growth but also exerts significant influence on global trade. By negotiating collectively in international agreements, the European Union (EU) enhances its bargaining power, shaping global standards, tariffs, and regulatory frameworks. The bloc demonstrates how regional integration can deliver internal economic efficiency while strengthening a region’s global economic position, making it a key case study in the political economy of trade blocs. Through trade creation, management of trade diversion, and facilitation of labor and capital mobility, the European Union (EU) promotes intra-industry specialization, investment flows, and knowledge transfer, thereby enhancing the competitiveness of its member states and reinforcing its strategic role in the international economy.

UNITED STATES-MEXICO-CANADA AGREEMENT (USMCA)

The United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA in 2020, establishes a comprehensive trade framework governing economic relations among North America’s three largest economies. Effective July 1, 2020, the agreement modernized regional trade rules to reflect technological advancements, evolving supply chains, and changing global economic conditions, including updates in digital commerce, labor rights, and intellectual property, while maintaining tariff-free trade for most goods. From a scientific perspective, the United States–Mexico–Canada Agreement (USMCA) provides a valuable case study for examining the effects of deep regional integration on trade flows, investment patterns, labor markets, and regulatory alignment. Scholars frequently analyze it through the lenses of international trade theory, political economy, and regional development economics to assess its impact on comparative advantage, production specialization, and market efficiency across the bloc.

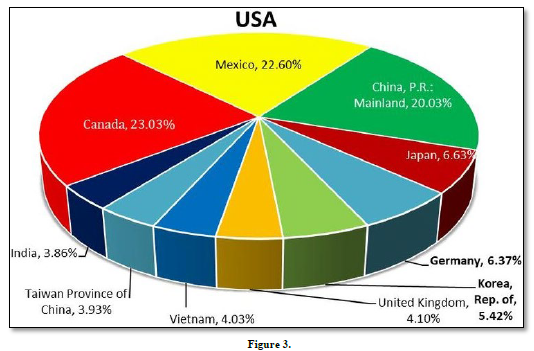

The United States-Mexico-Canada Agreement (USMCA), NAFTA’s successor, constitutes one of the world’s largest regional trade blocs, with a combined annual trade volume of approximately USD $7.8 trillion, comprising about $3.25 trillion in exports and $4.53 trillion in imports among its three-member countries. This reflects the high level of economic integration and interdependence within North America. By regulating the flow of goods, services, and investment, the United States–Mexico–Canada Agreement (USMCA) not only facilitates cross-border commerce but also enhances regional competitiveness and supply chain efficiency, establishing it as a leading global trade bloc in terms of total trade revenue. Implemented in 2020, the United States–Mexico–Canada Agreement (USMCA) is a regional trade pact that modernizes and replaces NAFTA. As a trade bloc, it reduces tariffs, harmonizes trade rules, and facilitates cross-border investment and supply chain integration among its three-member countries. The agreement targets key sectors including automotive manufacturing, agriculture, digital trade, and intellectual property with the goal of enhancing economic efficiency, competitiveness, and deeper regional integration (Figure 3).

Trade Creation and Diversion

The United States–Mexico–Canada Agreement (USMCA) fosters trade creation by allowing member countries to specialize according to comparative advantage and access larger integrated markets with lower transaction costs. For example, Mexico gains preferential access to U.S. agricultural and automotive markets, enhancing production efficiency and stimulating regional industrial growth. At the same time, the agreement may generate trade diversion, as imports from non-member countries face comparatively higher barriers, potentially reducing global trade efficiency while reinforcing intra-bloc economic ties.

Investment Flows and Supply Chain Integration

The United States–Mexico–Canada Agreement (USMCA) significantly promotes intra-bloc investment by offering regulatory predictability and strong investor protections. It strengthens North American supply chains, particularly in the manufacturing and automotive sectors, enabling firms to optimize cross-border production and lower costs. Furthermore, the agreement facilitates the movement of skilled labor and technology transfer, enhancing knowledge diffusion, fostering innovation, and bolstering regional competitiveness.

Economic and Strategic Implications

From a scientific perspective, the United States–Mexico–Canada Agreement (USMCA) demonstrates how trade blocs can reshape regional economic structures, affecting domestic industries and global trade relationships. Through a combination of tariff reductions, investment incentives, and regulatory harmonization, the agreement enhances efficiency and growth within member countries while increasing the bloc’s strategic leverage in international trade negotiations. Its outcomes underscore the interplay between economic theory, particularly New Trade Theory concepts such as economies of scale and intra-industry trade and practical policy design in shaping contemporary regional trade agreements.

The United States–Mexico–Canada Agreement (USMCA) exemplifies a modern trade bloc by reducing tariffs, harmonizing regulations, and facilitating cross-border investment and supply chain integration. It fosters trade creation by allowing member countries to specialize according to comparative advantage, while potentially causing trade diversion by prioritizing intra-bloc over non-member imports. The United States–Mexico–Canada Agreement (USMCA) also strengthens investment flows, technology transfer, and knowledge diffusion, particularly in manufacturing and automotive sectors, enhancing regional competitiveness. By combining economic efficiency with strategic policy coordination, the agreement demonstrates how regional trade blocs can drive growth, innovation, and sustained participation in the global economy, reflecting New Trade Theory principles such as economies of scale and intra-industry trade.

AFRICAN CONTINENTAL FREE TRADE AREA (AFCFTA)

Launched in 2021, the African Continental Free Trade Area (AfCFTA) seeks to create a single market for goods and services across 54 African nations, encompassing approximately 1.4 billion people. Although full implementation is ongoing, the agreement has the potential to form a market with a combined GDP exceeding USD $3.4 trillion. The African Continental Free Trade Area (AfCFTA) aims to boost intra-African trade, deepen economic integration, and drive industrialization across the continent. Scholars analyze the initiative using frameworks from development economics, trade theory, and political economy, evaluating its potential to stimulate trade, attract foreign investment, enhance industrial capacity, and reduce reliance on external markets. By reshaping production networks and promoting economies of scale, the African Continental Free Trade Area (AfCFTA) could significantly transform Africa’s role in the global economic system, making it a critical focus for research and policy analysis.

Overview of the African Continental Free Trade Area (AfCFTA)

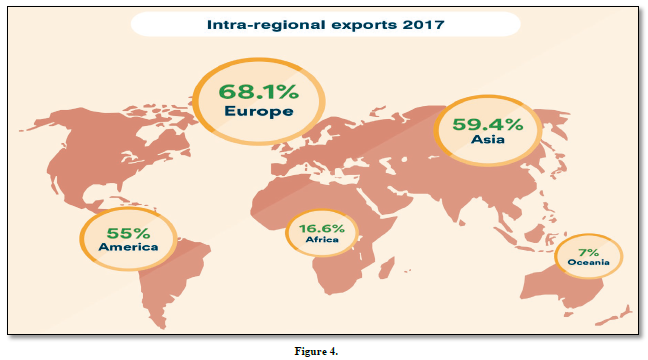

The African Continental Free Trade Area (AfCFTA), launched in 2021, represents one of the largest trade blocs in the world, encompassing 54 African countries and over 1.3 billion people. Its primary objective is to create a single continental market for goods and services, facilitating free movement of capital and labor while reducing tariffs and non-tariff barriers. The African Continental Free Trade Area (AfCFTA) aims to boost intra-African trade, enhance industrialization, and integrate regional economies, positioning Africa as a more competitive player in the global economy. The African Continental Free Trade Area (AfCFTA), comprising 54 of the 55 African Union member states, creates a unified market of over 1.3 billion people. As of 2024, this bloc represents a combined Gross Domestic Product (GDP) of approximately USD $3.4 trillion. This economic integration aims to bolster intra-African trade, enhance industrialization, and reduce reliance on external markets, thereby positioning Africa as a significant player in the global economy. Projections indicate that the African Continental Free Trade Area (AfCFTA)'s GDP could reach USD $7 trillion by 2035 and USD $29 trillion by 2050, contingent upon successful implementation of trade liberalization and infrastructural development (Figure 4).

Trade Creation and Diversion

The African Continental Free Trade Area (AfCFTA) is expected to drive significant trade creation by allowing member states to specialize according to comparative advantage and access a larger integrated market with lower transaction costs. For instance, landlocked countries can more efficiently import raw materials or manufactured goods from neighboring members, reducing reliance on non-African suppliers. At the same time, the agreement may generate trade diversion, as preferential treatment within the bloc could redirect imports from more efficient external producers, potentially leading to suboptimal global resource allocation while simultaneously strengthening regional economic interdependence.

Investment Flows and Industrial Development

The African Continental Free Trade Area (AfCFTA) is expected to boost intra-continental investment by offering regulatory predictability and harmonized trade rules, thereby increasing the continent’s appeal to both domestic and foreign investors. The agreement promotes cross-border industrial projects, regional value chain development, and supply chain integration, particularly in manufacturing, agriculture, and energy sectors. Enhanced labor mobility and knowledge transfer among member states further facilitate technology diffusion, innovation, and skills development, supporting long-term economic growth and industrial diversification across Africa.

Economic and Strategic Implications

From a scientific perspective, the African Continental Free Trade Area (AfCFTA) exemplifies how a trade bloc can transform regional economic structures. By expanding market size, promoting economies of scale, and fostering intra-industry trade, it reflects the principles of New Trade Theory (NTT), illustrating how integrated markets can generate efficiency gains and strategic advantages. Effective implementation of African Continental Free Trade Area (AfCFTA) has the potential to reduce Africa’s reliance on external markets, enhance regional competitiveness, and serve as a foundation for sustainable economic development across the continent.

TRADE BLOCS AND THE GLOBAL ECONOMIC SYSTEM

Overview of Trade Blocs in the Global Economy

Trade blocs are formal agreements among countries designed to reduce tariffs, harmonize regulations, and facilitate the free movement of goods, services, capital, and, in some cases, labor. Prominent examples include the European Union (EU), the United States–Mexico–Canada Agreement (USMCA), and the African Continental Free Trade Area (AfCFTA). These blocs constitute a crucial layer of the global economic system, complementing multilateral institutions such as the World Trade Organization (WTO) by promoting regional economic integration, enabling industrial specialization, and supporting coordinated policy frameworks.

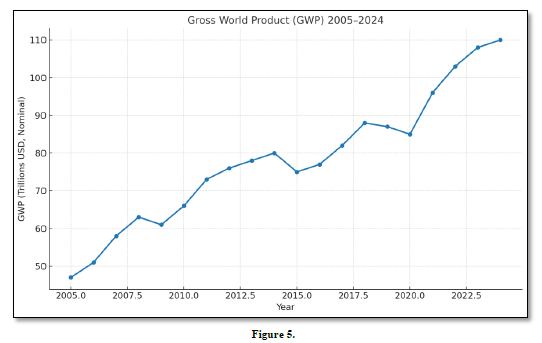

The global economic system, as measured by Gross World Product (GWP), is estimated at approximately $110 trillion USD in 2024, representing the total market value of all final goods and services produced worldwide. This figure reflects the aggregate output of interconnected economies shaped by trade, finance, technological innovation, and geopolitical dynamics. Beyond its monetary value, the system encompasses the structural networks of institutions, supply chains, and policies that underpin growth, development, and stability. Scientific assessments note that while GWP captures economic productivity, it underrepresents critical factors such as environmental costs, informal economies, and social well-being, highlighting that the true “worth” of the global economic system is both quantitative and qualitative.

Economic Functions and Efficiency

Trade blocs shape global trade patterns through both trade creation and trade diversion. Trade creation enables member states to replace higher-cost domestic production with lower-cost imports from within the bloc, improving efficiency and overall welfare. Conversely, trade diversion may redirect trade away from more efficient external producers, generating potential global inefficiencies. By expanding integrated markets, trade blocs also promote economies of scale, intra-industry trade, and product differentiation, consistent with New Trade Theory (NTT), thereby enhancing the competitiveness of firms within the bloc and broadening consumer choice.

Investment, Knowledge Transfer and Global Competitiveness

Trade blocs significantly influence investment flows, knowledge transfer, and technology diffusion within and across regions. By creating larger integrated markets, they reduce transaction costs and regulatory uncertainty, attracting both intra-bloc and external investment. Enhanced mobility of skilled labor and collaboration among firms fosters innovation, industrial upgrading, and long-term competitiveness. These dynamics strengthen trade blocs’ position in the global economy, enabling member states to coordinate industrial policies, negotiate collectively in international forums, and participate more effectively in global value chains. By 2024, global Foreign Direct Investment (FDI) stock exceeded $45 trillion, with annual flows of approximately $1.5 trillion, and trade blocs amplify these flows by expanding market size, lowering costs, and providing regulatory certainty.

Strategic Implications for the Global Economy

The proliferation of trade blocs carries significant implications for the global economic system. While they enhance regional efficiency and competitiveness, preferential agreements can also fragment global trade by creating overlapping rules and diverting commerce from non-members. At the same time, trade blocs function as laboratories for policy experimentation, fostering innovation, market integration, and strategic economic coordination, thereby shaping global trade patterns, investment flows, and broader economic governance structures (Figure 5).

Here’s the 20-year trajectory of Gross World Product (GWP) in trillions of USD (nominal), showing global growth, the 2008-09 financial crisis dip, the COVID-19 contraction in 2020, and the strong rebound in 2021-2022 leading to about $110 trillion in 2024 (Figure 6).

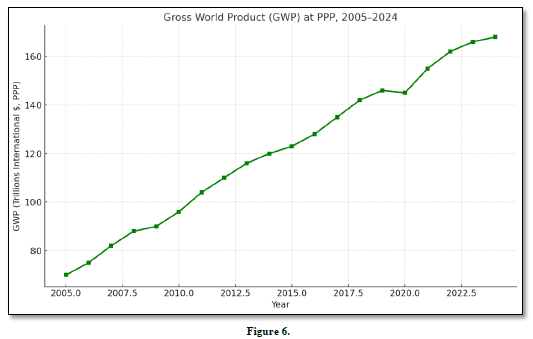

Here is the PPP-adjusted Gross World Product (GWP) trajectory from 2005-2024, measured in trillions of international dollars. It shows that, accounting for purchasing power parity, the global economy is valued at about $168 trillion in 2024, significantly larger than the nominal figure of $110 trillion.

Trade blocs play a central role in the global economic system by fostering regional integration, promoting trade creation, and enabling economies of scale, while also shaping investment flows, facilitating knowledge transfer, and enhancing industrial competitiveness. By influencing trade patterns, improving market efficiency, and providing strategic advantages to member states, they act as key drivers of economic growth and innovation in an increasingly interconnected global economy.

INTERACTION WITH THE WORLD TRADE ORGANIZATION (WTO)

Regulatory Alignment and Complementarity

Trade blocs operate within the broader framework of the World Trade Organization (WTO), which sets global rules for trade liberalization, dispute resolution, and non-discrimination among members. While blocs reduce internal barriers, they must comply with the World Trade Organization (WTO) principles, including Most-Favored-Nation (MFN) treatment for non-members, except where legally recognized preferential agreements apply. This alignment ensures that regional integration complements rather than undermines the multilateral system, preserving predictability and stability in global trade. Empirically, trade blocs play an increasingly significant role in attracting Foreign Direct Investment (FDI) and integrating supply chains, while the World Trade Organization (WTO) faces challenges in adapting to digital trade, climate-related policies, and geopolitical fragmentation. The interaction between trade blocs and the World Trade Organization (WTO) highlights the tension between faster, deeper regional cooperation and the slower, consensus-driven multilateral framework.

Trade Creation and Global Impact

The interaction between trade blocs and the World Trade Organization (WTO) influences global trade flows through both trade creation and diversion. While regional agreements promote intra-bloc trade and enhance efficiency among members, they can also redirect commerce away from more efficient non-members. The World Trade Organization (WTO) oversight helps monitor these effects, ensuring that trade blocs adhere to nondiscriminatory practices and global trade norms, thereby fostering balanced integration that benefits both regional and international markets.

Dispute Resolution and Policy Coordination

Trade blocs engage with the World Trade Organization (WTO) in dispute resolution and policy coordination, addressing conflicts that arise from overlapping regional and multilateral commitments through established World Trade Organization (WTO) mechanisms to ensure transparency and fairness. Moreover, trade blocs frequently use World Trade Organization (WTO) rules as a reference when shaping internal policies on tariffs, intellectual property rights, and technical standards, facilitating the alignment of regional agreements with the broader global economic framework.

The World Trade Organization (WTO) serves as the primary multilateral institution promoting fair and free trade by establishing binding rules and dispute resolution mechanisms that reduce tariffs, subsidies, and non-tariff barriers among member states. Its framework ensures transparent, nondiscriminatory trade practices consistent with international law while facilitating market access. Trade blocs, such as the European Union (EU), NAFTA/USMCA, and the African Continental Free Trade Area (AfCFTA), operate alongside the World Trade Organization (WTO), creating regional agreements that deepen economic integration through preferential market access and harmonized regulatory standards. While these blocs enhance intra-regional trade efficiency and attract foreign direct investment, they can also generate trade diversion, challenging the World Trade Organization (WTO)’s principle of non-discrimination. Empirical evidence underscores that the interaction between global institutions like the World Trade Organization (WTO) and regional trade blocs is essential for shaping trade flows, maintaining regulatory coherence, and fostering sustainable economic growth across both developed and developing economies.

Strategic Implications

The coexistence of trade blocs and the World Trade Organization (WTO) exemplifies a layered approach to global governance, in which regional integration and multilateral trade rules mutually reinforce one another. Trade blocs act as laboratories for economic policies and regulatory innovation, while the World Trade Organization (WTO) provides the overarching framework to manage interactions, prevent protectionism, and uphold a rules-based international trading system. This dynamic interplay underscores the complementary relationship between regional and global economic governance.

Trade blocs operate within the global economic framework in close coordination with the World Trade Organization (WTO), ensuring that regional integration complements rather than conflicts with multilateral trade rules. By aligning internal policies with the World Trade Organization (WTO) principles such as tariff commitments and non-discrimination norms trade blocs promote predictable and transparent trade flows while minimizing tensions with non-member countries. The World Trade Organization (WTO)’s mechanisms for dispute resolution, regulatory harmonization, and oversight further enhance the legitimacy and stability of bloc operations. In addition, trade blocs utilize the World Trade Organization (WTO) framework to coordinate policies on tariffs, technical standards, and intellectual property, fostering regulatory coherence and enabling members to participate more effectively in global supply chains. This dynamic interplay between regional integration and multilateral governance allows trade blocs to serve as platforms for economic experimentation and innovation, reinforcing both regional competitiveness and the stability of the broader international trading system.

GEOPOLITICAL IMPLICATIONS

Regional Influence and Power Dynamics

Trade blocs influence not only economic outcomes but also global geopolitical dynamics. By integrating member economies, they enhance the collective bargaining power of participating nations in international negotiations. The European Union (EU), for example, uses its single market to shape trade standards, environmental regulations, and global policy frameworks, while the USMCA fosters political and economic alignment in North America, enabling coordinated policy responses and strategic positioning in global markets. In this way, trade blocs function as instruments of regional influence, strengthening the geopolitical standing of their member states.

Strategic Alliances and Security Considerations

Beyond economic integration, trade blocs can strengthen strategic alliances and regional security by encouraging member states to align policies across political, security, and economic domains, thereby promoting stability in volatile regions. The EU’s integration, for instance, was partly driven by post-World War II efforts to secure lasting peace in Europe, while the AfCFTA has the potential to foster cooperation among African nations with historically conflicting interests, enhancing regional stability and diplomatic collaboration. By connecting economic prosperity with political cohesion, trade blocs serve as instruments of both soft and hard power, reinforcing their strategic significance.

Global Trade and Diplomatic Leverage

Trade blocs significantly shape global diplomatic and trade negotiations by enabling member states to engage collectively with non-members and multilateral institutions, thereby strengthening their leverage in trade disputes, investment agreements, and policy forums. This coordinated approach can alter global economic and political dynamics, as exemplified by the EU’s unified stance in World Trade Organization (WTO) negotiations or ASEAN’s coordinated trade and foreign policy strategies. By consolidating influence, trade blocs can reshape alliances, impact global governance structures, and affect broader geopolitical stability.

Challenges and Potential Conflicts

Despite their economic and strategic benefits, trade blocs can generate geopolitical tensions. Preferential trade agreements may marginalize non-member states, creating economic and political friction, while trade diversion can foster dependency within the bloc. Divergences in political priorities, regulatory standards, or economic capabilities among members can also trigger internal disputes. Additionally, overlapping regional agreements and competition between blocs may complicate global diplomacy, intensifying rivalries and prompting strategic competition among major powers.

Strategic Implications for the Global Order

Overall, trade blocs serve as powerful instruments that link economic integration with geopolitical strategy, reinforcing regional cohesion, enhancing collective bargaining power, and shaping both global economic and political systems. Yet, their effectiveness depends on careful governance to balance diverse internal interests with external relations, ensuring that regional advantages translate into sustainable influence while avoiding disruptions to the broader international order.

Trade blocs shape regional and global power dynamics by enhancing collective bargaining capacity, fostering political and economic cohesion, and expanding strategic influence in the international system. By integrating economic and political objectives, they strengthen regional solidarity and provide members with greater leverage in global affairs. At the same time, trade blocs must carefully manage internal disparities and external relations to preserve stability, ensure competitiveness, and sustain their role as influential actors in the evolving global order.

DIGITAL AND GREEN TRADE INTEGRATION

Digital Trade Integration

Digital trade integration involves embedding digital technologies, e-commerce frameworks, and data governance standards within trade blocs. Modern agreements, such as those in the EU and USMCA, increasingly prioritize rules on cross-border data flows, intellectual property rights, cybersecurity, and online consumer protection. From an academic perspective, digital trade enhances market efficiency, lowers transaction costs, and fosters innovation, enabling firms to integrate more effectively into regional and global value chains. It also expands opportunities for small and medium-sized enterprises by reducing entry barriers and facilitating intra-industry trade in digitally enabled goods and services, consistent with the principles of New Trade Theory and economies of scale.

Green Trade Integration

Green trade integration embeds environmental sustainability standards into trade agreements by incorporating regulations on carbon emissions, renewable energy use, sustainable production practices, and eco-friendly certification. Trade blocs such as the EU have advanced these standards to promote cleaner production, incentivize green technology adoption, and lower the environmental impact of intra-bloc trade. Empirical research demonstrates that such policies generate long-term economic and ecological gains, including innovation in renewable technologies, alignment with global climate objectives, and the development of sustainable value chains that enhance competitiveness while mitigating negative externalities.

Synergies Between Digital and Green Trade

Digital and green trade are increasingly interconnected, as digital technologies enhance the monitoring, reporting, and verification of environmental standards, optimize supply chain management, and improve energy efficiency across production and logistics. Trade blocs that integrate these dimensions can unlock synergistic benefits, including more efficient resource allocation, lower emissions, and the promotion of sustainable industrial specialization. For instance, digital platforms that track the carbon footprint of goods within the EU also enable small and medium-sized enterprises to participate in green-certified supply chains, illustrating how technology supports both sustainability and deeper regional integration.

Implications for Trade Bloc Competitiveness

Integrating digital and green trade strengthens the global competitiveness of trade bloc members by fostering shared standards and regulatory frameworks that attract investment in technology and sustainable industries, stimulate innovation, and deepen intra-bloc trade. High environmental and digital benchmarks further provide a strategic edge in global markets by signaling reliability, resilience, and sustainability to external partners. This dual focus aligns with both economic theory and policy objectives, demonstrating how trade blocs can simultaneously advance efficiency, innovation, and environmental stewardship within the global economic system.

POLICY RECOMMENDATIONS

Enhancing Intra-Bloc Trade and Reducing Barriers

To fully realize the benefits of trade blocs, member states should prioritize the reduction of both tariff and non-tariff barriers while strengthening infrastructure for trade facilitation. Harmonizing customs procedures, regulatory frameworks, and digital trade systems can substantially lower transaction costs and stimulate intra-bloc trade. At the same time, targeted investment in transportation networks, logistics, and border management is critical to ensuring efficient cross-border flows, particularly in regions marked by uneven economic development. Collectively, these measures enhance economic efficiency, deepen market integration, and improve the bloc’s overall competitiveness.

Trade blocs constitute critical institutional mechanisms for reducing trade barriers by establishing binding agreements that progressively dismantle tariffs, quotas, and non-tariff restrictions on goods, services, and capital flows. Through instruments such as common external tariffs, regulatory harmonization, mutual recognition frameworks, and streamlined customs procedures, they significantly lower transaction costs and enhance cross-border efficiency. Complementary policy coordination in areas including investment, competition, and intellectual property rights further mitigates indirect obstacles to market entry. Empirical evidence consistently demonstrates that these measures not only intensify intra-bloc trade and deepen economic integration but also attract foreign direct investment, thereby stimulating productivity gains, technological diffusion, and sustainable economic growth. In creating a transparent and predictable commercial environment, trade blocs function simultaneously as vehicles of regional development and as supportive complements to the multilateral trade regime administered by the World Trade Organization (WTO).

Promoting Investment Flows and Industrial Development

Trade blocs should adopt policies that promote both intra-bloc and external investment by establishing strong investor protection frameworks, streamlining regulatory procedures, and providing incentives for strategic industries. Facilitating cross-border joint ventures and regional value chains fosters knowledge transfer, innovation, and technology diffusion, thereby strengthening industrial capacity and competitiveness. At the same time, targeted support for Small and Medium-sized Enterprises (SMEs) is essential to ensure inclusive growth, enabling smaller economies and firms to participate fully and effectively in the integrated market.

Integrating Digital and Green Trade Standards

Modern trade blocs increasingly benefit from integrating digital and green trade policies that enhance efficiency, sustainability, and long-term competitiveness. Establishing common standards for e-commerce, data protection, and cybersecurity, alongside the promotion of environmentally sustainable practices, enables smoother cross-border transactions while advancing climate-conscious growth. Digital platforms for trade monitoring and compliance can further streamline processes, while green regulations incentivize low-carbon technologies and circular economy initiatives. Together, this dual approach not only strengthens regional competitiveness but also aligns trade policies with global sustainability objectives.

Strengthening Governance, Dispute Resolution, and Compliance

Robust institutional mechanisms are essential to the success of trade blocs, ensuring that agreements are enforced fairly and consistently through clear dispute resolution systems, transparent decision-making, and effective compliance monitoring. Strengthening governance structures and providing technical assistance to member states can mitigate political conflicts, reduce regulatory disparities, and build trust among participants. By reinforcing institutional capacity, trade blocs enhance their stability and credibility, making them more attractive for investment, trade, and long-term regional integration.

Balancing Regional and Global Integration

Finally, trade blocs must coordinate closely with multilateral institutions such as the WTO to ensure that regional integration complements rather than undermines global trade rules. By fostering synergies between intra-bloc policies and multilateral agreements, policymakers can minimize trade diversion, enhance global efficiency, and align regional strategies with international norms. In doing so, trade blocs not only strengthen their collective bargaining power but also contribute to the stability, inclusiveness, and resilience of the global economic system.

The effectiveness of trade blocs rests on well-designed policies that reduce trade barriers, harmonize regulations, and improve infrastructure to facilitate intra-bloc commerce, while simultaneously promoting investment flows, industrial development, and knowledge transfer to strengthen regional competitiveness. Integrating digital trade standards and environmentally sustainable practices further enhances efficiency, innovation, and long-term resilience, enabling member states to participate more effectively in global value chains. Stability and trust within the bloc require strong institutional governance, transparent dispute resolution, and consistent compliance monitoring, while alignment with multilateral frameworks such as the WTO helps minimize trade diversion, uphold global trade norms, and maximize welfare gains. By balancing regional integration with global engagement, trade blocs can drive inclusive growth, foster technological advancement, and reinforce their role as key engines of both regional and international economic development.

CONCLUSION

Trade blocs occupy a pivotal position in shaping the contemporary global economic landscape. When effectively designed and governed, they stimulate economic growth, attract investment, and foster political cooperation. Yet, without sound governance and alignment with multilateral frameworks, they risk fragmenting the global trade system. The central challenge for policymakers lies in maximizing the advantages of regional integration while safeguarding the stability, inclusivity, and efficiency of the broader global economy.

Moreover, contemporary trade blocs increasingly incorporate emerging policy dimensions such as digital trade and environmental sustainability, reflecting both the transformation of global commerce and the strategic relevance of technological and green standards. Digital integration expands market access, lowers transaction costs, and facilitates cross-border e-commerce, while sustainability-oriented initiatives encourage climate-conscious growth and the adoption of environmentally responsible industrial practices. The interaction of labor mobility, investment flows, and knowledge transfer within trade blocs highlights their capacity to foster regional resilience and long-term competitiveness. From a geopolitical standpoint, trade blocs enhance collective bargaining power, shape global governance frameworks, and reinforce regional security and political cohesion, though these benefits must be carefully balanced against the challenges of managing internal disparities and external relations.

Although trade blocs generate significant economic and strategic benefits, they also confront persistent challenges, including regulatory divergence, limited institutional capacity, social and environmental concerns, and potential frictions with non-member states. Policy recommendations highlight the importance of harmonizing regulatory frameworks, strengthening governance structures, fostering targeted investment incentives, and ensuring coherence with multilateral institutions such as the WTO. These measures are essential to enhance welfare gains and safeguard global trade stability. By carefully balancing economic, social, and strategic priorities, trade blocs can function as catalysts for sustainable development, innovation, and regional integration. Ultimately, the scientific assessment of trade blocs underscores their multidimensional influence on the global economic system, revealing both their transformative potential and the complexities inherent in optimizing their role within an increasingly interconnected and dynamic international trade landscape.

No Files Found

Share Your Publication :