-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Nwagbala Stella Chinelo*, Tony-Anukwu Josephine Uche and Ezeanokwasa Francisca Nkiruka

Corresponding Author: Nwagbala Stella Chinelo, Department of Business Administration, Faculty of Management Sciences, Tansian University, Umunya, Nigeria.

Received: August 07, 2025 ; Revised: September 18, 2025 ; Accepted: September 21, 2025 ; Available Online: September 26, 2025

Citation:

Copyrights:

Views & Citations

Likes & Shares

The consistent decline of the Naira against the US Dollar has had severe consequences for a developing nation like the Nigerian economy, especially for small and medium-sized businesses (SMEs). The study investigated the impact of exchange rate fluctuations on the sustainability of small and medium-sized enterprises in Anambra State, Nigeria. A primary source of data was used. The descriptive survey research method was used through the distribution of questionnaires to skilled workforce of selected small and medium scale enterprises in Anambra State. The population of the study consisted of 548 skilled workers of selected small and medium scale enterprises in Anambra, and 246 sample size was derived from Taro Yamane formula and 240 copies of questionnaires were recovered. Linear regression analysis was used to test the hypotheses. It was found that the fluctuations in the dollar exchange rate have a significant effect on the competitive advantage of small and medium-scale enterprises in Anambra, and market speculation has a significant impact on the profitability of small and medium-scale enterprises in Anambra. The study concluded that fluctuations in the dollar exchange rate significantly impact the sustainability of small and medium-sized businesses in Anambah State, Nigeria and recommends that Anambra SMEs diversify their supply chains by sourcing raw materials locally, thereby reducing reliance on imported goods vulnerable to dollar exchange rate fluctuations, and emphasizing the importance of acquiring accurate market intelligence to enable informed decision-making and minimize speculative losses.

Keywords: Exchange rate fluctuations, Competitive advantage, Market speculation, Profitability, Sustainability

INTRODUCTION

Nigeria is currently undergoing unprecedented fluctuations in oil prices and a depreciation of the Naira against the Dollar, with exchange rate volatility significantly impacting macroeconomic and financial stability, thereby affecting the survival rates of small and medium enterprises in the country [1]. For over four decades, there have been inconsistencies in exchange rate policies, and a lack of continuity in the exchange rate policies has worsened the unstable nature of the naira rate [1]. These changes make it difficult to anticipate the costs of inputs, build up pricing strategies, and cut into the margins for operation, which puts these businesses' long-term profitability and sustainability at risk [2]. The exchange rate is the price of one country’s currency in terms of another’s, dictating how one unit of a currency is exchanged for another on the global market. This rate is predominantly established in the Foreign Exchange (FOREX) market, where diverse entities, including Bureau de Change operators, small and medium-sized enterprises (SMEs), commercial banks, and central banks, engage in currency exchange transactions [3]. These changes have a significant effect on a country's objectives for the growth and diversification of the economy, which in turn affect trade and investment decisions [4].

Small business enterprises (SBEs) in Nigeria play a crucial role in economic development, employment generation, and poverty alleviation. However, their sustainability is increasingly threatened by fluctuations in the exchange rate of the U.S. dollar. Many SBEs struggle to maintain profitability due to rising costs of goods, unpredictable financial planning, and difficulties in securing foreign exchange for imports [5]. The central bank is crucial in this process by regularly infusing liquidity into the market to stabilize exchange rates and maintain economic stability [6]. Without effective exchange rate policies and economic stabilization measures, small businesses in Anambra State may continue to face operational difficulties, reduced competitiveness, and potential closure, thereby impacting the overall economic growth of the region [7]. As stated in Nwagbala, Ezeanokwasa and Johnson [8], in international markets, the devaluation of the naira also affects the ability of entrepreneurial businesses to compete. As the value of the naira decreases, businesses that export their products or services will find that they can sell their products or services at a cheaper price in international markets. However, this also means that it becomes more expensive for businesses to import raw materials or equipment, which may affect their ability to compete in international markets [8]. According to Eruka, Stella and Francisca [9] Stated that notwithstanding Nigeria's enormous oil reserves, the nation remains significantly dependent on imported refined petroleum products, which not only decreases its foreign exchange reserves but also exposes the country to fluctuations in the international price of oil. The poor utilization of its refineries not only hinders Nigeria's economic potential but also negatively affects the performance of SMEs, hence hindering job creation and local value addition as stated in Eruka, Stella & Francisca [9].

The question remains whether the government has done enough to build an enabling environment for companies to produce locally and earn more foreign exchange. Without a doubt, devaluation can be used as a fiscal policy tool to discourage imports, achieve balance of payment, support and promote businesses, but Nigeria isn't there yet, as most SMEs still depend on goods and services from other nations to stay afloat. Devaluation of the Naira without adequate plans being put on the ground would be dangerous, as small and medium-scale businesses would have to pay more to import finished products from other countries [8]. For instance, the Naira depreciated by approximately 40% in 2023, leading to increased costs for imported raw materials and subsequently raising production costs for businesses reliant on these imports. This depreciation, coupled with inflationary pressures, has not only driven up the cost of living but also created significant challenges for SMEs in maintaining profitability and sustainability [10]. The impact is compounded by Nigeria’s high inflation rate, which reached double digits and has been difficult to control due to factors such as poor coordination between fiscal and monetary policies and an underdeveloped financial system. This situation forces businesses to navigate higher operational costs, while consumers face reduced purchasing power, further straining economic stability [10].

The adverse effects of these fluctuations are not limited to costs; they also extend to pricing strategies, which can undermine the competitive position of SMEs both locally and internationally [5]. Market speculation significantly influences the profitability of small and medium-scale enterprises (SMEs) in Anambra State, Nigeria. Speculation in currency and commodity markets leads to price instability, which affects the cost of raw materials, inventory management, and overall business operations [11]. When traders and investors anticipate future exchange rate movements, their speculative activities can cause sudden fluctuations in the value of the naira, increasing import costs for SMEs that rely on foreign goods and materials [12]. The uncertainty caused by speculative activities makes it difficult for SMEs to plan and set stable prices for their products and services.

In response to these challenges, policymakers and financial institutions have implemented various measures to stabilize exchange rates and support the sustainability of SMEs. For instance, the Central Bank of Nigeria (CBN) has introduced several policies aimed at mitigating the impact of exchange rate fluctuations on small businesses, including intervention in the foreign exchange market and the provision of targeted credit facilities [13,14]. Despite these efforts, the effectiveness of such policies remains a subject of debate. Despite government initiatives aimed at supporting small businesses, such as the National Enterprise Development Programme (NEDEP), many SMEs continue to struggle, underscoring the need for more targeted policies and support mechanisms to enhance their resilience and capacity to contribute more effectively to Nigeria's economic development [15].

STATEMENT OF THE PROBLEM

The continuous fluctuations in the dollar exchange rate pose a serious challenge to the sustainability of small business enterprises (SMEs) in Anambra State, Nigeria. When the Naira depreciates against the US dollar, the cost of importing goods and raw materials increases. This leads to higher production costs, reduced profit margins, and, in many cases, the inability to sustain business operations. Many SMEs struggle to obtain dollars at official rates and are forced to rely on the black market, where rates are significantly higher. As a result, many manufacturing SMEs in Anambra are struggling to maintain their operations, let alone expand or innovate, due to the unpredictable nature of exchange rate fluctuations and the corresponding impact on their cost structures.

A survey on manufacturing SMEs in Anambra highlighted several critical issues exacerbated by exchange rate instability. Many businesses reported a drastic reduction in profitability, primarily driven by the escalating costs of imported goods, which have become increasingly difficult to absorb without passing on the costs to consumers. However, the competitive market environment makes it challenging for these firms to adjust their prices without risking a loss of market share. Consequently, profit margins have been squeezed, leaving these SMEs with limited resources to reinvest in business growth or resilience-building measures. Additionally, the competitiveness of manufacturing SMEs in Anambra has been severely impacted, both locally and in the broader Nigerian market. The increased production costs have hindered their ability to compete with products from other regions or imported goods, which are often cheaper despite the exchange rate challenges. This situation has led to a decline in the number of active manufacturing firms, contributing to rising unemployment and economic stagnation in Anambra.

Given these challenges, there is a need for targeted policy interventions at the state and federal levels to stabilize the exchange rate and create a more supportive business environment for manufacturing SMEs in Awka to sustain their operations and contribute to regional economic development. This study aims to fill this knowledge gap by investigating the impact of dollar exchange rate fluctuations on the sustainability of SMEs in Anambra State.

OBJECTIVES OF THE STUDY

The broad objective will be to investigate dollar exchange rate fluctuations on the sustainability of small business enterprises (SMEs) in Anambra State, Nigeria.

Specifically, this study seeks:

LITERATURE REVIEW

Dollar Rate Fluctuations

Dollar rate fluctuations, both in Nigeria and globally, have been a focal point of economic discussions, policy decisions, and market behavior. These fluctuations significantly impact the prices of goods and services, inflation rates, foreign reserves, and the overall economic health of countries [16]. Nwagbala, Ezeanokwasa, and Johnson [8] reported a strong positive relationship between naira devaluation and a decrease in profitability among small businesses in Awka-South, demonstrating the localized influence of currency movements. Currency exchange rates, including the value of the U.S. dollar, are influenced by a complex array of factors, including monetary policies, inflation rates, geopolitical events, trade balances, and investor sentiment. For Nigeria, being an import-dependent economy and an oil exporter, these fluctuations are particularly critical for the businesses [16].

In the case of Nigeria, inflation has remained persistently high due to several structural issues, such as poor infrastructure, insecurity, and dependence on imports for essential goods. In contrast, inflation in the U.S. has been comparatively low, resulting in the Nigerian naira depreciating against the U.S. dollar over time [17]. In response to these challenges, the Nigerian government has introduced several policies aimed at stabilizing the exchange rate and boosting dollar inflows. One such policy is the promotion of non-oil exports to diversify the country’s foreign exchange earnings. Efforts have been made to support sectors such as agriculture, manufacturing, and technology to reduce the economy’s dependence on oil revenues. However, these initiatives have had limited success, as structural barriers and a lack of competitiveness in non-oil sectors persist [18]. Domestically, efforts to address structural weaknesses, such as improving infrastructure, enhancing security, and diversifying the economy, will be crucial in stabilizing the currency.

MARKET SPECULATION

Market speculation plays a pivotal role in shaping currency fluctuations, particularly in the situation of the dollar rate. Speculation in financial markets involves the purchase or sale of assets with the expectation that their value will change in the future. This behavior can significantly influence supply and demand dynamics, leading to volatility in exchange rates. For instance, investors often react to economic indicators, geopolitical events, or market sentiment, all of which can lead to increased speculative trading activities. For instance, during times of economic uncertainty, speculation can lead to increased demand for the dollar as a safe-haven asset, resulting in appreciation against other currencies [19]. As noted by Garcia and Marquez [20], the central bank's communication strategies can significantly impact speculative trading, thereby influencing the country's dollar exchange rate.

SMALL BUSINESS ENTERPRISES

Nwagbala, Ezeanokwasa and Johnson [8] Small and Medium Scale Enterprises (SMEs) refer to businesses with relatively limited resources, including capital, workforce, and operational scope, compared to large corporations. They form a vital component of the business landscape, operating across diverse sectors like retail, services, manufacturing, and technology. These businesses are characterized by their localized focus, direct owner involvement, and significant contributions to local economies. They are critical in driving economic growth, job creation, and innovation in many economies [8]. According to the National Bureau of Statistics (NBS), there are approximately 41.5 million MSMEs in Nigeria, contributing about 48% of the national GDP. Despite their importance, these businesses face numerous challenges, including limited access to finance, inadequate infrastructure, and bureaucratic red tape [21]. These problems often hinder their growth and sustainability, affecting their overall contribution to the economy. Despite the advantages of digitalization, small businesses worldwide still face challenges related to cybersecurity and data protection. In Nigeria, businesses that have diversified their operations and embraced innovation have been better positioned to weather economic uncertainties [22]. Moreover, addressing challenges related to finance, infrastructure, and cybersecurity will be essential for sustaining growth and competitiveness [23].

SUSTAINABILITY OF SMALL BUSINESS ENTERPRISES

Globally, the concept of sustainability extends beyond mere survival and profitability to encompass the long-term impacts on society, the environment, and the economy. In Nigeria, the sustainability of SMEs presents unique challenges and opportunities that reflect broader global trends but also exhibit specific local nuances [24]. Globally, sustainability for SMEs involves integrating economic, environmental, and social dimensions into business practices. This approach ensures that companies not only strive for profitability but also contribute positively to their communities and minimize their ecological footprint. Business sustainability refers to the practice of managing an organization's operations, products, and services in a manner that is economically viable, environmentally responsible, and socially equitable, with the goal of long-term success and resilience. As stated in Nkiru, Chinelo and Raphael [25] Business sustainability is the process of ensuring that an organization's operations, products, and services are handled in a way that is environmentally responsible, economically viable, and socially equitable, with the aim of achieving long-term growth and resilience. It entails the integration of environmental, social, and economic factors into decision-making processes to reduce the adverse effects on the economy, society, and the planet, while at the same time creating value for stakeholders [25].

According to a study by NESREA [26]. SMEs that adopt sustainable practices often experience enhanced reputation, increased customer loyalty, and improved operational efficiencies. This is particularly relevant in an era where consumers are becoming more conscious of the environmental and social impacts of their purchases [26]. The Nigerian government has introduced several initiatives aimed at supporting green business practices, such as the National Environmental Standards and Regulations Enforcement Agency (NESREA) guidelines and the Nigerian Industrial Revolution Plan (NIRP) [26]. These policies provide a foundation for sustainable practices but often lack the enforcement mechanisms and financial support needed to be fully effective. Nonetheless, there is a growing trend among Nigerian SMEs to incorporate sustainability into their business models, driven by both consumer demand and a desire to differentiate themselves in the market. Environmental sustainability is a critical component of overall sustainability. According to the Global Reporting Initiative [27], companies are increasingly expected to address social issues such as labour rights, diversity, and community development as part of their sustainability strategies [27].

COMPETITIVE ADVANTAGE

The concept of competitive advantage plays a pivotal role in the sustainability of small and medium-sized enterprises (SMEs). Competitiveness in SMEs is closely related to the establishment of strong customer relationships. Customer-centric strategies, such as personalized services and engagement initiatives, contribute to the competitive advantage of SMEs. A study by Zhang and Kim [6] emphasizes that SMEs that prioritize customer relationships are more likely to foster loyalty and repeat business, which are essential for sustained revenue growth. This focus on customer engagement not only enhances competitiveness but also aligns with sustainable practices that promote ethical and responsible business operations. Moreover, the role of technology in enhancing competitiveness and sustainability cannot be overlooked. Digital transformation has become a critical factor for SMEs aiming to improve their competitiveness. SMEs that leverage digital technologies are better positioned to streamline operations, enhance customer engagement, and adapt to market changes. The adoption of technology also supports the implementation of sustainable practices, as it enables SMEs to monitor their environmental impact and optimize resource utilization [6,28]. In practice, this means that SMEs in Awka and similar markets must either absorb higher costs (losing competitiveness) or innovate in their supply chains to retain market share. Without such strategies, persistent exchange‐rate fluctuations tend to undermine SMEs’ relative competitiveness by increasing their production costs and forcing frequent price adjustments [29].

PROFITABILITY

Profitability is traditionally viewed as the ability of a business to generate more income than expenses, but its implications for sustainability extend beyond mere financial gain. In the context of SMEs, profitability serves as an essential indicator of the business's overall health and longevity, impacting its capacity to invest in sustainable practices, employee welfare, and community development [30]. This interconnectedness suggests that profitability is not merely an endpoint but rather a necessary condition for sustainable operations. Moreover, the profitability of SMEs directly influences their capacity to innovate and adapt to changing market conditions. Research indicates that profitable firms are more likely to allocate resources toward research and development, enabling them to create sustainable products and services [31]. In contrast, SMEs struggling with profitability often lack the financial flexibility to invest in innovation, which can hinder their competitiveness and sustainability. Thus, profitability plays a pivotal role in shaping the long-term strategic direction of SMEs, making it a crucial component of their sustainability framework.

DOLLAR RATE FLUCTUATIONS AND SUSTAINABILITY OF SMALL BUSINESS ENTERPRISES

The impact of dollar rate fluctuation on the sustainability of small business enterprises is a multifaceted issue, influencing both domestic and global markets. For small businesses in Nigeria, where the economy is heavily influenced by fluctuations in foreign exchange rates, the impact can be profound and multifarious. The dollar exchange rate is crucial for small businesses engaged in import and export activities. In Nigeria, where many small enterprises rely on imported raw materials and goods, a high dollar rate means increased costs for these imports. When the naira weakens against the dollar, businesses face higher expenses for raw materials, which directly impact their profit margins [32]. This situation forces businesses to either absorb the increased costs or pass them onto consumers through higher prices, which can reduce demand and ultimately affect profitability [33].

Moreover, dollar rate fluctuations can exacerbate inflationary pressures. For small businesses operating in economies like Nigeria's, which are susceptible to inflation, an increase in the dollar rate can lead to higher costs of goods and services. As prices rise, consumer purchasing power declines, affecting sales and revenue streams for small businesses [34]. Exchange rate management policies, such as foreign exchange controls and monetary interventions, can affect the stability of the naira and, consequently, the operational environment for small enterprises [35]. Effective policy measures can help stabilize exchange rates and reduce the volatility faced by businesses, contributing to their long-term sustainability.

Small businesses may also face challenges related to pricing strategies and cost management in the face of dollar rate fluctuations. Adjusting pricing structures to reflect changes in exchange rates can be complex, especially in competitive markets where price sensitivity is high [36]. Businesses must carefully balance their pricing strategies to maintain profitability while remaining competitive in the market. The broader economic environment also affects how small businesses respond to dollar rate fluctuations. In times of economic uncertainty or financial crises, businesses may face additional pressures related to currency fluctuations. For instance, during global financial crises, exchange rate volatility can increase, creating additional challenges for small enterprises [37]. These conditions can strain business operations and necessitate adaptive strategies to navigate the turbulent economic landscape.

DOLLAR EXCHANGE RATE FLUCTUATIONS ON THE COMPETITIVE ADVANTAGE OF SMALL AND MEDIUM SCALE ENTERPRISES

Fluctuations in the dollar exchange rate significantly influence the operations and competitive advantage of Small and Medium Enterprises (SMEs) in Nigeria, particularly in Anambra State. As SMEs in developing economies like Nigeria increasingly rely on imported materials and machinery, exchange rate volatility imposes various challenges. A depreciating naira, for instance, raises the cost of imported goods and services, which in turn hampers the ability of SMEs to maintain competitive pricing in both local and global markets [38]. The high dependency on imports for raw materials and machinery forces SMEs to adjust their prices upward, thereby reducing their competitive edge compared to foreign enterprises with access to cheaper resources. In addition, when the local currency weakens, SMEs face higher production costs that often result in a reduced ability to attract customers, a key aspect of sustaining their competitiveness. In Anambra State, where SMEs constitute a substantial part of the economy, dollar exchange rate fluctuations exacerbate existing vulnerabilities. Many SMEs, particularly those in manufacturing and trading, rely on foreign suppliers for inputs. When the naira depreciates, the cost of procurement rises, forcing SMEs to either absorb these costs or transfer them to consumers, thus affecting profit margins [39]. As profit margins reduced, the ability of these enterprises to reinvest in their operations, innovate, and expand diminishes, directly affecting their competitive positioning. These challenges are particularly acute for businesses in the agro-allied, manufacturing, and trading sectors, which are critical to the state's economic growth [39].

To mitigate the effects of dollar fluctuations, SMEs in Anambra State must adopt adaptive strategies. These include seeking local alternatives to imported inputs, diversifying revenue streams, and investing in risk management practices [40]. Moreover, partnerships between SMEs and larger corporations or foreign entities can provide much-needed capital and expertise, enabling them to compete more effectively in both local and global markets. However, these strategies require government support in the form of favorable policies, access to finance, and infrastructure development [11].

MARKET SPECULATION ON PROFITABILITY OF SMALL AND MEDIUM SCALE ENTERPRISES

Market speculation, particularly in the situation of fluctuations in the dollar exchange rate, plays a significant role in influencing the profitability of small and medium-sized enterprises (SMEs). SMEs often serve as the backbone of economies, contributing to job creation and economic diversification. However, they are also uniquely vulnerable to external shocks, such as currency fluctuations. The volatility of the dollar impacts SMEs' operational costs, pricing strategies, and ultimately, their profitability [41]. When the dollar appreciates, SMEs that rely on imported goods may face higher costs, which can reduce their profit margins and create a cascading effect throughout the supply chain. In many countries, SMEs are heavily dependent on imported raw materials, equipment, and even technology. When market speculation leads to a depreciation of the local currency against the dollar, the costs of these imports rise significantly [20,42]. Thus, a small manufacturing company that depends on imported machinery may encounter unexpected increase in costs as a result of dollar fluctuations. This may necessitate the company to either absorb the costs, which could potentially reduce profitability, or shift the costs onto consumers, which could negatively impact demand.

Moreover, the impact of market speculation extends beyond direct costs associated with imports. Fluctuations in the dollar also affect SMEs' pricing strategies. In an environment of currency instability, SMEs may find it challenging to set prices that reflect both market conditions and the fluctuating costs of goods [43]. If SMEs decide to increase prices in response to higher costs, they risk losing customers to competitors who might not have been similarly affected. Alternatively, if they choose to keep prices stable, their profit margins will be limited. This price rigidity can lead to a loss of competitiveness in both local and international markets, further threatening the sustainability of these enterprises [28,44].

Moreover, SMEs that export their goods face unique challenges when dealing with dollar fluctuations. A strong dollar can make their products more expensive for foreign buyers, reducing demand and impacting sales [45]. Conversely, when the dollar weakens, SMEs may find it easier to penetrate foreign markets due to lower prices, but they might still struggle with the increased costs of imported raw materials. This dual challenge underscores the complexity of market speculation and its direct effects on profitability, emphasizing the need for effective risk management strategies to navigate such fluctuations [46].

Finally, in the face of market speculation an organization's ability to harness its human capital can significantly influence its resilience and profitability. For instance, effective communication with customers regarding pricing strategies during periods of dollar instability can maintain loyalty and mitigate potential losses in sales. Furthermore, collaborative relationships with suppliers can lead to mutually beneficial arrangements that allow SMEs to better manage costs during uncertain times [35,46].

THEORETICAL REVIEW

This study is anchored on the Exchange Rate Risk Theory

Exchange Rate Risk Theory [47]

Exchange rate risk theory, initially propounded by economist Ronald M. McKinnon [47] in the 1970s, addresses how fluctuations in currency exchange rates can impact businesses and economies. McKinnon’s [47] work, particularly his 1973 book "Money and Capital in Economic Development," laid the groundwork for understanding exchange rate risk. This theory focuses on how changes in exchange rates can affect the financial performance of businesses engaged in international trade. It provides a framework for analyzing the risks associated with currency volatility and its implications for business sustainability.

In small business enterprises in Anambra, the relevance of exchange rate risk theory is significant. Small businesses in this region, like many others, may engage in cross-border trade or rely on imported goods and services. Fluctuations in the dollar rate can directly affect these businesses’ costs and revenues. For instance, if the dollar strengthens against the local currency, the cost of imported raw materials or goods increases, which can erode profit margins for businesses that cannot pass on these costs to consumers. Conversely, dollar depreciation might increase the cost of exporting goods, potentially making local products less competitive in international markets. The financial stability of these businesses can be jeopardized, affecting their ability to maintain operations, invest in growth, or remain competitive.

In conclusion, exchange rate risk theory, as propounded by Ronald M. McKinnon [47], provides valuable insights into how currency fluctuations impact businesses, particularly those engaged in international trade. For small business enterprises in Anambra, this theory highlights the significance of managing exchange rate risks to ensure financial stability and sustainability. By implementing appropriate risk management strategies and improving their financial practices, these businesses can better navigate the challenges posed by currency volatility and enhance their prospects for long-term success.

MATERIALS AND METHODS

A descriptive survey research design was employed and a quantitative approach was utilized to collect sample data from a specific population. The selection of this method aimed to ensure more robust and dependable outcomes for the study. A population of 548 skilled employees working in administrative, marketing, and production departments across seven strategically selected, accessible, and reputable SMEs in Awka was used. These employees were chosen for their relevant expertise and knowledge aligned with the research objectives, thereby enhancing the study's validity. The sample size of 246was determined using Taro Yamani Formula. Quantitative data was generated through the questionnaire. Linear regression analysis were be used to test the hypotheses.

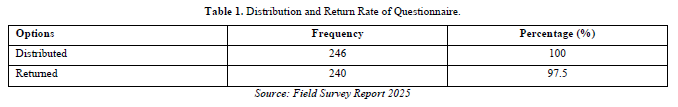

Table 1 presents the distribution of the questionnaire by the researcher. It shows the number of questionnaires that was distributed and the number that was gathered back after the distribution.

Table 1 show that out of the 246 copies of the questionnaire distributed, 240 copies (representing (97.5%) were returned and 6 copies (2.5%) was not returned. Thus 97.5% of the questionnaires administered were utilized to reach conclusion in this work.

TEST OF HYPOTHESES

Hypothesis 1

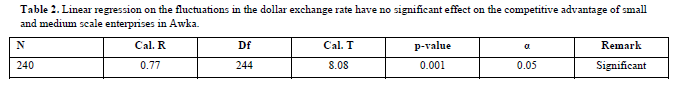

Table 2 indicated that at 0.05 level of significance and 244 df, the calculated t 8.08 with p-value 0.001 which is less than 0.05 (r(244) = 0.77, p < 0.05), the null hypothesis is rejected. This means that fluctuations in the dollar exchange rate have a significant effect on the competitive advantage of small and medium scale enterprises in Awka.

Hypothesis 2

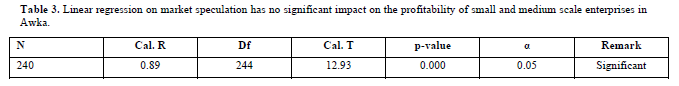

Table 3 indicated that at 0.05 level of significance and 244 df, the calculated t 12.93 with p-value 0.00 which is less than 0.05, (r(1185) = 0.89, p < 0.05), the null hypothesis is rejected. This means that market speculation has significant impact on the profitability of small and medium scale enterprises in Awka.

Findings of the study indicate that;

CONCLUSION

From the perspective of this study. It was concluded that the fluctuations in the dollar exchange rate has significant effect on the competitive advantage of small and medium scale enterprises in Awka, market speculation has significant impact on the profitability of small and medium scale enterprises in Awka.

Based on the findings of the study, the following recommendations were made;

No Files Found

Share Your Publication :