-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Surajdeen Tunde Ajagbe* and Taofeek Bolaji Usman

Corresponding Author: Surajdeen Tunde Ajagbe, Department of Finance, Al-Hikmah University, Ilorin, Nigeria.

Received: February 26, 2025 ; Revised: April 12, 2025 ; Accepted: April 15, 2025 ; Available Online: April 17, 2025

Citation:

Copyrights:

Views & Citations

Likes & Shares

Financial intermediaries are crucial for economic development by connecting surplus and deficit units. This study examines the impact of financial intermediation on Nigeria's economic growth from 2003 to 2023, using a descriptive survey method and time-series data analysis. The research regressed real GDP against factors such as credit to the private sector, lending rates, and money supply with ordinary least squares (OLS) estimators. Results indicated a long-run relationship among these variables, with the overall regression model showing statistical significance at the 5% level. The findings demonstrate that financial intermediation positively impacts Nigeria's economic growth. The study recommends that monetary authorities encourage banks to lower lending rates, manage the money supply to control inflation, and enhance credit access for viable sectors to foster economic development.

Keywords: Economic growth, Money supply, Lending rate, Financial intermediation, Time-series

JEL Classification: G1, G2, O1, O4

INTRODUCTION

In rising economies like Nigeria, financial intermediation is especially important for promoting economic progress. The ability of the banking and financial industries to effectively manage risks, mobilize savings, and allocate resources is becoming more and more important as they develop. The efficiency of its financial intermediaries has frequently impacted the cycles of growth and recession that the Nigerian economy has experienced, with its many industries spanning from telecoms to agriculture. The process by which banks, insurance providers, and investment organizations serve as middlemen between savers and borrowers is known as financial intermediation. This idea is essential to how contemporary economies work because it makes it easier for money to go from those with extra money (savers) to people who need it for investments (borrowers). This intermediary position has multiple important components and improves the stability and efficiency of financial systems in an economy.

The intricate connection between financial intermediation and economic expansion in Nigeria, emphasizing the main ways in which financial institutions support economic progress. Among the various strategies employed were the functions of banks, microfinance organizations, and capital markets in encouraging investment, raising productivity, and stimulating innovation. Insights and suggestions for fostering a more resilient financial environment that might greatly improve the nation's economic growth trajectory will be provided by an understanding of the complexities of financial intermediation in Nigeria.

However, the resources and experience of financial intermediaries enable them to evaluate borrowers' creditworthiness. By assessing their possible risks, intermediaries might reduce the likelihood of defaults by making well-informed lending decisions. Additionally, they use diversification to mitigate risks, distributing assets among several borrowers and industries to reduce possible losses. Therefore, financial intermediaries aid in the effective distribution of resources within the economy by directing capital toward profitable ventures. By identifying the most promising ventures and enterprises, they make sure that money goes to the places where it can yield the biggest profits, which fosters economic expansion. Also, new financial products and services are constantly being developed and made available by financial intermediaries to satisfy the changing demands of both businesses and consumers offer consumers a range of choices for efficient money management and can include loans, investment funds, insurance policies, and retirement savings schemes.

Economic growth in Nigeria is associated with a number of more general developmental outcomes, including the creation of jobs, higher living standards, and a decrease in poverty. Inclusive policies that meet the needs of underserved groups and encourage fair resource allocation must be the mainstay of sustainable growth plans. The idea of economic growth in Nigeria is complex and impacted by a number of internal and external factors. Despite the country's recent considerable progress, there are still important issues that need to be resolved to guarantee inclusive and sustainable growth. The private sector, stakeholders, and policymakers must work together to create plans that increase infrastructure, diversify the economy, and foster stability in order to fully utilize Nigeria's potential as a catalyst for African economic growth at large.

Also, economic growth is closely tied to the liquidity provision function of the financial system. This connection exists because many high-return projects require a long-term commitment of capital, while savers often prefer to maintain control over their savings for shorter periods. Financial intermediation can stimulate key drivers of growth, such as capital and factor productivity. Also, financial intermediaries help reduce transaction costs associated with capital accumulation and encourage savings. They also play a crucial role in enhancing total factor productivity by directing investments to the most productive projects and monitoring them efficiently [1].

In other words, access to funds for investment is essential for stimulating growth in any economy. Therefore, the progress of every economy relies heavily on its financial system, which enhances the production capacity of a nation. Efficient mobilization of funds and access to credit are critical for initiating economic growth. However, in July 2004, the Central Bank of Nigeria [2] introduced a 13-point agenda aimed at creating larger banks with stronger financial positions, ensuring safe banking practices, and enhancing regulatory capacity to supervise the industry. These banking reforms were designed to address existing challenges and strengthen the Nigerian banking system, with the vision of making Nigeria the financial hub of Africa and mitigating the systemic distress affecting the sector. However, some firms continue to struggle to survive and grow due to financial issues, raising questions about the effectiveness of the intermediation process.

Despite its significance, financial intermediation may encounter a number of difficulties: financial institutions frequently work in highly regulated contexts, which can hinder their capacity to innovate and react quickly to shifts in the market. Particularly for low-income individuals and small and medium-sized businesses (SMEs), access to financial services can be severely hampered in many developing nations. Ineffective infrastructure, knowledge asymmetries, and excessive transaction costs are examples of inefficiencies that might impede efficient financial intermediation. Additionally, currency changes, inflation, and economic instability can affect financial intermediaries' stability and, consequently, the health of the economy as a whole.

Thus, it is essential to thoroughly investigate the impact of financial intermediaries’ functions on economic growth and this is particularly important in a developing country like Nigeria. Therefore, the primary objective of this research is to explore the relationship between financial intermediaries and economic growth. And specifically, this study aims to examine the impact of financial intermediation on economic growth in Nigeria. To achieve this, the study seeks to answer the following questions: What is the effect of credit to the private sector on real gross domestic product? What is the effect of the lending rate on real gross domestic product? And what is the effect of money supply on real gross domestic product?

Hypotheses Formulated

The following hypotheses were formulated:

Ho1: Credit to the private sector does not have a significant impact on real gross domestic product in Nigeria.

Ho2: The lending rate does not have a significant impact on real gross domestic product in Nigeria.

Ho3: Money supply does not have a significant impact on real gross domestic product in Nigeria.

LITERATURE REVIEW

Conceptual Review

Concept of Financial intermediation

Financial intermediaries play a crucial role in the development and growth of economies worldwide. They facilitate the intermediation between surplus and deficit units within any financial system. The financial system mobilizes savings from surplus units (lenders) and channels these funds to deficit units (borrowers). It comprises various financial institutions that operate in an organized manner to ensure smooth fund flow, along with regulatory and supervisory authorities that oversee these institutions, the financial market, its participants, and the instruments traded. Also, Ezirim [3] describes the financial system as a network of financial market arrangements, institutions, and agents that interact with each other and other economic units, governed by a set of rules and regulations. The money market, capital market, and regulatory and supervisory bodies for banks and non-bank financial firms are among the divisions that make up Nigeria's financial industry, according to Onoh [4]. Through financial intermediation, these intermediaries mobilize deposits from savers and allocate credit facilities to borrowers and investors, fostering economic development. Economic development encompasses activities in both the private and public sectors that require bank credit for expansion and growth. Odedokun (2018) argues that the rising costs of financial intermediation have negative implications for Nigeria's economic development.

The private sector, a major driver of economic development, depends mostly on bank lending to finance developments in the absence of a robust capital market. This dependence suggests that the low returns on deposits caused by rising financial intermediation costs may deter prospective savings.

Concept of Economic Growth

The term "economic growth" describes a quantifiable shift in a country's economic core, where those core qualities and attributes alter over time. Increased production scale and enhanced productivity through innovations in products and processes are the main drivers of this ongoing improvement in the capacity to meet the demand for goods and services. The process through which output or national income rises is known as economic growth. If the real output of goods and services per capita increases steadily, the economy is said to be expanding. The percentage increase in real national output over a given time period, usually a year, relative to the level of the prior year is measured by the rate of economic growth. On the other hand, economic growth is a process that, over time, raises a nation's real per capita income as indicated by an increase in the volume of products and services produced.

Economic growth occurs when an economy's productive capacity expands, enabling the production of more goods and services. It can be assessed through national income and real per capita income. As a crucial goal of macroeconomic policy, economic growth plays a significant role in fostering overall economic development. As an economy's ability to meet demand continues to increase, stringent regulations that hold up over time are produced. In industrialized economies that are subject to intense competition from around the world and rapid technological breakthroughs, factors that increase productivity are especially important for growth. Increased production capacity and effective resource use are necessary for economic progress, which encourages income redistribution in society. But occasionally, economic expansion is confused with economic turbulence. Expansionary fiscal and monetary policies could close recessionary gaps and raise GDP over its potential level [5].

Concept of Credit to Private Sector

Credit to the private sector refers to financial resources extended to private entities by financial institutions. This includes loans, the purchase of non-equity securities, trade credits, and other receivables that establish a repayment claim. In some countries, these claims may also encompass credit to public enterprises. Financial institutions involved include monetary authorities, deposit money banks, and other financial entities for which data is available. This category extends to companies that do not accept transferable deposits but hold liabilities such as time and savings deposits. Examples of other financial institutions include finance and leasing companies, money lenders, insurance corporations, pension funds, and foreign exchange companies [6]. Access to financial resources is essential to a country's sustainable development, according to financial research. Access to and availability of investment capital are essential for promoting economic expansion. Any economy's development is therefore intimately related to its financial system, which raises the country's potential for production. Initiating economic growth requires effective financial mobilization and credit availability.

Concept of Lending Rate

The lending rate is the interest rate set by banks to address the short- and medium-term financing needs of the private sector. This rate typically varies based on the creditworthiness of borrowers and the purpose of the financing. It represents the cost charged by financial institutions for lending money. The increase in lending rates will have a negative effect on economic growth [7]. Banks generally provide three types of loans: commercial and industrial loans, consumer loans, and mortgage loans. Commercial and industrial loans are directed towards businesses or industrial firms and can be categorized into short-term working capital loans (to finance the purchase of materials or labor) and longer-term loans (for acquiring machinery and equipment). Most commercial banks offer variable rates on these loans, meaning the interest rate can fluctuate during the loan term. The value of any collateral pledged to secure the loan, the borrower's credit and loan history, their ability to make scheduled payments, the amount of capital they have invested in the business, and the state of the economy as a whole all play a role in the decision to grant a loan.

Concept of Money Supply

Money supply refers to the total amount of money in circulation within an economy. It includes currency (paper bills and coins) as well as bank deposits. The Central Bank manages the money supply using three primary methods: buying and selling government securities, adjusting the required reserve ratio (the percentage of deposits that banks must keep with the Central Bank), and altering the discount rate (the interest rate banks pay to borrow from the Central Bank). Money supply is a crucial component of government monetary policy. Alongside fiscal policy, which focuses on taxation and spending, monetary policy aims to foster economic growth, high employment, and low inflation. Two significant schools of thought are Keynesianism and monetarism. Keynesians argue that increasing the money supply can boost employment and output, while monetarists contend that such increases primarily affect prices, leading to inflation without necessarily enhancing output [8].

Concept of Gross Domestic Product (GDP)

Gross Domestic Product (GDP) is the monetary value of all finished goods and services produced within a country during a specific period. It serves as an economic indicator, providing a snapshot of a nation's economy and its growth rate. GDP can be calculated in three ways: by expenditures, production, or incomes [1]. Specifically, GDP represents the total value of goods and services produced in a country over a defined timeframe. The three methods to calculate GDP include summing the value of all produced goods and services, adding up expenditures on those goods and services at the point of sale, and tallying producers’ incomes from the sale of goods and services. However, accurately measuring GDP can be challenging, mainly due to the existence of an unofficial economy, often referred to as the black economy, which includes unreported transactions. GDP reflects a country's economic activity, irrespective of who owns the productive assets.

Economists often use GDP to assess living standards in a country by dividing GDP by the population to obtain GDP per capita. This figure is frequently converted into U.S. dollars for comparative purposes. If GDP grows at a faster rate than the population, living standards are considered to be improving. Conversely, if the population grows more quickly than GDP, living standards are viewed as declining. It's important to note that GDP per capita does not account for the cost of living, leading some to advocate for alternative measures of living standards.

Theoretical Framework

There are different supporting theories on this study such like risk management theory, liquidity provision theory, information asymmetry theory, access to credit, capital market development theory, supply of funds theory as well economic structural transformation. But this study is underpinned by three of the above-mentioned theories.

Supply of Fund Theory

This theory posits that the availability and accessibility of funds in the financial system play a crucial role in facilitating economic activities and driving growth. Focuses on the relationships between the supply of financial resources (funds) and their allocation in the economy, particularly how these funds affect investment and economic growth. Financial intermediaries such as banks and investment firms, mobilize savings from various sectors of the economy and channel them into productive investments. By transforming savings into investments, they help in capital formation which is essential for economic growth.

Information Asymmetry Theory

Hypothesis that states that in a transaction, one party has more or better information than another. This imbalance in information can lead to adverse selection, moral hazard, and overall inefficiencies in markets. Therefore, financial intermediaries reduce information asymmetries between borrowers and lenders. They conduct due diligence and credit assessments which helps to identify worthy projects. This reduction in uncertainty fosters investment and enhances productivity.

Access to Credit Theory

This theory emphasizes on the function of financial intermediaries by providing access to credit borrowers in such a way that it makes easy for the repayment. The theory focusses on small enterprises financing by financial institutions to foster the economic growth and sustainability. Financial intermediaries enable firms, particularly small and medium-sized enterprises (SMES) to finance their operations and expansion. In doing this, easier access to credit can enhance productivity and innovation which further stimulate economic growth.

Empirical Review

Adolphus and Samuel [8] examining the effects of financial intermediation on economic growth in Nigeria. The data is obtained from secondary sources from the Central Bank of Nigeria [2] database. The study adopts vector autoregressive (VAR) methodology. Thus, the data consisting of a total of 148 observations is considered adequate enough to produce dependable results. The results show that financial intermediation measures jointly have no causal effect on real GDP growth, but individually, only the effect of bank deposit ratio is significant. Therefore, the study recommends that the Central Bank of Nigeria [2] should persuade deposit money banks to reduce the current interest rate margin by reducing the lending rate and increasing the deposit rates.

Ogiriki and Andabai [10] used co-integration tests and the Vector Error Correction Mechanism (VECM) to reveal a long-term relationship, indicating that financial intermediation accounts for a significant portion of the variation in economic growth. Yakubu and Affoi [11] explored the role of commercial bank credit to the private sector in economic growth, finding that this form of financial intermediation significantly and directly impacts the economy. Likewise, Mamman and Hashim [12] utilized OLS regression analysis to demonstrate that bank lending activities are statistically relevant to economic growth. Murty, Sailaja, and Demissie [1], through co-integration methodology, determined that bank credit to the private sector has a long-run positive effect on economic growth in Ethiopia.

Bouzid and Radhia [13] investigated the relationship between financial intermediation and economic growth in Tunisia, using the Vector Autoregressive (VAR) approach, concluding that financial intermediation positively influences economic growth. Sahoo [14] analyzed the impact of financial intermediation on India's economic development, using the Granger causality test to confirm that causality flows from private sector credit to growth, indicating that financial intermediation drives growth. The ARDL method further suggested that bank-based financial development plays a more significant positive role compared to market-based financial development.

Dumani [15] re-examined the impact of financial intermediation on economic growth in Nigeria. The objective of the study was to determine the disaggregate influence of credit to the private sector in Nigeria. To achieve this, we adopted the ex post research design to determine how the explanatory variables affects the dependent variable in retrospect. The study further adopted the Engle Granger Representative Theorem to estimate the functional relationship in the model. The empirical results predict that loans and advances to agriculture, fisheries forestry, manufacturing sector and commercial bank credit to small scale enterprises has a significant influence on economic growth in Nigeria. We therefore suggest that banks should be more efficient in mobilizing and allocating funds to entrepreneurs in the real sector. The policy implication of this is that regulatory authorities should continue to take measures to liberalize the financial system to avoid any form of shock on the system.

Allen and Gale [16] investigated the connection between financial intermediation and economic growth in 12 Credit Union (CU) countries using the panel GMM estimation technique, revealing a significant positive effect of financial intermediation on economic growth. Bencivenga and Smith [17] analyzed a panel dataset of 28 emerging economies and found a direct relationship between financial intermediation and economic growth. Idris [18] examined the cost of financial intermediation in Jordan from 2000 to 2008 using a random effects estimation approach. It found that elevated and increasing financial intermediation costs are associated with efficiency levels, as well as factors like the capital adequacy ratio and the loan-to-total asset ratio. Additionally, like previous research, this study did not evaluate the impact of financial intermediation on economic development by including variables such as private sector credit, lending rates, and interest rate margins.

Beck and Hesse [19] examined the factors contributing to high financial intermediation costs in Uganda, utilizing a unique dataset from the banking sector covering 1999 to 2005. It identified that bank-specific characteristics such as size, operating costs, and loan portfolio composition significantly influence these costs. However, the research revealed no substantial relationship between financial intermediation costs and foreign bank ownership, market structure, or bank efficiency. Additionally, similar to previous studies, it did not explore the impact of financial intermediation on economic development through variables like private sector credit, lending rates, and interest rate margins. Tapen [20] explored the relationship between financial intermediation and economic growth in Nigeria using a vector error correction model. It found a long-term relationship, indicating that about 89% of the variations in Nigeria's economic growth are linked to changes in financial intermediation variables. However, the research did not consider the impact of financial intermediation on economic development by examining factors such as private sector credit, lending rates, and interest rate margins.

Sulaiman and Aluko [21] examine the causality between financial intermediation and economic growth in Nigeria between 1990 and 2013. Utilizing the Toda-Yamamoto Granger non-causality test, it reveals that causality is absent between financial intermediation and economic growth. It recommends that government should design and implement reforms that would increase the banks’ capacity to intermediate funds to the real sector as well as deepen the financial sector.

RESEARCH METHODOLOGY

This research uses the ex-post facto design for the data analysis. The study utilized secondary time series data spanning from 2003 to 2023, which were sourced from the Central Bank of Nigeria [2] statistical database. The analysis of the collected data was conducted using the Ordinary Least Squares (OLS) method, facilitated by E-Views version 12 for inferential statistical analysis. Hypothesis testing was performed at a significance level of 0.05.

Model Specification

Justification for this model comes from its attempt to capture important elements affecting economic growth, particularly in the context of Nigeria or a comparable economy. Policymakers and economists can gain insight into the dynamics of the economy by analyzing the correlations between GDP and the independent variables.

And the true regression line is given below:

Where: GDP: Gross Domestic Product; CPS: Credit to Private Sector; LDR: Lending Rate; MS: Money Supply; Ut: Stochastic Error; B0: Constant Term (Intercept); B1, B2, B3: Parameters to be Estimated; Ut: Disturbance Term/ Stochastic Error Term

EMPIRICAL RESULTS AND DISCUSSIONS

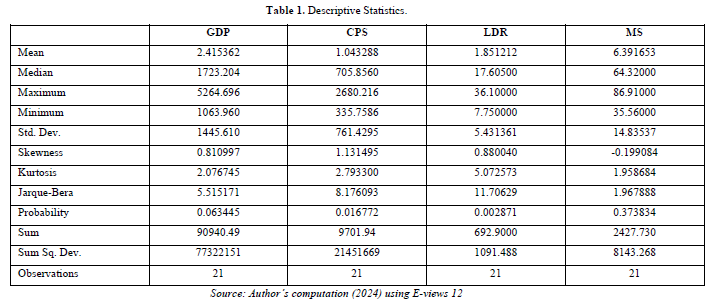

Descriptive Statistics (Table 1)

Descriptive statistics indicate that the average Gross Domestic Product (GDP) over the 21-year period was approximately 2.415 trillion naira. The Credit to the Private Sector (CPS), which reflects the funds available to the private sector, averaged about 1.043 trillion naira. The mean Loan to Deposit Ratio (LDR) during this period was approximately 1.851, while the average Money Supply (MS) was around 6.391 trillion naira. A variable is considered normally distributed because the probability value of the Jarque-Bera test exceeds 0.05; otherwise, it is deemed skewed or not normally distributed.

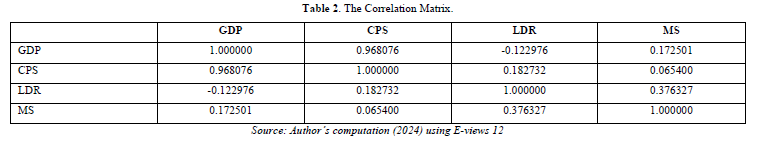

The Correlation Matrix (Table 2)

GDP and the CPS have a very strong positive correlation (0.968), whereas the MS has a small positive correlation (0.173), suggesting that GDP has a slight propensity to rise in tandem with an increase in the money supply. There is a slight negative connection between GDP and LDR, as indicated by the coefficient of -0.123, which suggests that changes in GDP have little effect on LDR. Overall, the interpretation shows that most correlations are weak, while some do exist, especially between GDP and CPS. Thus, it suggests that while the links with the Loan to Deposit Ratio (LDR) and Money Supply (MS) are less strong, economic output (GDP) is strongly linked to Credit to the Private Sector (CPS).

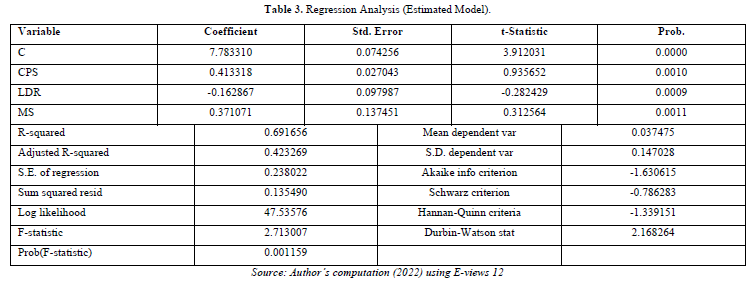

Regression Analysis (Estimated Model) (Table 3)

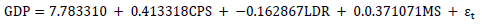

Thus, the model is

R2 value of 0.691, meaning that the independent variables-credit to the private sector, lending rate, and money supply-account for 69% of the variance in the dependent variable (economic growth). Error terms, which are factors that cannot be quantitatively incorporated in the model because of their qualitative nature, account for the remaining 31% of the variation.

The model's robustness is demonstrated by the assessment metrics overall, with the R2 of 0.691 emphasizing its explanatory power. Additionally, even at the 1% significance level, the model has a significant degree of statistical significance, as evidenced by the F-statistic of 2.713 and p-value of 0. 001.With a coefficient of 7.783, a standard error of 0.074, and a t-value of 3.912, the study calculated an intercept (C). The intercept is statistically significant and positive since the t-statistic is more than the threshold value of 1.96 and the standard error is noticeably less than half of the coefficient. The coefficient for the Credit to the Private Sector (CPS) variable is 0.413, with a t-value of 0.935, a standard error of 0.027, and a significance level of 0.001. This finding suggests that an increase in credit to the private sector has a favorable impact on economic growth and that CPS is a positive and substantial predictor of economic growth in Nigeria. In particular, a 4.1% increase in Nigeria's economic development is linked to a 10% increase in CPS.

Tests of Hypotheses

Ho1, the p-value for Credit to the Private Sector (CPS) is 0.001, which is less than 0.05, indicating significance. Since the estimated value is lower than the significance threshold, we reject the null hypothesis and accept the alternative hypothesis, confirming that CPS has a significant impact on economic growth. The coefficient for the Lending Rate (LDR) variable is also significant but exhibits a negative impact on economic growth, with a value of -0.167, a standard error of 0.096, and a t-statistic of 0.282. This indicates that LDR negatively and significantly affects economic growth in Nigeria. Specifically, if the Lending Rate increases by 10%, the performance of the banking industry in Nigeria is expected to decline by 1.6%.

Ho2, the p-value for the Lending Rate (LDR) is 0.000, which is less than 0.05, indicating significance. Since the estimated value is lower than the significance level, we reject the null hypothesis and accept the alternative hypothesis, confirming that the Lending Rate (LDR) has a significant but negative effect on economic growth in Nigeria. The Money Supply (MS) variable also significantly affects economic growth in Nigeria. Its coefficient is 0.371, with a standard error of 0.136 and a t-value of 0.312. These results suggest that this variable has a positive and significant impact on economic growth. Specifically, a 10% increase in Money Supply (MS) is expected to lead to a 3.8% increase in economic growth in Nigeria.

Ho3, the p-value for Money Supply (MS) is 0.001, which is less than 0.05, indicating significance. Since the estimated value is lower than the significance threshold, we reject the null hypothesis and accept the alternative hypothesis, confirming that Money Supply (MS) has a positive and significant effect on economic growth in Nigeria.

CONCLUSION AND RECOMMENDATIONS

The study identified a long-run relationship among the explanatory variables of financial intermediation and economic growth after co-integrating them. The overall regression model demonstrated statistical significance at the 5% level, highlighting the connection between financial intermediation indicators-specifically, credit to the private sector relative to nominal GDP and the loan-to-deposit ratio-and the economic growth indicator, represented by the growth rate of real GDP. The consolidation of certain financial intermediaries has led to greater efficiency within the sector, which is commendable. However, there is still considerable work required by the government and regulatory authorities to ensure that all financial intermediaries are adequately equipped, possess sufficient capital, and effectively fulfill their roles to prevent the recurrence of past issues.

The study concludes that financial intermediation has a significant and positive impact on economic growth in Nigeria. Therefore, it recommends that monetary authorities encourage banks to lower lending rates to bolster the productive sectors of the economy. Additionally, it emphasizes the necessity of managing the money supply to prevent inflation and potential increases in unemployment. Furthermore, the study advocates for improved access to credit for viable sectors to support overall economic development.

No Files Found

Share Your Publication :