-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Grace Oyeyemi Ogundajo*, Tamunokonbia Promise Ogan, Adeyanju Joel Oluwasijibomi and Jafaru Marughu

Corresponding Author: Grace Oyeyemi Ogundajo, Department of Accounting, School of Management Sciences, Babcock University, Ogun State, Nigeria.

Received: September 06, 2023 ; Revised: December 06, 2023 ; Accepted: January 09, 2024 ; Available Online: February 19, 2024

Citation:

Copyrights:

Views & Citations

Likes & Shares

The importance of forecasting and controlling costs in business cannot be overemphasized. Costs if left unchecked will have a significant negative impact on profitability. In today's business environment, many companies face challenges in making effective and prudent decisions in the area of forecasting and cost control. Companies can only overcome these challenges through strategies that optimize resources to maximize profits. Therefore, this study examines the impact of accounting and cloud computing on the cost forecasting and control of Nigeria-listed depository banks. The study subjects included all (14) listed depository banks in Nigeria as of December 31, 2021. However, due to data availability and accessibility, 13 depository banks were listed. chosen. Research data were obtained from the 10-year annual report (2012-2021) of the study subjects, while regression analysis was used to analyze the research model developed for the panel data specification. Regression estimation results show that the F-statistic is statistically significant at the 5% level (the F-statistic is 7.9286, the P-value is 0.000000). This indicates that the combined ROI, TOC and SOB have a statistically significant impact on cost control and forecasting at 5% significance level. Therefore, the study concludes that accounting and cloud computing have a statistically significant impact on cost control and forecasting in Nigerian depository banks. So, an important step in reducing the huge infrastructure costs of deposit banks in Nigeria is forecasting and controlling costs. Cloud computing offers a solution to overcome this challenge.

Keywords: Cloud accounting, Cost control and prediction, Software-as-a-Service, Infrastructure-as-a-Service, Platform-as-a-Service

INTRODUCTION

The advent of globalization has led to intense competition among businesses as they no longer operate in a traditional business environment but operate within a broader network of service partnerships. Therefore, producing quality products and services in this environment at affordable prices no longer guarantees financial success [1]. This shows a daily increase in complexity. As a result, business leaders face the challenge of increased risk and uncertainty in their efforts to meet stakeholder expectations. To meet stakeholder expectations and remain sustainable, businesses, especially those in the studied environment (i.e. banks), must remain profitable through assessment. correct price of operating costs and interest payable, as a reference to maintain sustainability. The performance of a bank is determined by operating costs, operational efficiency, credit risk, liquidity risk, risk aversion and market share [2]. Operating costs are very important for a company, especially in its operating activities. The bank's operating expenses include interest on time deposits, loans received, labor, maintenance, repairs, fixed assets, stationery, accounts receivable, goods and services. by third parties to increase operating income.

To achieve business goals, managers must make informed decisions in the area of cost control and forecasting. Cost control is the process by which management seeks to influence costs to keep them within planned limits [3]. It's about finding ways to reduce waste in the organization for better and more economical ways of doing things. It is management's effort to influence the actions of those responsible for performing tasks, setting costs and generating revenue, and reducing costs while at the same time ensuring the best for the company. company. This is usually defined as the standard cost or target cost limit in the formal operational plan.

Forecasting and cost control techniques include budgeting, operating cost estimating (ABC), standard cost estimating, materials control, life cycle costing, etc. It improves management efficiency and leads to actions taken to reduce operational costs for profitability, efficiency and to prevent fraud and other forms of corporate negligence. Taking this into account, cost control and forecasting is important for every business, including banks, and ignoring them will always affect profitability [4].

There are situations in which companies report poor performance. This may be due to uncontrolled operating costs, as evidenced by the increased costs of Nigerian banks during the study period. Therefore, for better performance, it is necessary to maintain a quality cost structure along with cost forecasting and control measures to minimize costs and improve performance [4].

The advent of information technology (IT) has affected organizational costs. Cloud computing is one of the exciting but hot trends among emerging information and communication technology (ICT) solutions that can be deployed for forecasting and cost control. It is a powerful computing model whose goal is efficient use of resources. The cloud computing paradigm has evolved recently and taken enterprise computing to the next level. Over the past few years, cloud computing has revolutionized the business and technology landscape, providing more flexible and lower-cost IT solutions that allow companies to outsource enterprise resource planning systems. traditional or any other on-site application for outside or on-site. - site site. ask for a solution. The concept of cloud computing is based on the idea that a computing resource will be located somewhere outside the computer room and users will connect to it using the resource as needed. In effect, this moves the infrastructure into the network, thus reducing the total cost of managing hardware/software resources [5]. It is a highly disruptive technology [6] that heralds a future where computing moves from local computers to centralized facilities operated by storage utilities and third-party computation [7]. However, considering the actual implementation of cloud computing, the adoption of the cloud platform by scientific institutions/communities is still in its infancy.

One of the characteristics of the modern working environment is the application of IT in all areas of administration. The use of information, communication and electronic technology has changed the traditional accounting system and changed the accounting process. Companies are required to strengthen their accounting processes to meet global accounting standards. Cloud accounting is a product of information and communication technology known as electronic computing. Cloud accounting is offered to solve problems such as accounting errors, delays, and validation of accounting information. Cloud accounting helps companies improve their efficiency. Cloud accounting and cloud costing can be both complex and challenging. The cost structure of cloud accounting can significantly affect product pricing, cost accrual methods, and other accounting transactions from the perspective of the business organization and the customer [8]. Companies with a cloud facility involve many different types of costs, including website development costs, infrastructure acquisition costs, contract acquisition costs, maintenance costs, or hardware costs. software for continuous services. These actually affect the cost structure of the business, such as direct and indirect costs. However, while the adoption of these accounting technologies has a long history in advanced economies, they are still in their infancy in developing economies such as Nigeria, as there are no experimental studies are known in this country. This study aims to examine the impact of accounting and cloud computing on cost control and forecasting of listed depository banks in Nigeria.

LITERATURE REVIEW

Conceptual Review

Cost Prediction and Control

Expenses have always been one of the key components of the overall business of a company, even a commercial bank. Cost is a function of a company's operations, because it is impossible to operate without costs. Therefore, cost control and forecasting are essential for the management of every business.

Cost control, also known as cost management, is a broad set of cost accounting methods and management techniques with the common goal of improving business profitability by reducing costs or reducing costs. by limiting their growth rate. Onuora and Edoziuno [3] describe cost control as the process by which management seeks to influence costs to keep them within planned limits. It is about finding ways to reduce waste in the organization to find better and more efficient ways to run operations.

Akeem [9] defines cost control as regulating the operating costs of a business and is concerned with keeping costs within acceptable limits. It is a management effort to influence the actions of those responsible for performing tasks, setting costs and generating revenue, and reducing costs to ensure the best for the company. This is usually defined as the standard cost or target cost limit in the formal operational plan.

Companies use cost control methods to monitor, evaluate, and ultimately improve the effectiveness of specific areas, such as departments, divisions, or product lines, in their operations. own. Cost control techniques include budget control, operational costing (ABC), standard costing, material control, life cycle costing, and more.

Controlling costs improves management efficiency and leads to actions taken to reduce operational costs for profitability, efficiency and to prevent fraud and other forms of corporate negligence. Akeem [9] observes that cost control can lead to rational use of materials and labor, ensure adequate production, avoid material redundancies, and ensure key decision-making. easy book.

Forecasting and controlling costs tied to operational efficiency. Operational efficiency means that the costs incurred to make a profit are less than the profit gained from using the asset. Therefore, forecasting and cost control is measured by the efficiency ratio, which indicates how well managers control their costs. Expenses in the banking sector are expenses related to banking operations, namely interest expenses, other foreign exchange costs, labor costs, depreciation and infrastructure costs. Banks that fail to improve business efficiency will lose their competitiveness in deposit mobilization.

Cloud Computing

The Cloud Computing Paper highlights several factors involved in implementing cloud computing in an enterprise. These include adoption, technical implementation details, cloud infrastructure, and more. Pyke [10] discussed how cloud computing would be a potential paradigm shift from the traditional computing paradigm and to what extent an application is considered to be in the cloud. Cloud infrastructure and delivery models have been studied in Nucleus [11] as well as market-oriented asset resource allocation. Real-world implementation challenges and opportunities in cloud architecture as well as the risks of migrating from legacy systems to the cloud were explored in Fox [12]. They also present a trade-off equation to evaluate the profitability of cloud adoption, which is used to derive some aspects of the model proposed in this study.

Research on cloud accounting has focused on calculating return on investment (ROI) in cloud computing [13]. The goal of the ROI calculation is to mathematically deduce the return the business will receive based on the required investment in cloud computing. The models are limited to cost/savings and in some cases business information [14]. However, the detailed analysis of cost factors in ROI calculation seems to be the missing link in cloud ROI related studies. A brief cost-benefit analysis was presented in Simson [15], in which the experimental API was evaluated in the cloud. This study assesses Amazon's service quality; however, the list of parameters to be considered for cost-benefit analysis is limited. Deelman [16] studied how to tailor the project's requirements to facilitate its deployment in the cloud. They regulate the cost of running scientific workflows in the cloud. However, none of the models presented can be used by an organization to decide to adopt cloud computing. Similar execution of workflow structured applications was discussed in Singh [17] and Zhao and Sakellariou [18].

Various blogs have explored the benefits of cloud adoption [11,19,20]. These blogs reference individual case studies, focusing on the benefits gained through cloud implementations. Most blogs cover basic cloud cost calculations and also start discussing the benefits of cloud computing. However, these blogs are limited in scope because they deal with individual cases and there is no model for cost-benefit assessment. ROI of cloud deployment has been demonstrated in several studies. However, the scope is limited to mail servers and the goal is not towards a cost-benefit model.

On the other hand, very few studies have attempted to study Cloud pricing, the results of which can serve as a basis for the development of a cost-benefit model. Buyya [21] explored the performance of several pricing mechanisms, including Fixed Time and Fixed Time, in the Aneka enterprise cloud environment setup. Palankar [2008] evaluated Amazon S3's ability to provide low-cost storage for large-scale projects from a cost, availability, and performance perspective. This is a good effort since many home users, both small and large businesses, subscribe to the S3 service [22]. It stores more than 5 billion user objects and processes more than 900 million user requests per day [23]. However, it does not consider the user-side cost calculation because the goal is to evaluate the performance of the Amazon service based on the defined parameters. A similar assessment of Amazon EC2 service performance was performed on MPI applications in Walker [24]. An excellent cost analysis has also been performed by Li [2009], but all calculations are done from the vendor’s perspective only.

Cloud Accounting

Antonio [25] reflected on the role of business process management and related technologies in supporting/developing current accounting information systems. While traditional accounting information systems fulfill financial reporting needs, by collecting data from a central database and consolidating it so that decision makers can easily use the information believe, but they have not yet been created to bear in mind the idea of doing business processes. oriented accounting. “Organizations have always worked implicitly or explicitly, focusing on business processes. The adoption of business process management as a management method has become widespread in recent years, making the transition from accounting information systems to business process-oriented accounting supported by the ministry of management. business process management is reasonable” [25]. According to them, "the benefits of this evolution include flexibility and agility in redefining business processes, empowering knowledge workers, establishing checkpoints for data collection to generate reports and alerts using real-time financial and non-financial information for actionable decision makers” [25].

Benefits of cloud accounting include real-time operations and visibility across the organization, enhanced mobility and cross-departmental collaboration, accurate account balances, reliable transactions reliability, good multi-currency management and better management of business-to-business transactions [26]. They confirm that "some definitions of cloud computing do not address the meaning of cloud computing, nor do they address the characteristics of the phenomenon". Buttell [27] considers “cloud computing as a way to 'move your computer applications and programs from the office to the Internet'.

On Cost Accounting

Recent studies and theories on the cost structure of cloud computing are not easy to find. Skilton [28] argues that “cloud providers need to be concerned with the production and product efficiency as well as the cost/effectiveness of the delivery services”. They highlight three cost elements in the cost structure of a cloud-based business model. These cost factors include “the most expensive critical resources and the most expensive critical operations.” He concluded that these subsets should be understood as the operating mechanism of accounting to detail the cost structure and cost factors. In this classification, accounts can be classified according to the theory behind the transaction or by the overall cost. When transaction theory is applied, cost classification and income statement structure are considered; Two ways of aggregating costs can be distinguished, including direct and indirect costs [29].

Effiong [30] confirm that the volume of activity is a determinant of the extent to which costs are allocated directly or indirectly. Mohanty & Mishra [31] states that “in construction, all costs necessary to complete the installation, but not directly related to the cost object, are indirect, such as costs. Shared”. At the same time, they argue that “in manufacturing operations, costs that are not directly related to the final product or process are indirect. For example, these may include management, insurance, taxes, or maintenance fees. Indirect costs are the costs of activities or services that benefit multiple projects. In their assessment, “exact cost benefits indirectly related to a particular project are often difficult, if not impossible, to track. For example, it can be difficult to pinpoint exactly how the activities of an organization's director benefit a particular project. Indirect costs do not vary significantly in certain production volumes or other performance indicators and can therefore sometimes be considered fixed costs” [31].

Costs Incurred in Cloud Accounting

Ongoing maintenance or service costs: Expenses related to ongoing maintenance and service are usually charged as incurred, while some other enhancements or upgrades that provide additional features and functionality may qualify for capitalization. in certain cases, once a customer's cloud service is deployed, the cloud service provider may incur costs to maintain and support a continuous level of service. Depending on the specific cloud structure, these costs can be related to a variety of activities, such as phone support, routine maintenance, software improvements, or software upgrades or replacements. hard. Although not specifically specified in the systematization of Accounting Standard 350-40, maintenance is defined in the systematization of Accounting Standard 985-20-20 "as activities performed after when the product is made available to the customer to correct a defect or to maintain the product. Update current information, including changes and additions regularly” [32]. Maintenance will include modify software to correct errors or omissions, apply fixes, install minor upgrades, or provide other general support services [32]. For example, modification to allow a software product to on top of a new operating system without providing additional functionality would be considered maintenance.

Software development or acquisition costs: Cloud agreements may provide access to software applications developed internally or purchased externally, or software applications that give customers access to the cloud. Recording and keeping of cost accounts that a cloud service provider may track to develop or purchase related software may depend on the structure of the cloud, how the software is used, or the nature of the agreement. In addition, expenses that qualify for capitalization may depend on whether they are accounted for under “Accounting Standard 985-20 or Accounting Standard 350-40” [33].

Infrastructure purchase cost: Cloud service provider services may incur costs when building cloud service infrastructure, such as costs associated with purchasing storage, mainframe equipment, or servers. For public clouds, the infrastructure is usually maintained in a location dedicated to the cloud service provider and accessible to the customer over the Internet. “The benefits and challenges of cloud accounting for the accounting and decision-making capabilities of companies reviewed in this qualitative study, based on the most relevant literature on the topic” [31]. They argue that “the literature on the subject is largely based on studies and manuals by practitioners, surveys conducted by specialized research firms or by service developers.” cloud.

Website development costs Accounting Standard Code 350-501 provides guidance on classifying costs as capital or expenses at each stage of website development. The implementation guide to Accounting Standards Code 350-50 includes descriptions and examples of the types of activities to be performed at each of these stages [34]. For example, the website application phase and the infrastructure development phase would include the purchase or development of the software needed to work with the website and obtain an internet domain name. Expenses incurred for activities during the planning, content development, and operations phases are generally considered expenses because they are incurred in some exceptional circumstances.

However, accounting for costs related to other activities, such as costs related to web applications, infrastructure development or graphics, is more dependent on the nature of the costs incurred. For example, recording costs associated with creating software or graphics may depend on whether the software is developed for internal needs or for external marketing [35]. The preparation of Accounting Standard 350-40 lists the cost and account recording guidelines of the software for internal use and not to be marketed, while the preparation of Accounting Standard 985 -20 provides guidance on recording and accounting software that is marketed and used externally. The accounting section of Code 350-50 accounting standard provides guidance on cost accounting related to activities during each stage of site development” [36].

Theoretical Framework

Innovations Theory of Profits

The profit innovation theory was put forward by Joseph. A. Schumpeter. Schumpeter believes that an entrepreneur has the ability to realize economic benefits through innovation. This theory holds that economic profits are the result of successful innovations launched by entrepreneurs. Joseph Schumpeter explains that the primary function of an entrepreneur is to introduce innovations, and when this is done, profits begin to accrue. Schumpeter defines innovation as any measure or policy adopted by an entrepreneur to reduce production costs or increase demand for his or her product.

According to Schumpeter, there are two types of innovation. The first types of innovations are innovations that reduce production costs. These include the introduction of new machinery, new and less expensive production techniques or processes, exploitation of new sources of raw materials, and new and improved methods of business organization. The second type of innovation involves actions that increase demand for the product. This includes the introduction of a new product, a new variety or design of a product, a new and superior method of advertising, the discovery of new markets, etc. If an innovation is successful, reducing production costs or increasing demand for a product, it will turn a profit.

Profits are made through successful innovations, or costs fall below the prevailing price of the product, or the entrepreneur can sell more and at a better price than before. It is worth mentioning that the benefits generated by a particular innovation tend to be competitive as others imitate and adopt it. An innovation is no longer new or novel when others learn and apply it as well. When an entrepreneur introduces a new innovation, he first finds himself in a monopoly position because the new innovation is limited to him alone. So, he makes big profits. After a while, others will also apply it to be shared, the benefit will disappear.

This theory is useful for this article because accounting and cloud computing are new innovations and if adopted by the business, they will help to reduce the cost of running the business and if costs are reduced then profits will increase.

Empirical Review

Dimitriu and Matei [37] studied “cloud accounting as a new business model in a difficult context and concluded that the cloud has conquered most areas of activity, but it seems the accounting world skeptical about this new model.” According to them, “some accountants see cloud-based software as an obvious threat. Of course, this can be seen as a threat to those who are not willing to adapt and understand the benefits that this brings. As we all know, people fear what they don't understand. This economic model does not mean that accountants are excluded from the industry.” “In fact, these solutions aim to simplify accountants' tasks and optimize company workflows. Cloud-based applications are not designed to replace the human element in business operations (as some surveys may suggest)” [37].

Khanom [38] considers the theoretical view that “the practice of accounting in the cloud has been greatly improved by the emergence of accounting software using cloud technology, one of the major IT innovations of the past decade”. He notes that “the ever-changing business world today is becoming more competitive and complex with advancements in cloud technology. Like other businesses, accounting also applies cloud computing solutions to deliver specific and relevant information and real-time business insights to all stakeholders. mandarin." For him, “although cloud accounting is becoming more and more popular, many business owners and professionals are still not sure what it is, what its benefits are, or how it will shape accounting in the future. How [38].

Effiong [39] examined the impact of cloud accounting in harmonizing the cost structure of production-oriented companies listed on the Nigerian Stock Exchange. The results show that cloud accounting has a significant impact on the cost structure of manufacturing companies and therefore cloud costs need to be harmonized in the cost structure of manufacturing companies. Hamad [40] examined the impact of accounting software on reducing business costs. Research shows that accounting software has a positive and significant effect on reducing business costs. Albashabsheh, Alhroob, Irbihat and Javed [41] examined the impact of accounting information systems on cost reduction in Jordanian banks. The study shows that there is a negative correlation between accounting information system and expenditure, which shows that the application of accounting information system will reduce the operating costs of banks in Jordan.

Maelah [42] explore the relationship between management accounting information, decision making and cloud computing among SMEs in Malaysia. Research shows that cloud computing moderates the relationship between management accounting information and decision making. Alwan [43] measured the impact between the adoption of cloud accounting technology and cost reduction. The study found a statistically significant relationship between the adoption of cloud accounting technology and cost reduction.

Convenient [2022] examined the determinants of accounting information system (AIS) adoption in small and medium enterprises (SMEs) in Vietnam. The results indicate that there is a positive relationship between the use and effectiveness of accounting information systems. The study also shows that the operational efficiency of the accounting information system has a positive impact on business performance.

METHODOLOGY

This study examines the impact of accounting and cloud computing on cost forecasting and control among Nigerian listed depository banks. The study applied a fact-after-fact study design. The study subjects included all (14) depository banks listed in Nigeria as of December 31, 2021. The banking sector was chosen because of the important role banks play in financial stability. and economic development of the country and they are also related to the cloud. data saving. However, due to the availability and accessibility of data, 13 listed depository banks were selected. Research data were obtained from the study subjects' 10-year annual report (2012-2021), while regression analysis was used to analyze the research model developed for the panel data specification.

Operationalization of variables

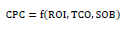

Where:

Y: Cost control and prediction (CPC); X: Cloud computing and accounting (CCA); X: x1, x2; x1: Return on investment (ROI); x2: Total cost of ownership (TCO); Z: Size of bank (SOB)

Functional relationship

Model Specification

A-priori Expectation

It is expected that cloud computing and accounting would have a positive impact on cost control and prediction. Thus, the coefficient of the independent variable would be greater than zero (0).

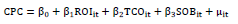

Measurement of Variables (Table 1)

Data Presentation and Analysis

In an attempt to provide answer to the research question, the study collected data from 10-year annual report of deposit money banks in Nigeria, covering 2012-2021. The data obtained in the data is as presented and analyzed in the preceding sections.

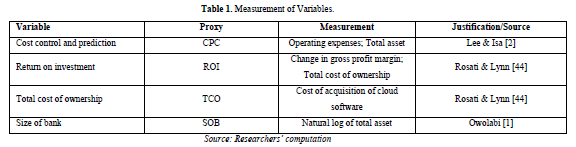

Descriptive Statistics (Table 2)

Table 2 presents a summary of the descriptive statistics of the data series. The CPC showed a mean value of 0.5722 with minimum and maximum values of 0.1720 and 12.3380 respectively. ROI showed a mean value of 4.4166 from a range of 0.6942 and 8.5404. For TCO, the lowest and highest values are 3.4012 and 15.9554 respectively with average value of 10.2996. For SOB, the mean value is 17.7454 with minimum and maximum values are 13.4252 and 23.1819 respectively indicating wide gap in size of the banks.

The standard deviation of the variables indicates 1.0428, 1.1855, 3.1236 and 2.9454 for the CPC, ROI, TCO and SOB respectively. This shows that variation in the data series for the mean is high. This indicates that the level of cost control and prediction, investment in cloud computing and accounting as well as size of the banks across the period under investigation varies greatly. This is confirmed by the behavior of the data series across the period of investigation.

Test for Research Hypothesis

Research Objective: To investigate the impact of cloud accounting and computing on cost control and prediction among listed deposit money banks in Nigeria.

Research Question: Does cloud accounting and computing have any significant impact on cost control and prediction among listed deposit money banks in Nigeria.

Research Hypothesis: Cloud accounting and computing do not have any significant impact on cost control and prediction among listed deposit money banks in Nigeria.

Hausman test

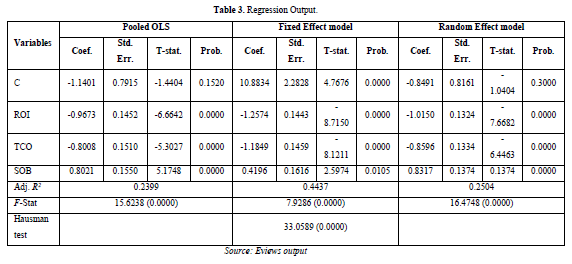

To test for the most appropriate model between the fixed effect and random effect models to employ in the study, we conducted the Hausman test. The Hausman test showed a chi square (X2) value of 33.0589 with P-value of 0.000 indicating that probability value is statistically significant at 5% level. Hence, we conclude that the fixed effect model is the most appropriate model to estimate the research model (Table 3).

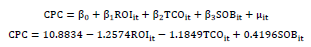

The objective of the research model is to provide an answer to the question of how accounting and cloud computing affect cost control and forecasting in Nigerian depository banks. The model shows an adjusted R2 of 0.4437, indicating a 44.37% change in cost control and predictability in Nigerian depository banks as explained by the explanatory variable. The remaining variable 55.63% is explained by factors outside the research model.

The constant y intercept yields a positive coefficient value of 10.8834, demonstrating that accounting and cloud computing have a positive effect on cost control and forecasting, which confirms the a priori expectation. our experience. This implies that a one-unit increase in the explanatory variable will result in an increase of 10.8834 in controlling and forecasting costs. Regarding the goodness of fit of the model, the results show a goodness of fit of 7.9286 (P value of 0.000000), showing that the combined ROI, TOC and SOB have a statistically significant impact on the model. control and forecasting costs at 5% significance level. Therefore, we conclude that accounting and cloud computing have a statistically significant impact on cost forecasting and control in Nigerian depository banks.

Discussion of results

The quest to reduce operational inefficiencies has become commonplace within the Nigerian banking industry as well as other institutions. An important step in reducing this operational inefficiency is cost control and forecasting. Cloud computing provides a solution to this inefficiency through cost-effective and IT solution delivery. Thus, this study evaluated the impact of accounting and cloud computing on cost control and forecasting among Nigerian listed depository banks.

The regression estimation results show that the F-statistic is statistically significant at the 5% level (the F-statistic is 7.9286, the P-value is 0.000000). This indicates that the combined ROI, TOC and SOB have a statistically significant impact on cost control and forecasting at the 5% significance level. Therefore, the study concludes that accounting and cloud computing have a statistically significant impact on cost control and forecasting in Nigerian depository banks. This implies that ROI and TOC can predict a bank's cost structure. The optimal cost structure will improve the bank's operational efficiency and help the bank control operating costs, which will affect the bank's profit.

Cloud computing and accounting systems like ERP can lead to standardization of data collection formats and reports, giving employees faster and more efficient access to the right amount of information. This will facilitate cost control and forecasting tools such as budgeting, standard costing, ABC, real-time cost tracking, and analysis of variance. et cetera. The results of this study support the results of previous studies such as Effiong [39], Hamad [40], Maelah [42], Alwan [43] and Thuan [45].

Implication of the results

The research results have both theoretical and practical significance. Theoretically, this result demonstrates the need to solve the problem of cost control and forecasting using cloud computing and accounting. Thus, this contributes to the debate between variables.

In fact, it provides guidance to business leaders regarding organizational resource allocation on the need for adequate investments in cloud computing and accounting as a forecasting and control tool. expense.

SUMMARY AND CONCLUSION

This study examines the impact of accounting and cloud computing on cost forecasting and control among Nigerian listed depository banks. The importance of forecasting and controlling costs in business cannot be overemphasized. Costs if left unchecked will have a significant negative impact on profitability. In today's business environment, many companies face challenges in making effective and prudent decisions in the area of forecasting and cost control. Companies can only overcome these challenges through strategies that optimize resources to maximize profits.

Traditionally, the operations of a business take place in the on-premises environment where business operations and reporting are carried out. In this environment, equipment and other information and communication technology infrastructure is installed. The rapid development of technology has led to the introduction of complex concepts and models such as accounting and cloud computing, which have added additional means and methods for forecasting and controlling costs. by companies such as deposit banks. Accounting and cloud computing are service-based methods that enable on-demand network access to a pool of computing resources and infrastructure such as servers, storage, and software. The implication is that businesses do not need to spend money to buy and install computer equipment and software in their traditional business environment, but cloud providers provide these services on demand and users have to pay a fee. With this evolution, companies can predict their data processing costs and similarly control unnecessary costs. Cloud-based applications such as Software as a Service, Infrastructure as a Service, and Platform as a Service are available to subscribers and charged based on usage. In addition, there are application variants for every functional area of the business, such as Salesforce.com providing cloud-based customer relationship management, Oracle providing human resource management while SAP provides ERP services.

Companies with a cloud facility involve many different types of costs, including website development costs, infrastructure acquisition costs, contract acquisition costs, maintenance costs, or hardware costs. continuous service software. These actually affect the cost structure of the business, such as direct and indirect costs. However, while the adoption of these accounting technologies has a long history in advanced economies, they are still in their infancy in developing economies such as Nigeria, as there are no experimental studies are known in this country. The increasing availability of cloud computing presents an opportunity to manage costs by effectively outsourcing certain IT functions. But as with any outsourcing decision, careful analysis is required to ensure that the savings can outweigh the costs and risks of transferring control to an outside supplier. In summary, an important step in reducing the huge infrastructure costs of deposit banks in Nigeria is forecasting and controlling costs. Cloud computing offers the solution to overcome this challenge.

No Files Found

Share Your Publication :