-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Chukwu Emeke*, Emuebie Emeke an.d Adegbie, Folajimi Festus

Corresponding Author: Chukwu Emeke, Petroleum Economics Department, Emerald Energy Institute, University of Port Harcourt, Rivers State, Nigeria.

Received: September 18, 2023 ; Revised: October 14, 2023 ; Accepted: October 17, 2023 ; Available Online: November 17, 2023

Citation:

Copyrights:

Views & Citations

Likes & Shares

The Nigerian oil and gas industry play a pivotal role in the country's economic growth and development. However, concerns about the environmental impact of these activities have intensified in recent years. The environmental, methodological and theoretical gaps identified in this area was filled and the objective of the study addressed. Hence, this research aims to investigate the effect of environmental firm characteristics on financial performance of listed oil and gas companies in Nigeria. By analyzing a comprehensive dataset, including environmental management practices, carbon emissions, waste management, and sustainability reporting, the study employed an ex-post facto research design in sampling nine (9) oil and gas companies out of a total population of ten (10) listed on the Nigerian Exchange Group (NGX) as December 31st 2021. Panel data covering a period of ten years (2012-2021) were extracted and analyzed using the multiple regression as a technique of analysis. Financial performance was proxied using return on assets (ROA). The results of the analysis revealed that, environmental firms’ characteristics have significant effect on the financial performance of listed oil and gas companies in Nigeria. This was implied from the model’s statistics of R2=9.14%, F-stats = 20.28 and p-value of 0.0004. Firm size and firm growth have significant effect on the financial performance of listed oil and gas companies in Nigeria with significant values of 1% (0.001) and 1% (0.008) respectively. While environmental disclosure and firm leverage showed an insignificant effect on the financial performance of listed oil and gas companies in Nigeria with a p-value greater than 5%. Thus, the study concludes that, environmental firm characteristics affect the financial performance of listed oil and gas companies in Nigeria. Thus, it is recommended that investors should include environmental and operational considerations in their investment decisions. Additionally, regulators should ensure that investors have access to adequate information on environmental and operational performance of Nigerian oil and gas companies, in order to make informed investment decisions. Finally, policymakers should develop policies and regulations to ensure that oil and gas companies in Nigeria are aware of the need to integrate environmental and operational performance into their long-term strategic plans.

Keywords: Disclosure, Environmental, Financial, Growth, Performance, Leverage, Size

INTRODUCTION

Financial performance plays a high-level affair in economic resources distribution of any nations. Financial performance is the bedrock of sustainable business growth [1]. Financial performance has implication in terms of economic growth of any nations; great financial performance will attract more investors while poor financial performance will discourage investors, from investment which lead to financial failure and crisis, this can affect economic growth of a country. According to Oladipupo [2] Profitability has an aim of financial direction, as long as the aim of financial direction is to generate owners’ wealth, profit is one of the determinants financial performances. The aims of any business are to make profit; profitable businesses are capable to award its owners with a high return on assets and make sure that there rises sustainability of a business. Various factors impact the financial performance of companies, including those specific to each firm. In Nigeria, oil and gas companies face unique factors inherent to their sector that influence their overall performance. The financial performance of these companies is also shaped by their individual characteristics. These characteristics encompass elements like how transparent they are about their environmental impact, their size, the rate at which they're growing, and the extent of their financial leverage. All of these factors collectively play significant roles in determining the financial performance of oil and gas companies [3].

Upon reviewing the existing literature, it becomes evident that previous research focused on the determinants of financial performance among listed companies in Nigeria and other parts of the world. For instance, Akindele [4], Olusanmi and Uwuigbe [5], as well as studies by Arif and Anees [6], Khidmat and Rehman [7], and Otieno & Nyagol [8] directed their attention primarily towards the banking and other sectors. Regrettably, they often overlooked the crucial strategic role played by the oil and gas sector in Nigeria's economy. Scant research has been conducted on this topic, with only a handful of foreign studies, such as those conducted by Patrick [9] and Suheyli [10], touching upon it.

These creates a gap for further study in Nigeria by including environmental disclosure and firm growth as a proxy of oil and gas companies specific attribute on financial performance using oil and gas companies as a domain of the study. Thus, the main objective of the study was to examine the effect of environmental firm characteristic on the financial performance of listed oil and gas companies in Nigeria.

Nigerian oil and gas companies face several practical financial performance problems that can impact their operations and profitability. Environmental issues, such as oil spills and pollution, can result in significant financial liabilities for oil and gas companies. Costs associated with environmental remediation, fines, and legal disputes can impact profitability and cash flow [11]. In addition, managing costs effectively is crucial for financial performance, but Nigerian oil and gas companies often struggle with cost control due to factors such as inadequate budgeting, inefficient procurement processes, and operational inefficiencies. In view of these concerns, it is imperative that the effect of environmental firm characteristics be examined in relation to financial performance of listed oil and gas companies in Nigeria. Hence, the main objective of the study is to examine the effect of environmental firm characteristics on the financial performance of listed oil and gas companies in Nigeria.

The following is the hypothesis of the study, presented in null form.

H01: Environmental firm characteristics has no significant effect on the financial performance of listed oil and gas companies in Nigeria.

Shareholders of listed oil and gas companies are directly affected by the financial performance. Positive financial performance, such as increased revenues, profitability, and dividends, can lead to higher shareholder value and returns on investment. On the other hand, poor financial performance can result in a decline in share prices and reduced shareholder wealth. Also, the financial performance of oil and gas companies affects government revenue and the country's economy. The government of Nigeria relies heavily on taxes, royalties, and other fiscal contributions from the oil and gas sector. A strong financial performance means higher tax revenues, increased economic activity, and potential investments in social and infrastructure development.

The following section is structured into four. The first part is the literature review which provide review on related studies and theory. It is followed by methodology adopted in the study. The Fourth deals with the result and discussion of finding and the final part deals with conclusion and Recommendation.

LITERATURE REVIEW/THEORETICAL REVIEW

This section provides a guide and details of the independent and dependent variables of the study with the interrelationship between and among the variables.

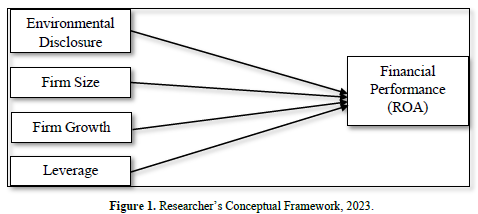

Conceptual Framework (Figure 1)

Financial Performance

Financial performance is commonly used as an indicator of a firm's financial health over a given period of time. The financial performance of a firm can be defined or measured in various ways including profitability, gauge return, market share growth, return on investment, return on equity and liquidity. Financial performance is measured by the development of revenues and profits [12]. Revenue development can be seen as a growth indicator of a firm and also as a competitive strategy for consecutive firms. A firm can, by being environmentally sustainable, differentiate its products and thus increase its revenue [13]. Similarly, a firm can save costs on resources, regulatory costs, capital, and labor and therewith increase its profits. In this study, financial performance will be measured by, Net Profit Margin (NPM), Return on Assets (ROA) and Return on Equity (ROE).

The concept of “financial performance” describes how well organizations have fared in a given periods or years. Most analysts examine financial performance by obtaining data for reported indices in the financial statements of firms and expressing same in forms of financial ratios [14]. According to Oshoke and Sumaina [15], financial ratios, being the oldest instrument of analyzing firms’ performance, are the arithmetic expression of the relationship between variables and/or items reported in the financial statements of entities. They are mainly used as indicants of firms’ performances so that meaningful comparisons are made between certain measures/indicators and other related variables, either by looking at present or past/similar indicator(s) for a particular firm or similar firms in an industry.

Environmental Disclosure

According to Crowther [16], the primary purpose of environmental disclosure is to examine and incorporate in the firm annual reports issues that bother on environmental hazard that are not taken cognizance of in traditional or conventional accounting function that stakeholders can use for decision making. Disclosure of corporate environmental activities stressed the necessity for a close monitoring of natural resources and the corporation’s harmful effect on the society it operate. Environmental effects caused by activities of firms especially those in the manufacturing, oil and gas and banking include pollutions like noise, waste, hazardous emission, spillages, degradation [17].

In recent years, a belief has arisen in businesses and in society that reporting has a wider role than that expressed in the traditional ‘stockholder/shareholder’ perspective. Importantly, one need not hold to the ‘deep green’ end of the argument to hold these views: there are strategic reasons why a wider view of accountability may be held and, accordingly, why initiatives such as environmental reporting may be supported; this encapsulates the environmental consequences of an organization’s inputs and outputs. Inputs include the measurement of key environmental resources such as energy, water, inventories (especially if any of these are scarce or threatened), land use, etc. Outputs include the efficiency of internal processes (possibly including a ‘mass balance’ or ‘yield’ calculation) and the impact of outputs. These might include the proportion of product recyclability, tones of carbon or other gases produced by company activities, any waste or pollution [18].

Firm Size

The amount and variety of manufacturing capacity and services that a company can currently provide to its consumers are also indicators of its size. Because of the concept of economies of scale, which can be found in the traditional neo classical perspective of the firm, the size of a corporation is a main criterion utilized in determining the performance of a company's activities [19]. When compared to small businesses, large businesses have stronger competitive power during the competition period. Furthermore, because they have more resources, large enterprises have the power to grasp all work possibilities during times of competition that require high capital rates, and this condition offers them with greater work opportunities to maximize their profit with the competition. Firm size, according to Oluwamayowa [20], is a scale that shows whether a corporation is huge or tiny. A company's size can be classified as large or small depending on the total assets it owns or the total sales it generates. Assets are economic resources possessed by an entity and whose cost (or fair worth) could be objectively ascertained at the time of purchase [21].

Firm Growth

The concept of firm growth refers to the expansion and development of a business entity over time. It encompasses various dimensions, including increases in sales revenue, market share, profitability, assets, workforce, and market reach. Firm growth is a fundamental objective for most companies, as it signifies success, competitiveness, and long-term sustainability [22]. Firm growth can occur through internal or organic growth, where a company expands its operations through increased production, new product development, market penetration, or geographical expansion. It can also be achieved through external growth strategies, such as mergers, acquisitions, strategic alliances, and partnerships. These strategies enable firms to access new markets, technologies, resources, and capabilities [23].

The concept of firm growth is influenced by multiple factors. Internal factors include effective management, innovation, operational efficiency, strategic planning, and organizational culture. External factors encompass market conditions, industry dynamics, competition, regulatory environment, technological advancements, and economic factors. Firm growth has significant implications for various stakeholders [24]. For shareholders and investors, it enhances the value of their investments and generates returns. For employees, it can lead to career advancement opportunities, job security, and improved compensation. Firm growth also benefits customers by providing a wider range of products and services, improved quality, and enhanced customer experiences. Moreover, it contributes to economic development by creating employment opportunities, generating tax revenues, and fostering innovation and productivity [25].

Firm Leverage

Firm leverage is a combination of equity and liability that a company uses to finance its assets. Debt and/or equity can be used to fund a company's investments [26]. Preference capital may also be used by the corporation. Regardless of the company's rate of return on assets, the interest rate on debt remains constant. A company's financial leverage is designed to make more on fixed charges funds than it costs. As debt grows, so does financial leverage [27]. Financial leverage is used by businesses to boost shareholder returns in times of good economic conditions. It is believed that funds with fixed charges (such as a loan) would be used. Fixed-charges funds (such as loans from financial institutions and other sources or debentures) are considered to be available at a lower cost than the firm's net asset return. Leverage is also defined as the amount of equity debt a company utilizes to finance its assets. As a result, business leverage represents the amount of debt utilized in the firm's capital structure. It is anticipated that increasing leverage in the capital structure will improve the firm's worth as well as the market price of its shares [27].

Theoretical Framework

Stakeholder Theory

Stakeholder theory has infiltrated the academic dialogue in management and a wide array of disciplines such as health care, law, and public policy [28]. Considerable attention has been dedicated to several fundamental themes that have become well-established in the literature. These themes include the acknowledgment that companies have stakeholders and an obligation to actively consider their interests. This recognition often leads to a contrast between stakeholder theory and shareholder theory. A noteworthy point is that stakeholder theory can serve as a bridge linking ethics and strategic decisions [29]. Furthermore, companies that genuinely strive to cater to a diverse range of stakeholders tend to generate enhanced value in the long run. Nonetheless, the multitude of different interpretations of these core stakeholder concepts has posed challenges for the advancement of theoretical frameworks [30].

Legitimacy Theory

The concept of legitimacy is important in analyzing the relationships between companies and their environment. Parsons [31] defines legitimacy as “the appraisal of action in terms of shared or common values in the context of the involvement of the action in the social society” This book contains a collection of ten essays. It provides a theory of formal organization. Central constructs of legitimacy research are provided. For example, it distinguishes “authority” from “legitimation” and “authorization. Maurer [32] points out that legitimacy is the process whereby an organization justifies to a peer or super ordinate system its right to exist; that is to continue, import, transform, and export energy material or information.

Legitimacy theory is derived from the concept of organizational legitimacy, which has been defined as “a condition or status, which exists when an entity’s value system is congruent with the value system of the large social system of which the entity is a part.” When a disparity, actual or potential, exists between the two value systems, there is a threat to the entity’s legitimacy” [33]. It was pointed out that legitimacy is conceived as congruence between institutional actions and social values, and legitimization as actions that institutions take either to signal value congruency or to change social value.

In summary, Legitimacy Theory underpins this study because it argues that organizations seek to ensure that they operate within the bounds and norms of society, although the stakeholder theory, legitimacy theory, the slack resources theory and the theory virtuous cycle have been reviewed. These theories explain the phenomenon of voluntary social and environmental disclosures in corporate communication. Consistent with the notion of legitimacy theory, companies seek to gain, maintain, or repair their legitimacy by using social and environmental reporting. Legitimacy theory provides useful insights for corporate social and environmental disclosures [34].

Empirical Review

Oti and Mbu-Ogar [35] examined the impact of environmental and social disclosure on the financial performance of quoted oil and gas companies in Nigeria. Time series data for five years 2012 to 2016 were collected and analyzed using the ordinary least square regression technique. The theoretical framework was hinged on stakeholder and legitimacy theories which describe the tie between organizations and the social/societal strata need for disclosure and financial performance. Results from the statistical analysis revealed that disclosure on employee health and safety and community development do not significantly affect financial performance while disclosure on waste management had a positive and significant effect on firm’s financial performance. The study recommended that oil and gas companies should constantly review their waste management strategy and employ bespoke technology in waste management to mitigate their impact on the environment. Furthermore, Oil and gas companies should improve on employee health and safety as part of their mission and vision statement for enhanced firm value. Companies should also ensure sustained development of their host communities to avoid hostility by stakeholder groups which will have negative effect on its operations and in turn affects performance [36].

Abubakar [37] investigated the impact of firms Attributes and Performance of Insurance firms that are listed on the floor of Nigerian Stock Exchange. The study used secondary data which were collected from the annual reports of Insurance companies in Nigeria for the period of 2007 and 2016. Regression analysis was conducted to test the hypothesis in addition to some post estimation and diagnostic tests conducted so as to enhance the validity and reliability of the findings. The results of the study revealed that the liquidity and age are statistically having negative impact on the financial results of the insurance companies in Nigeria. The researcher recommends that firms are to convert part of their cash and its equivalents to the means of production so as to improve their overall financial performance.

Salawu [38] examined the relationship of specific oil and gas firms’ attributes; firms age, board composition, financial performance, existence of foreign directors on the board and financial leverage with Environmental Disclosures (ED). Data were collected from the published annual reports of nine listed oil and gas firms quoted on the floor of the Nigerian Stock Exchange (NSE) as at 2018, for a period of seven years (2012-2018). Generalized Least Square (GLS) was used to test the hypotheses after satisfying the criteria of post estimation tests. The result established a positive and significant relationship between board composition, financial leverage, existence of foreign directors on the board and ED. However, firm age and financial performance was found not to have significant relationship with ED. Although they examined the oil and gas sector, emphasis was on environmental disclosure which is a qualitative measure. The present study focused on the quantitative characteristics of the oil and gas companies. The study period does not include recent available data which may give a different finding when analyzed. The present study thus, filled the period gap identified.

Arumona [13] examined the effect of Environmental Disclosure on Financial Performance of quoted oil and gas companies in Nigeria, using panel series data and regression analysis approach. The secondary data obtained from the annual reports of 12 oil and gas companies quoted on the floor of the Nigeria Stock Exchange (NSE) for 10 years ranging from year 2010- 2019 were used. The study adopted the E-view as a statistical tool for analysis with focus on Ordinary Least Square (OLS) regression method. The study found that Environmental Disclosure has positive and statistically significant effect on Financial Performance of quoted oil and gas companies in Nigeria during the period under review. The study concludes that Environmental Disclosures contribute immensely to Nigeria’s Oil and Gas firms to increase financial performance and profitability, as well as provide a springboard that can enable the country at large to emerge as an environmental-friendly nation. Although they focused on the oil and gas sector, the variables used were few compared to the present studies that combined firm attributes and environmental disclosure as variables. This would therefor provide robust findings.

Abubakar [39] investigated the effect of firm attributes on the financial performance of listed DMBs in Nigeria for ten years from 2011-2020. The study adopts the correlation design so that to correlate the relationship between variables. The population of this study comprises the Seventeen listed deposit money banks in Nigeria as at 31 December, 2020. A total of thirteen which represent seventy-seven percent of the banks were duly used as sample for the study. The audited annual reports were obtained from Nigerian stock exchange. The result provides evidence Bank size, Capital adequacy ratio and Income diversification have insignificant impact return on assets of the banks. In the determining the effects of moderating impact on firm age is that Capital adequacy ratio, Bank size, Income diversification has a statistically insignificant influence on the return on assets of listed deposit money banks in Nigeria. The study focused on firms’ characteristics variables only, excluding the environmental disclosure elements. Hence, the present study in addition to firm characteristics incorporated environmental disclosure as an independent variable.

Ezekwesili and Ezejiofor [40] examined the effect of firm characteristics on the environmental performance of quoted conglomerates firms in Nigeria. Ex-post facto research design was adopted for this study. The population of the study was constituted by all the five (5) conglomerate firms listed on the Nigerian Exchange Group as from 2011 to 2020. Data were derived from the financial statements of the selected firms over the years of interest. The descriptive statistical analysis of data for this study was done using mean, correlational analysis and standard deviation while Ordinary Least Square multiple regression analysis was used at 5% level of significance. The study focused on conglomerate firms, thus creating a period gap that the present study filled by focusing on the oil and gas sector of the Nigerian economy.

METHODOLOGY

The research design that was employed in this study is ex-post facto research design. The population of this study consisted of all the ten (10) oil and gas companies listed on the Nigerian Exchange Group (NGX) as at 31st December, 2022. They include: Capital Oil Plc; Conoil Plc; Eterna Plc; Ardova Plc (formerly Forte Oil Plc); Japaul Oil & Maritime Services; MRS Oil Nigeria Plc; Oando Plc; Rak Unity Petroleum Company Plc; Seplat Petroleum Development Company Plc; Total Energies Plc. The sample size of this study comprised nine (9) listed oil and gas companies on the Nigerian Exchange Group (NGX) from 2012 to 2021. Census sampling technique was adopted to select oil and gas companies that consistently filed their annual reports with the Nigerian Exchange Group for the study period (2012-2021), these are: Capital Oil Plc; Conoil Plc; Eterna Plc; Japaul Oil & Maritime Services; MRS Oil Nigeria Plc; Rak Unity Petroleum Company Plc; Seplat Petroleum Development Company Plc; Total Energies Plc. This study basically utilized secondary data that were extracted from the annual reports and statements of account of the sample listed oil and gas companies.

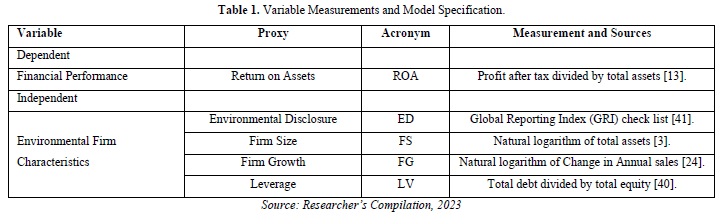

Operationalization of variables and Model specification (Table 1)

This study adopted the Global Reporting Initiative (GRI) framework disclosures according to the G4 guidelines for the purpose of developing the Environmental disclosure indices. Environmental Reporting was evaluated by 21 indicators. For each of these sustainability reports, all the 21 indicators were scored as follows: - a score of 0 for an item not referred to in a report; - a score of 1 when the report only briefly mentioned something pertinent to the item or provided only qualitative statements; - a score of 2 when the report provided detailed information with some numerical support; and rarely - a score of 3 was given when a report provided extensive numerical support with data on goals achieved or fully accomplished. So, a total score for environmental disclosure could reach the maximum score of 36. Multiple regression was employed as a technique of analysis in this study. Inferential statistics of this study was carried out using: descriptive statistics, Pearson correlation, Multicollinearity Test, Panel Least Square (PLS) regression analysis and Hausman Specification Test.

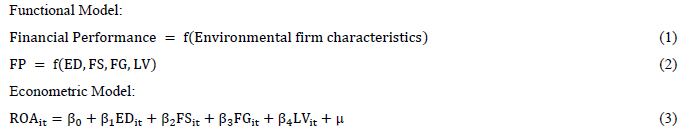

Model Specification

In order to test for the relevance of the hypotheses regarding the effect of Environmental firm Characteristics and financial performance of listed oil and gas companies on the Nigerian Exchange Group (NGX). This study adapted the model of Geerts, Dooms and Stas [42]:

Where: ROA: Return on Assets; ED: Environmental Disclosure; FS: Firm Size; FG: Firm Growth; LV: Leverage; β0: Constant; β1-β4: Coefficient; i: Cross section; t: Time series; µ: Stochastic error term

RESULTS, ANALYSIS AND DISCUSSION OF FINDINGS

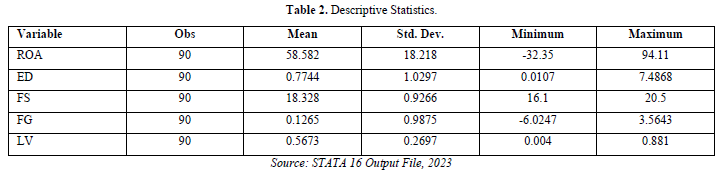

The results in Table 2 provides a summary of the data's central tendency, variability, and range. The mean value of ROA of 58.582 represents the average return on assets of the dataset. The standard deviation of 18.218 indicates the extent of variation or dispersion around the mean. The minimum value of -32.35 represents the smallest ROA value observed in the dataset, while the maximum value of 94.11 represents the largest ROA value observed. These values give an understanding of the range of values covered by the dataset. The standard deviation of 1.0297 measures the variability or dispersion of the environmental disclosure (ED) scores. A higher standard deviation suggests a wider spread of values, indicating a greater diversity in the level of environmental disclosure among the entities or cases being analyzed. The minimum value of 0.0107 represents the lowest recorded environmental disclosure score in the dataset. It indicates that at least one entity or case had a very low level of environmental disclosure. The maximum value of 7.4868 represents the highest recorded environmental disclosure score in the dataset. It indicates that at least one entity or case had a relatively high level of environmental disclosure.

Similarly, the mean value of 18.328 represents the average value of the Firm Size (FS) variable. The standard deviation of 0.9266, indicates a relatively low variability in Firm Size. The minimum value of 16.1 represents the smallest Firm Size observed in the dataset. The maximum value of 20.5 represents the largest Firm Size observed in the dataset indicating the largest firm size among the data points. In addition, Firm growth (FG) with an average value of 58.582 represents the average growth the companies experienced during the study period. A higher standard deviation indicates a greater variability in the dataset. In this case, the standard deviation is 18.218. The minimum value represents the smallest growth rate of companies during the period. The maximum value represents the largest observation in the dataset. Also, leverage (LV) showed a value of 0.5673 representing the average leverage in the dataset. It indicates the typical influence of data points on the regression model. The standard deviation of 0.2697 quantifies the variability or spread of leverage values around the mean. A higher standard deviation suggests a wider range of influence among the data points. The minimum leverage value of 0.004 represents the smallest observed value in the dataset. The maximum leverage value of 0.881 indicates the data point with the highest influence on the regression model

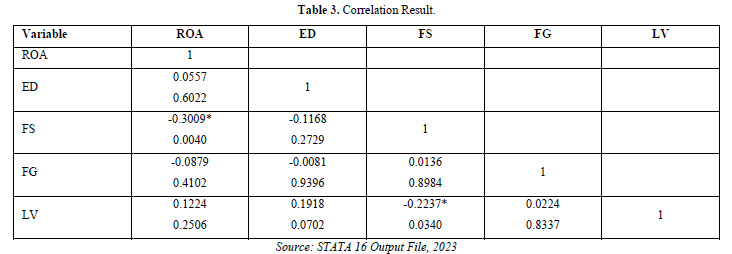

Correlation Matrix

The correlation results were used to check the direction and degree of association of between the independent variables and the independent variable s among themselves. It was also used to examine the presence or otherwise of Multicollinearity among the independent variables (Table 3).

tput File, 2023

tput File, 2023

The result in Table 3 showed that FS has a negative but moderate association with ROA which is statistically significant at 1%. Also, ED and FG were found to have a positive but weak association with ROA which are not statistically significant. On the issue of Multicollinearity, the highest coefficient is -0.2237 between LV and FS. This is less than 0.80. Thus, indicating that, there is no Multicollinearity among the independent variables of the study. However, a formal Multicollinearity test was conducted to further confirm the absence of Multicollinearity.

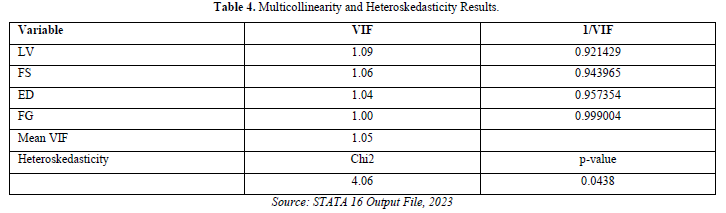

Multicollinearity and Heteroskedasticity Tests

According to Gujarati (2004), the existence of Multicollinearity in the estimations is indicated by a tolerance less than 0.1 and a VIF value of 10 or above. The findings of Table 4 indicate, however, that there is no excessive connection between the independent variables, as the lowest tolerance value (TV) is 0.921429and the largest variance inflation factor (VIF) IS 1.09. The test for Heteroskedasticity in the model revealed that, the residuals of the model are not homoscedastic. This is because the p-value of 0.0438 (4.38%) is less than 5% meaning that it is significant at 5%.

Inferential Statistics

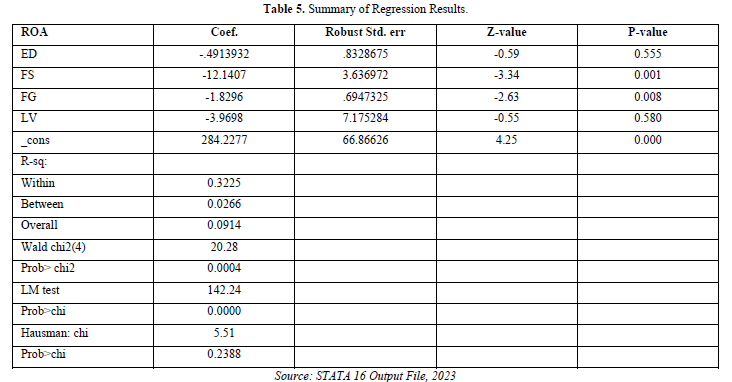

The results of the regression results are presented in Table 5 and used to explain the relationship between environmental firm characteristics and financial performance of listed oil and gas companies in Nigeria.

Table 5 showed the summary of regression results as generated from the panel data of the study. The overall statistical significance of the model can be assessed by the coefficient of determination. The overall R-sq value of 0.0914 represents the predictive power of the model. In indicates that, about 9% variation in financial performance measured by ROA of listed oil and gas companies in Nigeria can be jointly explained by Environmental Disclosure (ED), Firm Size (FS), Firm Growth (FG) and Leverage (LEV). This means that, the remaining 91% is explained by variables not employed in this study. In addition, the combined effect of a significant p-value of 0.0004 and Wald chi of 20.28 suggests that the model is fit hence interpreted to explain the relationship between environmental firm characteristics and financial performance of listed oil and gas companies in Nigeria. Furthermore, selecting the appropriate model requires some post estimation tests to be conducted. Hence, the Langragian Multiplier (LM) Test for panel effect was conducted. The results showed that, there is no panel effect in the model. This is because the p-value of the LM test of 0.0000 was statistically significant at 1% as desired. In addition, the Hausman Specification test was used to decide between the fixed and random effect models, which is appropriate. The result of the test revealed that, the random effect model (REM) is most suitable for the study.

Discussion of findings

The effect of environmental firm characteristics and financial performance of listed oil and gas companies is discussed in the following subsection.

Environmental Disclosure and Financial Performance

The negative environmental disclosure coefficient of -0.4914 suggests that there is an inverse relationship between environmental disclosure and financial performance. This coefficient indicates that as environmental disclosure increases, financial performance tends to decrease. However, the magnitude of the coefficient does not provide information about the strength or significance of the relationship. The p-value of 0.555 is relatively high. In statistical analysis, the p-value represents the probability of obtaining results as extreme as the observed, assuming that there is no true relationship between the variables. A p-value of 0.555 indicates that there is insufficient evidence to reject the null hypothesis, which suggests that the environmental disclosure coefficient is not significantly different from zero. This finding is in line with those of Abubakar [39] but contrary to the studies of Ezekwesili and Ezejiofor [40].

Firm Size and Financial Performance

The negative coefficient of -12.141 indicates that, on average, larger oil and gas companies tend to have lower financial performance when considering their environmental firm characteristics. It suggests that as the size of the company increases, its financial performance tends to decrease in the given context. The p-value of 0.001 indicates that the relationship between firm size and financial performance is statistically significant. In other words, the likelihood of observing such a strong negative relationship by chance alone is very low. This strengthens the evidence for the impact of firm size on financial performance in the specific context of environmental firm characteristics for listed oil and gas companies. This finding is in line with those of Oti and Mbu-Ogar [35] but contrary to the studies of Abubakar [37].

Firm Growth and Financial Performance

The negative coefficient (-1.8296) suggests that there is an inverse relationship between firm growth and environmental firm characteristics. In other words, as the environmental firm characteristics of listed oil and gas companies increase, the firm growth tends to decrease. This coefficient indicates the direction and magnitude of the relationship. The p-value of 0.008 is less than the conventional significance level of 0.05. This suggests that the relationship between firm growth and environmental firm characteristics is statistically significant. In other words, the observed relationship is unlikely to occur by chance. This finding is in line with those of Abubakar [37] but contrary to the studies of Salawu [38].

Leverage and Financial Performance

The coefficient of -3.9697 suggests that there is a negative relationship between leverage and environmental firm characteristics. However, since the p-value is not significant, we cannot confidently attribute this relationship to anything other than random chance. Therefore, the magnitude of the coefficient should be interpreted with caution. The p-value of 0.580 is greater than the conventional significance level of 0.05. This implies that there is no strong evidence to suggest that the relationship between leverage and environmental firm characteristics is statistically significant. The observed relationship is likely to occur by chance rather than being a meaningful association. This finding is in line with those of Abubakar [39] but contrary to the studies of Oti and Mbu-Ogar [35].

Policy Implication of Findings

The lack of a significant relationship between leverage and environmental firm characteristics indicates that changes in environmental practices are not strongly linked to variations in leverage levels for listed oil and gas companies. Other factors may play a more dominant role in determining the leverage positions of these companies. Also, the negative coefficient indicates that listed oil and gas companies with stronger environmental firm characteristics tend to experience lower levels of firm growth. This suggests that companies focusing on environmental sustainability may face challenges in achieving rapid growth or expansion. It could be due to the additional costs, regulations, or market perceptions associated with environmental initiatives. In addition, larger oil and gas companies may face challenges in managing their environmental impacts due to their size and scale of operations. Compliance with environmental regulations, mitigating environmental risks, and implementing sustainable practices could be more complex for larger companies, potentially affecting their financial performance.

CONCLUSION AND RECOMMENDATIONS

The presented results suggest that there is a significant relationship between firm growth and environmental firm characteristics in the context of listed oil and gas companies. These findings underscore the importance of balancing environmental sustainability and financial goals, as well as the increasing relevance of environmental considerations in the oil and gas industry. Also, the results suggest that there is no statistically significant relationship between leverage and environmental firm characteristics in the context of listed oil and gas companies. This implies that environmental considerations may not strongly influence leverage decisions in this specific industry, and other financial factors are likely more influential. Further research and analysis are necessary to explore the complex interplay between environmental practices and financial performance in the oil and gas sector. The negative environmental disclosure coefficient suggests that there may be a negative association between environmental disclosure and financial performance. This implies that oil and gas companies that prioritize environmental disclosure may experience a decrease in their financial performance.

CONTRIBUTION TO FUTURE RESEARCH

This research contributes to a deeper understanding of the relationship between environmental firm characteristics and the financial performance of listed oil and gas companies in Nigeria. It also provides valuable insights for policymakers, industry stakeholders, and investors seeking to promote sustainable practices and enhance financial outcomes in the oil and gas sector.

No Files Found

Share Your Publication :