-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Scott A J MacDonald*

Corresponding Author: Scott A J MacDonald, Financier, Founder and Chairman of MacCapital Global Pty Limited [ABN: 84 100 794 901] and related entities- [Australian Financial Services License-AFSL No. 534 407]; PO Box 8658 Gold Coast MC Queensland

Received: June 25, 2023 ; Revised: July 23, 2023 ; Accepted: July 26, 2023 ; Available Online: September 06, 2023

Citation:

Copyrights:

Views & Citations

Likes & Shares

‘The Golden Rule’….

‘Those with the Gold make the Rules…’

The adage, of ‘The Golden Rule; Those with the Gold make the Rules’-arguably can be attributed to the genius of Jean-Jacques Rousseau born some c. 310 years ago, but does this saying still hold true today? Or are we now seeing the emergence of other factors that I believe will have unintended consequences at play in directing modern economics.

Today I am seeing a large emerging impactful interpretation of this truism arising in established Western and emerging societies and economies. That of the growing potential power and influence of money managers.

So how will this new power be expressed? Who will really hold and control this power, shareholders or executive management, the skilled technocrat of finance and fund management or the humble investor and why will this be important to political power and economic and political theory moving into the future?

So, it is true that I like to believe that some top fund managers may become the new ‘Druids’ of our Age, that being the Global Fund Manager. They will wield soft power and influence and enable a few to become the high priests of a global political economy and this new model will be measured by assets under management. These few will potentially hold immense economic and potentially political power. The ‘Druid’ description and comparison I will expand upon a little later in this paper.

One unexpected extension of the current economic models throughout history from if you like the hunter gather; to farmer; to industrialist is potentially to a next stage that of the investor. And just as all participants of previous stages contributed to thought leadership in the same way investors and money managers will potentially lead society in new directions. Actually, we can see it now in society but I argue the sporting or UHNWI with huge wealth and social influence will be a mere bagatelle compared to the growing power of money managers.

Is this hypothesis remotely realistic you ask? -Let us look at the rate of growth and change in society with the expansion of AI, [ChatGPT etal] and other new technology we can see that the need for many traditional workers and the ageing demographics of many advanced Nations is driving a paradigm shift in developed societies, many of which will need to provide for growing retirement demands. These changes will no doubt be felt in the West first as this is where the money has initially accumulated. However, Nations such as China face a serious problem in the next 30 years as the one child policy combined with lack of retirement funding combine for a perfect storm of economic uncertainty as unfunded liabilities begin to rip at social harmony and an ability to maintain a calm and cooperative aging population. This pattern may also be true of Japan and South Korea.

Clearly, this extreme future vision is some way off-but the trend is in play and so there is a real argument of the growing influence by money managers as this topic has as yet, been seen as almost irrelevant but in my opinion needs to be fully explored and written up.

As Jean-Jacques Rousseau stated some c.300 years ago and reminds us ‘The Rich holds the Law in a Purse’.

With Nation States globally deeply indebted, as never before, will we see a shift in power to those that hold the vast pools of exponentially growing of AUM/ FUM. [Assets Under Management/Funds Under Management].

Record leverage: Global debt has hit a record $300 trillion, or 349% leverage on gross domestic product. This translates to $37,500 of average debt for each person in the world versus GDP per capita of just $12,000. Government debt-to-GDP leverage grew aggressively, by 76%, to a total of 102%, from 2007 to 2022.

This growth and accumulation of soft power by Asset Under Management/Funds Under Management [AUM/FUM] appears to be growing exponentially with the assistance of accelerating contributions, inflation and the effects of compounding and therefore is a topic worth noting. We note a doubling each 10 years in Europe for example.

It should be understood by investment professionals and economists alike that these assets are fundamentally controlled by a very few albeit highly skilled people, the men and women running these vast pools of money whom in turn are accumulating untold and as yet unknown power. In fact, I do not believe anyone has factored fully this latent source of influence. Yes, one can point to a handful of names, the current leaders and a dozen hot hedge fund managers. But the reality is the industry is still extremely fragmented so as funds continue to grow and reach out globally these players will start to accumulate increasing self -awareness and self- empowerment.

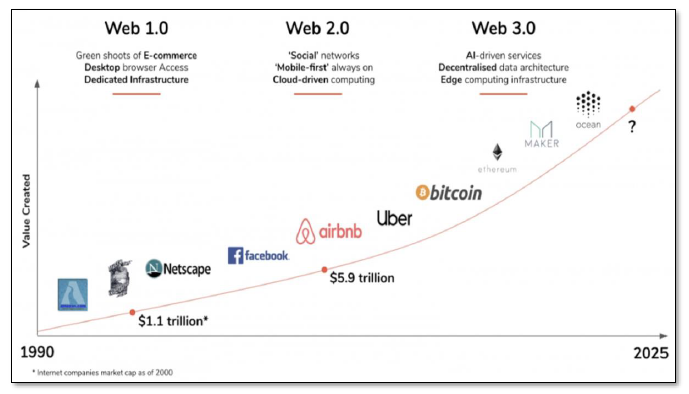

And it is not limited to Sovereign Wealth or Pension funds as they grow ever larger and diversify further, we will see this expansion of influence and power by this new elite among other sectors of fund management. This will include new digital assets and the Web 3.0.

Vulture funds, activist funds and others are already exercising some influence but what I am alluding to is the bigger players reaching a tipping point of power that enables them to sit at the top tables of influence and in fact will be sought out for guidance as the role emerges into that of a modern day ‘Druid’.

These new age ‘Druids’ as I like to think of them will be the holders of moral and ethical influence as a result of my proposition that the ‘Golden Rule’ holds true and that fund managers, ie those with power and pools of assets will have power beyond the power of those elected to public office. The new ‘Druids’ may end up as independent economic centres of influence as traditional Nation states and economic zones morph into the Web 3.0, which enables the amorphous movement from one jurisdiction to another with relative ease. As far back as 1997 we witnessed the power of the movement of money with the impact of the Asian currency crisis. As these pools grow this implicit power will also grow under the watch of the new age ‘Druids’.

The ‘Druids’ were an unusual elite with significant social influence....as Wikipedia states;

‘A druid was a member of the high-ranking class in ancient Celtic cultures. Druids were religious leaders as well as legal authorities, adjudicators, lore keepers, medical professionals and political advisors.’

Yes, you will be pleased to know there were also Lady Druid’s-and yes, they used techniques of persuasion that even the Romans felt needed curbing.

The point is that that influence of the few over the many backed by future vast FUM will potentially become the new religious doctrine.

It is also the investor whom becomes a limited partner in this new power game - one who is incrementally playing a part in politics via shareholder activism, proxy influence, and various other techniques of financial influence at the margins. However, my proposition is that this power and influence is growing into the hands and awareness of the very top players at the largest pension and money managers. This newly emerging power may not be solely dependent on Active over Passive as the weight of capital may still prove to wield influence, although perhaps not as directly as the Active influencer.

Union influence, corporate action influence, weight of money influence, and private equity influence…may overtime overtaking traditional sources of political influence-but as fund managers become so large as to influence Nation States regarding ESG or other moral and ethical current day issues their power will usurp many current and traditional sources of power.

My thesis is that this once perceived soft power of responsible ESG/impact investment by a moral cabal of fund managers will in time wield more and more influence over society.

The end game may be very different from the initial intent and as fund managers get bigger and we are seeing ongoing consolidations and global expansion thus in the future these managers will have soft and not so soft power that will in some instances potentially outweigh Nation states influence.

The current irony is that the majority of fund managers are yet to wake up to this potential influence and power. I believe that the funds industry has a tacit growing role of influence that is only beginning to emerge as an influence on policy and as it grows can set the agenda of not only companies but industry sectors, regional politics and potentially World order.

‘The implications of the growing power and influence of global Wealth Managers and the Nation State needs to be better understood.’

Source: Scott A J MacDonald, Gold Coast, Queensland. March 8, 2023.

The premise of my argument is the that growing influence and concentration of power among money managers globally is one that potentially holds exponentially expanding implications which need to be researched and understood.

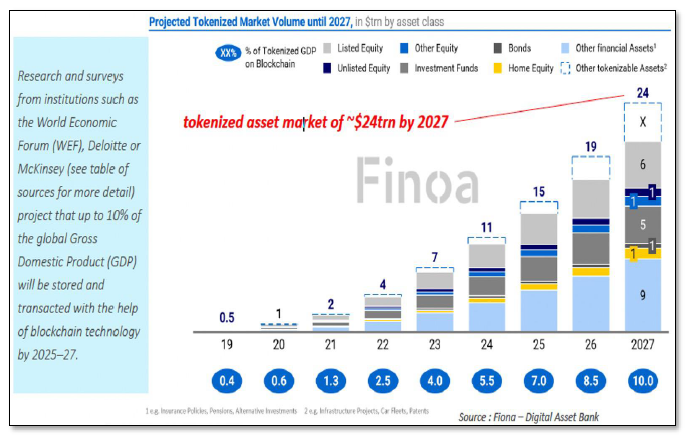

With the continual ageing within societies the need for retirement savings to fund retirees will grow exponentially over the next 30-50 years and as a result pools of funds under management will become very large. If we believe they double each 10 years then in 50 years they could amount to USD$3,000 plus Trillion. I must hasten to add this does not include the value of the digital assets that are emerging from everything from the alphabet to other esoteric digitized and monetized assets, yet to be created. This weight of capital and the relatively few that control such assets will experience a growing influence over the way in which companies operate and may influence the regulatory framework that Nation states are able to adopt when attracting funds to their capital markets. In addition, managers and their advisers will more and more be able to influence the behavior and thinking of societies and thus potentially influence democracy as we know it today.

With the exponential growth of pension industries around the globe it is apparent that domestic capital markets will continue to be influenced by large investment flows caused by fund managers seeking returns outside their own ‘limited’ capital markets. This will be because of their home capital markets not being large enough to sustain returns and also the need for portfolio allocations to seek prudent diversification.

For some time now working as an investment professional I have observed the growing influence of hedge funds [non-traditional] investment management and the growing sophistication and influence of derivative based structured investment solutions. This trend will continue as pension fund fiduciaries seek sustainable returns to fund retiree obligations.

The ‘pursuit of Alpha’ will continue to exert significant changes on companies, regulators and Nation states and provide money managers and their advisors with a growing moral and social influence never seen around the globe. This is important to write about as it may highlight a potential paradigm shift where Nation states are no longer able to control their destiny through taxation and regulation alone - but may give way to the power of money managers able to control a weight of funds that may overpower or at least significantly influence many Nation states behaviors. By the way such influence over ‘ESG’ environmental, social and corporate governance or energy issues may need not be all bad, in all instances.

From my limited research to date I have not found that this issue has been addressed fully nor written up. My desire is for this paper to act as a marker a catalyst to have a full research team address this premise and contribute to the global body of knowledge enabling a clear template of potential outcomes and discuss the social influence these ideas may have on the way the world economy will look in the future. Isolated examples of manager influence are being talked about but the macro impact I am postulating, and such trends appears yet to be fully expressed or understood.

Below is a draft suggested outline of the chapters for a thesis and research-however guidance and input from a university with a truly global perspective to execute this major research is required;

If we have learnt anything in political economics over the centuries, it is that we have seen the reset of those economic models over those centuries. Before vast pools of FUM existed or had been created, which in turn reduced the flexibility of these past players and their Bankers. Tomorrow these lessons of history that we have experienced may only partially provide a guide to future outcomes.

We can quickly see that the current data and overview of the industry is fundamentally fragmented and split between region, nation state and style of assets. That is to say there are many yet to be counted assets i.e. Retail, Wholesale, ESG, Pension or other i.e. alternatives, property and emerging digital assets industry reports vary but BGC today estimates a global total of $100 Trillion.

Nevertheless, the rate of accumulation globally is growing exponentially with asset returns compounding and assets under management showing almost 100% growth in Europe over past 10 years for example.

In addition to the projected growth of FUM - Revenue to these ‘Druids’ has increased in the same period also. A fact that according to McKinsey shows that this also has doubled in last 10 years to over $526bn pa.

So, funds under management are growing rapidly, revenues and costs are also growing but as we see further consolidation of the industry, we will also potentially see the consolidation of influence of a relative few who control such money management firms.

These managers may have a political view which culturally will permeate down into the ‘culture’ of the organization from ESG to ‘Gay Pride’, these top-down influences will also impact on the direction and style of decisions that such groups may make more broadly.

For example, ‘Please Stop cutting trees or risk withdrawal of investment in your top 50 corporations until government policy reflects common environmental sense.’

In addition, as we are learning more about the expansion and impact of technology on finance, media and many are predicting a continual global expansion of new forms of fiat currency namely tokenization. See this trend expressed in the charts below as this new power is not limited to our current regulatory frameworks and arguably will continue to evolve and expand hence enabling the ‘Druids’ to be found not only in the traditional environment but the new emerging Web 3.0 and digital metaverse now being developed.

Finally, I recall this adage;

‘Beware, as the innovative idea of today, rejected and scorned initially by all, becomes the accepted policy of tomorrow’ -Scott A J MacDonald, March 8, 2023.

No Files Found

Share Your Publication :