-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Kehinde Mutiyat, OWOLABI; Ishola Rufus, AKINTOYE and Samuel Olajide, DADA

Corresponding Author: Owolabi Kehinde, Department of Accounting, School of Management Sciences, Babcock University, Nigeria.

Received: April 18, 2023 ; Revised: May 02, 2023 ; Accepted: May 05, 2023 ; Available Online: May 31, 2023

Citation:

Copyrights:

Views & Citations

Likes & Shares

Revenue mobilization is pivotal to maintenance of debt sustainability. It is also essential to debt reduction through its application to debt financing. This study investigated the effect of tax revenue on external short-term debt stock of Sub-Saharan African [SSA] countries. The study also examined the controlling effect of inflation, exchange rate and corruption on tax revenue and external short-term debt of SSA countries. Ex-post facto research design was adopted in testing and analyzing a dynamic panel estimated with system General Method of Movements [GMM] data set for this study. Dynamic panel was adopted because it eliminates bias and weaknesses of the regressors’ dimension by taking it to its lag term. Population comprised 23 SSA countries for the period 1990 to 2020. The study found that tax revenue had significant effect on External Short-Term Debt Stock [J-stat 20.05 = 0.39, ρ > 0.1]. Exchange rate, inflation and corruption had significant control effect on tax revenue and External Short-Term Debt Stock [J-stat 17.398 = 0.36, ρ > 0.1]. The study concluded that tax revenue improved financing of external short-term debt of SSA countries. It recommended to policymakers to carefully consider reducing accumulation of external short-term debt stock, curtail the volatility of exchange rate, inflation and corruption, and sustain the nations’ revenue generation.

Keywords: Corruption, Debt, Exchange rate, External short-term debt, Inflation, System general method of movements, Tax revenue

INTRODUCTION

The dynamics of public debt in Sub-Saharan Africa progressed over the years through various forms including public debts owed to official creditors through multilateral institutions and bilateral creditors. Multilateral debt encompasses the debt owed to IMF and World Bank, in both its non-concessional [IBRD] and concessional [IDA] arrangements and debt owed to other multilateral lending agencies, such as the African Development Bank [AfDB], the International Fund for Agricultural Development [IFAD] [1]. Multilateral debt as a percentage of total debt is substantial to the overall debt of SSA countries [2].

The debt burden challenges facing the countries in SSA region deteriorated due to the environmental issue of mismanagement of the loan by the governments of the countries [3,4]. Corruption is entrenched in the system to the extent that it has given room for the debts to accumulate such that its financing through regular revenue is not enough. The weakened state of the economy thus raises much concern. This is also due to the rising debt financing on limited aggregate, even though revenue tax revenue remains a stable means of income to government.

The efforts of government on economy recovery and stabilization from recession in recent times have deteriorated on account of debt burden, its financing and the prevailing corruption in SSA region [4]. The impacts of corruption are often felt through the embezzlement of resources that should have been ploughed back into debt financing or invested in the economy. Olawale, Hassan and Nawaz [5] opined that debt relief programs would be of no effect due to persistent level of corruption. Rather, it might be a motivation for further misuse of resources in the region. Thus, it is safe to conclude that corruption is a foremost hindrance to the issue of debt burden. Therefore, corruption is a factor to reckon with in the debt burden of Sub-Saharan Africa countries, since it hinders the application of the debt for capital projects that impacts on the economy [6].

Rising government indebtedness gave rise to the issue of proper monitoring intensified by effective debt management [7]. Proper debt management was the main reason for setting up the debt management offices in various countries. It was to intensify the efforts toward debt balancing in the SSA countries. In the past before the introduction of debt management reforms to harmonize the debt portfolio, government debts were managed without clear objective and, supporting policy framework. They were subjected to political dictates and influences [8,9]. The resultant effect was the unsustainable accumulation of large debt in manners that the revenue accruing to government periodically cannot accommodate.

Measuring the percentage of a country's collective output [gross domestic product] that is attributable to tax receipts through tax-to-GDP ratio, is a major means of measuring the overall effectiveness of a country's tax system, which could be used to determine the level of economic activity. Steady economic activity means that tax revenue from changing tax rates [10,11] is expected to grow at the same rate as the repayment of debts, which is supposed to be paid. Oftentimes however, the revenue, is not enough to fund the liability. This is an indication of the reality that current receipts are lower than the expected expenditure leading to deficit. Management of the deficits in the current economic outlook has become a difficult task in the light of the current global financial and economic crises [12]. Allocation of the scarce resources by the governments in SSA countries to cover pressing demands and binding debt financing obligation is therefore a major constraint [13].

The devastating effect of high public debt was reiterated by Adam Smith [1776] regarding nations in Europe when he maintained that the enormous debts which presently oppress, will ultimately ruin the great nations of Europe [14]. The ideology is applicable and relevant to present day economic experience and is appropriate to public debt issues of SSA countries. While public debt was basically considered an outcome of emergency situation like war, the present debt situation in SSA is not conclusively a result of war, but due to continuous fiscal deficit [14]. Stein [1886] presumed that public debt is not all bad but important to developing economy such as SSA nations. He established the principle that government legislation should ensure the populace is made to pay for debt which benefits traverse generations. Financing debts incurred in productive developmental projects is expected to be as harmless and sustainable to the degree that its yield would generate the extra tax revenue necessary to cover the debt service [14]. Stein opined that the relationship between public debt and national revenue is important.

Revenue mobilization is pivotal and of high priority to maintenance of debt sustainability. It is essential to reduction of debt through its application in the debt financing. Among the four conceivable relationships that could exist between revenue and expenditure, the first is tax-spend hypothesis which states that revenue is a determinant of expenditure [15]. In this regard, government expenditure is expected to depend solely on the income earned by government during the fiscal year. Second is spend-tax hypothesis which emphasizes expenditure over revenue. The downside is that this could worsen the level of deficit in the economy. Third is fiscal synchronization which balances revenue and expenditure through policies. The fourth is fiscal separation, with revenue and expenditure decisions made independently. High deficit level is dangerous should expenditure rise faster than revenue. Thus, tax-spend is preferable by focusing on increasing tax revenue; deficit could be prevented [15].

Revenue accrues to government purse worldwide through diverse means. Efuntade, Efuntade & Akinola [14] alluded that globally, government revenue is applied to funding the macro and microeconomic activities. Revenue is required by government of the world to fund developmental projects, provide security for the citizens, fund public goods and maintenance of law and order [17]. The fund required for both capital and recurrent expenditures is huge and not often available. This accounts for the need for loans to meet up with the projected developmental objectives through diverse means; bilateral treaties, project funding on credit and loans to fund budget deficits that would be paid back into the future. Government revenues are applied to finance the repayment of both the capital and interest accrued on these debts. Governments of SSA countries had in time past failed in their debt repayment due to insufficient revenue [18].

The change in the structure of public debt in SSA had significantly impact on the debt financing requirement [19]. Countries in SSA moved away from traditional concessional sources of debt to a market-based lending from bilateral creditors, thus, resulting in the deteriorated share of multilateral and concessional debt, whereas the portion of non-Paris Club debt increased thereby increasing the configuration of public debt risk profile [20]. Consequently, G20 and the Paris Club introduced Debt Service Suspension Initiative [DSSI] to SSA to cushion the effect of the pandemic by freeing up fund meant for debt servicing [21,22].

Developing countries are characterized with heavy imports and thus subjected to foreign currency fluctuations [23]. The debts are issued and repaid in foreign currencies which further impacts on exchange rate instability. Exchange rate is one of the major traditional factors affecting flow of goods and services across boarder internationally. It is found to impact debt and revenue across international trade.

From the above mentioned, the expected debt profile is not achieved as the plan is still in progress, and it reflects in increased debt financing outlay, hence, it is important to study debt financing within tax revenue limit. This study therefore substantiates the effect of tax revenue on short term debt in SSA countries. The objectives of the study and hypotheses are as follows:

H01: Tax revenue has no significant effection External Short-Term Debt Stock of Sub-Saharan African countries.

H02: Inflation, exchange rate and corruption have no significant controlling effect on tax revenue and External Short-Term Debt Stock of Sub-Saharan African countries.

LITERATURE REVIEW/ THEORETICAL FRAMEWORK

Conceptual Review

Somorin [17] defined tax to mean a compulsory payment levied on the citizen by the government for the purposes of achieving its goals. A tax is not a voluntary payment or donation to the government but an enforced contribution, a pecuniary burden laid upon individuals or properties obtained in accordance to the legislative authority vested on the government. The fiscal decree is made to support public activities. A tax is an obligatory financial involvement imposed by the government of nations to generate revenue into public pool, levied on income or property of persons or organizations, on the production costs or selling prices of goods and services. Tax revenue is a sustainable means of nation building because it serves as the nexus between the state and the citizenry; it encourages government accountability. Consequently, it is safe to say that tax revenue unites every country resources generation toward state capacity building, application is central to government expenditures in overall economic management [24]; more so it is strategic in debt financing.

External debts are amount due to countries and institutions outside the debtor’s country. Short term public debt is known as floating debts, debts which its repayment period is within one year. Examples are treasury bills and treasury guaranteed bond [20]. Short term loan is payable within one year. Increasing debt servicing burden of debtor countries in the region are due to debts owed to private creditors and non-Paris Club governments with accompanying shorter maturities and higher interest rates. Debt comes about as a result of governments’ inability to earn enough revenue to fund expected public deliverables. Borrowing is the taking of money and its equivalent values intended for reimbursement to the creditor after an agreed period. Aybarç [25] defined public borrowing as the legal responsibility of the government to reimburse both the principal and related interest to the creditors on the prearranged rights according to the schedule. Both public credit and public borrowing represents debts taken by government or other public institutions.

Theoretical Review/Framework

Debt Overhang theory

The debt overhang theory was propounded by Howard in 1972 [26]. The underlining principle presents debt as an impediment to revenue in national development due to debt repayment. Debt overhang is the situation whereby a debtor country is prevented from investments because earned fund are applied to the repayment obligation of its debt with the related interest element [27,28] opined that debt overhang is a situation in which potential investors are discouraged by high public debt and fear that the returns from investments might accrue to previous lenders, thus preventing them from investing in the debtor country. Debt overhang explains the impediment of debt to nation’s economy. It prevents earning more revenue because the resources are directed into repaying debts. In another view, Borensztein [29] asserts that debt overhang is a situation in which the benefits derived by the debtor country from the debt obtained is insignificant in view of the return on any additional investment because of the debt service obligations. This condition is damaging to the debtor country.

Sani and Yahaya [30] in their critique opined that debt overhang generally happens when the level of indebtedness in a country exceeds her ability to pay, thus, the predicament of debt overhang is mostly detrimental to poor nations because they will be trapped in a continuous cycle of indebtedness and debt servicing so much that there will be no funds for provision of essential needs. Therefore, the debt overhang hypothesis leads to uncertainty in government policies by preventing it from meeting up with fiscal responsibilities. Potential investors generally study the attitude of government concerning debt servicing to determine their investment prospect [30].

Supporting this theory on adverse impact of high public debt on the economy is debt crowding out hypothesis as propounded by Modigliani in 1961. The proposition accepts that heavy debt burden dries up national resources required for spending on both physical and human capital, and therefore negatively affects the economy. This is mostly clear on the excess interests on debt which weakens the terms of trade of the indebted country [28,30]. The line of argument of authors in this regard is that debt depreciates the capability of a nation to maintain a sustainable level of debt. The reason is because high debt competes with the diminished resources considering investment, debt financing commitments and interest payment. Again, Gupta [31] in Sani and Yahaya [30] maintained that when debt servicing continues to grow, foreign investors steadily withdraw their investment from the economy, as high debt obligation frightens foreign investors and discourages them.

Tax Smoothing Theory

Tax smoothing theory is attributed to the pioneering work of Barro [32] to counter the Keynesian [33] theory [34]. The theory explains a situation where government incorporates debt financing into fiscal policy to ensure the economic activities are regulated in such a way that tax revenue earned by a country pays off the debt. The purpose is to maintain balanced fiscal policy. The theory explores the connection between fiscal policy and debt management to initiate fiscal balance which is resistant to economic contingent shocks. Debt management in this view allows the fiscal policy to be aligned to debt portfolios and designed such that cost of debt are low when there is a primary deficit, and are high during primary economic surplus.

This theory is supported by tax discounting theory known as Ricardian equivalence/invariance. This theory is credited to David Ricardo [1820], and it states that tax and public debt financing of government expenditure are equal and lead to the same outcome - debt reduction. Critique of this theory affirmed that future generations are made to reimburse for debt incurred prior to their birth.

Theoretical Framework

This study is centered on debt overhang and tax smoothing theories. These theories justify the study because they explain debt sustainability through tax revenue. Debt overhang theory in essence describe the situation of SSA countries and their debt predicament, which is explained to mean that viable investment opportunities elude them due to high debt burden. This idea assumes that public debts use up a significant percentage of the national income and therefore raises the rates of interest and crowds out private investment [30]. Tax smoothing on the other hand explains an economy in which fiscal policy enables the use of tax revenue in repayment of national debt. The two theories converge at the point of maintenance of debt sustainability and by extension the economy, thus the relevance to the study.

Empirical Review

Koh [18] explored debt and financial crises, and found that rapid buildup of debt, increased the likelihood of a financial crisis on short-term external debt, higher debt service and lower reserves cover. Also, incidents of debt accumulation are common with half of the episodes associated with financial crises. Kéïta and Hannu [35] found that both corruption and tax burden worsen total factor productivity, but that an increase in tax burden mitigates the negative effect of corruption. The study used panel data from 90 countries for the time span of 1996 to 2014. Ofori, Obeng & Mwinlaaru [36] found that exchange rate volatility is directly harmful to tax revenue performance, and indirectly through trade openness in their study into the effect of exchange rate volatility on tax revenue performance in SSA. Tarawalie and Jalloh [37] in the empirical analysis of the determinants of capital flight in post war Sierra Leone revealed that real effective exchange rate, corruption and external debt are the main determinants of capital flight in Sierra Leone. The study of Nagou, Bayale & Kouassi [38] on the robust drivers of public debt in Africa with fresh evidence from Bayesian model averaging approach; found that interest and exchange rates, debt-service, domestic credit, among other variables are the main and robust drivers of public debt accumulation in African countries.

Omodero, Egbide, Madugba and Ehikioya [39] in their study of a mismatch between external debt finances and consumption cost in Nigeria, utilized causal research structure style of normal least-squares on variables Consumer Price Index [CPI], external debt, debt financing and exchange rate. The result revealed that external debt does not improve consumption cost, but rather aids the rising cost of living in Nigeria, while exchange rate had an insignificant but positive impact on CPI. Lelya and Ngaruko’s [40] study of the impact of national debt on economic growth in Tanzania covering 1980 to 2019 using VECM on variables such as external and domestic debts, debt service and exchange revealed that both external and domestic debt significantly affect the economic growth of Tanzania. Asaolu [7] investigated domestic debt management and government revenue in Nigeria and found that domestic debt management has a positive relationship with government revenue and inverse relationship with inefficiency in government revenue utilization.

Al Kharusi and Mbah [41] studied external debt and economic growth, the case of emerging economy. The study employed ADL cointegration method to explain error correction mechanism. Time series data for the period 1990-2015 were used in the analysis. Result revealed a negative and significant influence of external debt on economic growth in Oman. Gross fixed capital was found to be positively significant in determining growth performance in Oman. Debt was related to financial crisis and economic growth; revenue was not reviewed and the method of analysis was not panel.

Sa’ad, Umar, Waziri and Maniam [42] study examined external debt burden and its determinants in Nigeria through ADRL cointegration technique on Nigeria’s external debt data from 1973 to 2013. The study revealed that consumer price index [CPI], interest rate [IR] on external debt, GDP, and money supply [M2] are cointegrated with external debt in both the short-run and long-run within the period. While, CPI and IR are negatively correlated with external debt, GDP and M2 revealed a positive relationship with ED. Also, Taha and Abdelaziz [43] searched to discover if external debt-poverty relationship confirms existence of debt overhang hypothesis for developing counties, using panel cointegration model for a panel of 25 developing countries for the period 2000-2015. They found positive and significant long-run relationship between poverty, external debt, GDP per capita, gross domestic and fixed investment. There was negative and significant association between poverty, infrastructure, health condition and openness. The Granger-causality results indicate bidirectional causality between external debt and poverty in both short- and long-run. The studies covered one country, not the entire SSA, and debt was not studied based on tax revue but poverty.

Gupta and Liu [31] asked if tax buoyancy in SSA could help finance the sustainable development goals. The question was addressed through the use of time series and panel techniques to estimate short- and long-term tax buoyancy of 44SSA countries during 1980-2017. They found that long-term tax buoyancy is either one or slightly above one for most SSA countries. Fragile states have lower short-term tax buoyancy. Short term buoyancy of personal income tax is significantly less than one. Both short- and long-run tax responses are lower than those reported in previous cross-country studies. Also found was that central government debt and shadow economy exerted a downward pressure on tax buoyancy. Jelilov, Abdulrahman and Isik’s [44] study into the impact of tax reforms and economic growth of Nigeria through the use of OLS regression method on data from 1986 to 2012 post-structural adjustment in Nigeria, showed that tax reform is positively and significantly related to economic growth and that tax reforms indeed causes economic growth. Tax reforms are targeted at improving tax revenue. Taxes excluding debt were studied in the initial investigation, while latter study excluded debt.

METHODOLOGY

Ex-post facto research design was adopted in testing and analyzing a dynamic panel estimated with system General Method of Movements [GMM] data set for this study. Dynamic panel was adopted because it eliminates bias and weaknesses of the regressors’ dimension by taking it to its lag term. System GMM is appropriate when time of the study is greater than 25 years and number of observations is less than 25 [t >25, n < 25], thus it is most applicable to this study. The research design allowed observation of multiple phenomena obtained over several time period of the data set. Therefore, ex-post facto research design was considered suitable for this study since its disallowed manipulation of the independent variable because the event had already occurred.

Also, the study employed dynamic panel data analysis with system GMM because the variables were converted to their lag term. This panel data analytical method allows data to be subjected to necessary tests to determine the effect of previous period over time and across periods to establish times series [t], where T > 1 along and cross period [n]; where N > 1 with total observation from 1990 to 2020.

The specified models were evaluated through second order statistical estimation of the results of coefficients and p-value which signify the explanatory power of model’s ability to predict the impact of tax revenue on debt financing in SSA. The J-statistic was used to test the statistical significance of the coefficients of individual regression model at 1%, 5% and 10% levels of significance; while aggregate combination of impact of tax revenue on debt financing was calculated using Arellano & Bond test; developed by Arellano & Bover [45].

Variable Description and Model Specification

y1= External Short-Term Debt Stock [ESTDS]

x1= Custom, Import and Export Duties [CIED]

x2= Taxes on Product [TXP]

x3= Taxes on Goods and Services [Value Added Tax] [VAT]

m1= Inflation [INF]

m2= Exchange Rate [EXR]

m3= Corruption [CRP]

LESTDSit = α0+β1LESTDSit+β1LCIEDit+β2LTXPit+β3LVATit+εit Model 1

LESTDSit = α0+β1LESTDSit+β1LCIEDit+β2LTXPit+β3LVATit+β4LINFit+β5LEXRit+β3LCRPit+εit Model 2

RESULTS, DATA ANALYSIS AND DISCUSSION

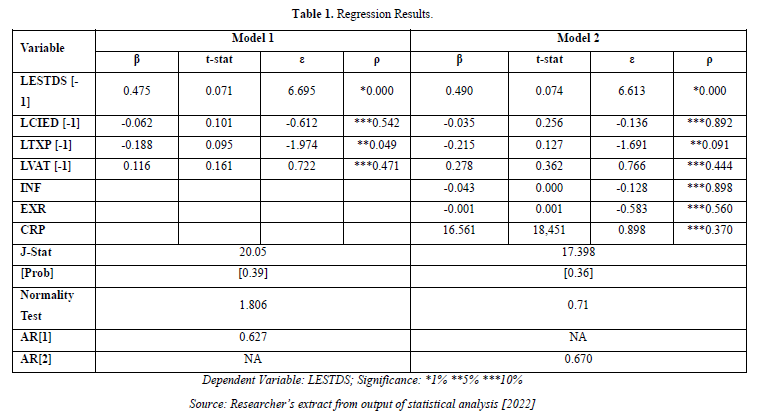

Regression Results (Table 1)

Interpretation

Shown from the value of J-statistics of model 1 being 20.05 with ρ-value of 0.39 and model 2 J-statistics stood at 17.398 and ρ-value of 0.36 being greater than the chosen significance level of 10%, the models are valid. Thus, the study stated that with a probability of 10% at 95% confidence level, the instruments used in this analysis are valid. The Arellano-Bond tests revealed no autocorrelation for both the first order and the second order. While for the AR[1] in first differences, the Arellano-Bond test did not reject the null hypothesis for both models [Model 1: ρ-value = 0.627 > 0.05], whereas the test is not available for model six, as predicted. In the case of AR[2] in first differences, the null hypothesis stands for model six [Model 2: ρ-value = 0.670 > 0.05] which means that there is no presence of serial correlation in model 2. However, the test is not applicable to model 1.

Hence, the explanatory model will take the following expression:

LESTDSit = α0+β1LESTDSit+β1LCIEDit+β2LTXPit+β3LVATit+εit Model 1

LESTDSit = 0.475LESTDSit-1 - 0.062LCIEDit-1 - 0.188LTXPit-1 + 0.0116LVATit-1

The result of the regression analysis for model one is presented in Table 1 with the coefficients LESTDS and LVAT being positive and others being negative. While the probability values of LESTDS and LTXP is less than 5% significant level and the other two explanatory variables being greater than the chosen significance level of 10% , it demonstrated that a year lag of: LESTDS [β = 0.475; ρ-value = 0.000 < 0.01], LCIED [β = -0.062; ρ-value = 0.542 > 0.1], LTXP [β = -0.188; ρ-value = 0.049< 0.05], and LVAT [β = 0.116; ρ-value = 0.471 < 0.1] positively and insignificantly affected LESTDS in the case of LVAT, while LCIED and LTXP both negatively insignificantly and Significantly affected LESTDS respectfully. The coefficient values showed that a change in LCIED would yield 47.5% change in LESTDS; a change in LTXP would result to -6.2% in LCIED while LTXP would change by 1.16% as a result of a change in LVAT.

Decision

With J-Statistics having a value of 20.05 and ρ-value of 0.39 which is greater than the chosen significance level of 10% confirmed the validity and exhaustiveness of the model. Also, from the probabilities of each of the measures of the explanatory and the controlling variables which are lower than the chosen significance levels of 1% and 5% for LESTDS and LTXP and greater than to 10% for LCIED and LVAT and assessing the significance of the effect of the individual variables, the study decided that LTXP effect is significant while LCEID and LVAT insignificantly affect LESTDS of SSA countries. Based on the probability of the J-Statistics confirming the validity and exhaustiveness of the model, null hypothesis five is rejected; the study accepts the alternative hypothesis five stating that: “Tax revenue has a significant effect on External Short-Term Debt Stock of Sub-Saharan African countries”.

Also, model 2 further analyzed with control variables INF, EXR and CRP as evidenced from the analyzed statistical result is expressed thus:

LESTDSit = 0.490LESTDSit-1-0.035LCIEDit-1-0.215LTXPit-1+0.278LVATit-1-0.043INFit-1-0.001EXRit-1+16.561CRP Model 2

Detected from the harvested result of the regression analysis of model two is that the coefficients of variation are positive for LESTDS and CRP while all others have negative coefficients. The probability values of the entire explanatory variables are greater than the chosen significance levels at 1%, 5% and 10% except LESTDS. This confirmed that a year lag of: LESTDS [β = 0.490; ρ-value = 0.000 < 0.01], LCIED [β = -0.035; ρ-value = 0.892 > 0.1], LTXP [β = -0.215; ρ-value = 0.091 < 0.05], LVAT [β = 0.278; ρ-value = 0.444 > 0.1], INF [β = -0.043; ρ-value = 0.898 > 0.1], EXR [β = -0.001; ρ-value = 0.560 > 0.1] and CRP [β = 16.561; ρ-value = 0.370 > 0.1], positively and insignificantly affected LVAT and CRP, while all others negatively and insignificantly affected LESTDS. The coefficient values reflected that a change in LCIED would yield 49.0% change in LESTDS; a change in LTXP would yield -3.5% change in LCIED while LESTDS would change by 27.8% due to a change in LVAT. The model is positively moderated by 1656.1% CRP; and negatively moderated -4.3% and -0.1% by INF and EXR respectively.

Decision

With the value of J-Statistics being 17.398 and its ρ-value stood at 0.36 which is greater than the chosen significant level of 10%: the model is confirmed valid exhaustive. Equally, evidenced from the probabilities of each of the measures of the explanatory variable which are all higher than the chosen significance level of 10%. Evaluating the significance of the impact of the individual variables; therefore, this study maintained that LCIED, LTXP, LVAT, INF, EXR and CRP positively but insignificantly affected LESTDS of SSA countries.

Evidenced on the probability of J-Statistics which confirmed that the model is valid and exhaustive, the study upholds that exchange rate, inflation and corruption significantly control the effect of tax revenue on External Short-Term Debt Stock of Sub-Saharan African countries. Thus, the study rejected null hypothesis two which states that “Exchange rate, inflation, and corruption have no significant controlling effect on tax revenue and External Short-Term Debt Stock of Sub-Saharan African countries. The study thus accepted the alternate hypothesis six which holds that “Exchange rate, inflation, and corruption have significant control in the effect of tax revenue on External Short-Term Debt Stock of Sub-Saharan African countries”.

DISCUSSION OF FINDINGS

Models one and two assessed the effect of the lag of custom, import and export duties [LCIED], lag of taxes on export [LTXP] and lag of Value Added Tax [LVAT]; controlled in model 2 with Inflation [INF], Exchange Rate [EXR] and Corruption [CRP] on lag of external short-term debt stock [LESTDS] of SSA countries. The study found both models to be valid from the probability values of J-statistics. The result of regression analysis shows that each of the measures of tax revenue has negative coefficients for model 1 excluding LVAT with positive coefficient. The implication of their p-value shows that LVAT positively and insignificantly affect LESTDS while LCIED and LTXP both negatively insignificantly and Significantly affected LESTDS of SSA countries respectfully. It is on this basis that, this study accepts the alternate hypothesis one that tax revenue has joint significant effect on external short-term debt stock of SSA countries.

Again, the coefficients and ρ-value of model two indicated all negative and insignificantly affected LESTDS except LVAT and CRP with positive coefficients. The study therefore accepts the alternate hypothesis two that inflation, exchange rate and corruption have joint significant controlling effect on tax revenue and external short-term debt stock of SSA countries. The coefficients are not consistent with the a priori expectation as it was expected that all independent variables would exert positive effect on short term debt financing of SSA countries. The mixed result indicated that external short-term debt stock of SSA countries is not affected by components of tax revenue individually but collectively.

These negative results aligned with prior findings of Al Kharusi and Mbah [41], Sa’ad [42], Efuntade, Olaniyan and Efuntade [46], Gachunga and Kuso [47], Ibrahim, Abdulkadir, Aminu & Abdurra’uf [48], Ndubuisi [49], Ntekpere & Olayinka [50], Onwe [51], Senadza [27], Teupe [52], Wani and Kabir [53]. Positive results were found in the studies of Gupta & Liu [31], Ofori [36], and Lelya & Ngaruko [40]. The evidence indicates that the stand of debt overhang theory which states that debt erodes away the effect of revenue earned by its impact on fiscal space which explains the negative effect. This is an indication that huge debt makes taxes to be ineffective in tackling debt reduction. Akintoye, Adegbie and Onyeka-Iheme [54] found that efficient tax planning impacts revenue. Nagou [38], Omodero [39], Lelya and Ngaruko [40], Asaolu [7] and Taha and Abdelaziz [43] all found positive outcomes from their studies combined with various variables.

CONCLUSION AND RECOMMENDATIONS

The study found that VAT positively but insignificantly affected external short-term debt stock of SSA countries while the effect of CIED and TXP were both negative and insignificant. This result was slightly altered when controlled in model 2 VAT positively but insignificantly impacted; CIED and TXP negative yet insignificantly affected LESTDS but was positively moderated by CRP and negatively moderated by INF and EXR respectively. We therefore recommended that:

CONTRIBUTION FOR FUTURE RESEARCH

This study’s specific objective offers an avenue for further studies on sustenance of short-term debt and its eventual reduction. The information could be created on another platform to expand further research in the area of debt sustainability, other forms of taxes, and reduction of debt accumulation in view of other forms of public debt.

No Files Found

Share Your Publication :