-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Yu-Ting Huang, Peng-Tung Chen*, Hsiu-Chen Chou and Ho-Chien Lin

Corresponding Author: Peng-Tung Chen, Department of Business Administration, MingDao University, Changhua, Taiwan.

Received: January 04, 2023 ; Revised: January 22, 2023 ; Accepted: January 25, 2023 ; Available Online: January 27, 2023

Citation:

Copyrights:

Views & Citations

Likes & Shares

The issue of corporate social responsibility has gradually attracted the attention of the international community. Whether corporate investment in social responsibility activities can help enhance the company’s value or operational performance has long been different from corporate management authorities or scholars, and is a topic worthy of discussion. With a sound corporate governance mechanism in the company, fulfilling corporate social responsibilities will help enhance the company’s value. Through continuous learning to integrate corporate social responsibility with ordinary business activities, companies will be able to create new company value and core competitiveness.

Keywords: Corporate social responsibility, Company value, Discretionary accruals

The problem of low wages for grassroots employees in Taiwan is still in the past. In the past few years, the main responsibility of accountants is to check and approve the company’s financial statements to ensure that the company’s financial statements are correct and fulfill their supervisory obligations. However, generally accepted accounting principles give the company the flexibility to choose accounting methods for preparing financial statements and discretionary accrual items, so that managers can selectively disclose private information that is critical to the company’s value, and through the manipulation of discretionary accruals. In order to achieve the purpose of interfering with external financial reports, the financial statements cannot reflect the real situation of the enterprise, and financial statement fraud cases are emerging in an endless stream. Since the late 19th century in Taiwan, there have been several financial statement fraud cases, the most notable of which is the Boda fraud case. Its methods of hollowing out assets and insider trading are like a replica of the American Enron case. The outbreak of the above-mentioned series of fraudulent financial reports has severely affected the trading confidence of market investors. The credibility of corporate financial statements has been seriously frustrated whether the capacity is sufficient.

Financial statements are important information that reflects the financial status and operating results of an enterprise and serve as an important bridge for the enterprise to communicate with the outside world. Based on the purpose of contracts and the formulation of investment decisions, the quality of financial statements has always been a concern of financial statement users [1]. However, generally accepted accounting principles allow companies to have the flexibility to choose accounting methods and adjudicated accruals when preparing financial statements, which allows the company’s management to have considerable discretion over accruals in accounting earnings. Make earnings information vulnerable to manipulation or distortion by company management. For example, in terms of strategy, the company may increase the company’s net profit through accounting methods or discretionary accruals, which may cause investors to make wrong investment decisions [2].

Corporate Social Responsibility (CSR) is one of the most attention-grabbing business management issues in the world in recent years, and its importance is related to the future survival of enterprises. Management scholar Porter even emphasized that “the combination of social responsibility and business strategy will be the source of a company’s future competitiveness”. Therefore, when a company formulates a strategy, it should take corporate social responsibility as one of its core business strategies. If a company can implement social responsibility, it will not only reflect the nature of the company’s operations, so that the investing public can better understand the company’s operations, but also convey the sustainable management concept of “take from the society and use it for the society”. In 2006, Foresight magazine conducted a survey on the current status of corporate social responsibility fulfillment in Taiwan and found that the attitude of Taiwanese corporates towards fulfilling social responsibility began to shift from wait-and-see to positive. Therefore, we are curious about whether the information disclosure provided by companies fulfilling their social responsibilities can combine the reporting of information related to social responsibility and operational performance and produce positive synergistic effects on the company.

Information disclosure can transmit private information exclusive to managers to external users, so as to alleviate the information asymmetry between each other, and the better the quality of information disclosure, the more it can help companies implement corporate governance mechanisms, reduce agency costs, and improve corporate governance. Stock liquidity, solves the problem of information asymmetry, and then enhances the value of the company [3]. And with the changes of the times, in today’s fierce business competition environment, the content of information disclosure should not be limited to traditional financial information, but must pay attention to the important economic resources, activities and future benefits reflected in non-financial information [4]. In the past, the disclosure of non-financial information was mainly in response to the needs of environmental policies or social policies. However, in recent years, the disclosure of non-financial information is in response to the implementation of corporate social responsibility. It also examines the nature of corporate operations through the performance of corporate social responsibility and conveys to the investing public the eternal message of “taking from society and using it in society”. Continuing business concept especially after a series of corporate frauds severely damaged investor confidence, why did the investing public pay more attention to corporate social responsibility [5]. However, under the pressure of scrutiny from the investing public, companies began to disclose more and more information related to corporate social responsibility [6]. Corporate social responsibility information contains important factors that affect the company’s future operating performance. When a company discloses information to the outside world, if it can integrate the report of corporate social responsibility-related information, the investing public will have a better understanding of the company’s operating conditions and receive positive evaluations.

The degree of impact of corporate social responsibility dimensions on corporate value will also vary. This research finding also helps the academic community to include the possible impact of different corporate social responsibility dimensions into the analysis when researching issues related to corporate social responsibility. It also helps the competent authority to encourage companies to set up social responsibility-related governance groups to strengthen the mechanism for fulfilling social responsibilities, and also wins positive market evaluation for the company.

The second chapter of this article first reviews the literature related to this study and deduces the research questions of this article. The third chapter is the research design, explaining the source of data, the process of sample selection, the definition of variables, and the design of the empirical model. The fourth chapter explains descriptive statistics, empirical analysis results, and the fifth chapter is the conclusion, research limitations and suggestions.

LITERATURE REVIEW

Past studies have had many different views on the measurement of the quality of financial statements. The common measurement methods generally include discretionary accruals [7,8], earnings response coefficient. The above-mentioned common measurement methods provide relatively indirect evidence, and the measurement methods are also more susceptible to noise interference. However, past research has used the discretionary accrual items as the good quality of earnings quality to measure the quality of financial statements proxy variable [7,8]. Any manipulation of accounting figures will eventually reflect the net impact of all accounting method choices on earnings levels through the measurement of abnormal accruals [9]. After DeAngelo [10], Healy (1985), and Jones (1991) proposed various accrual measures as indicators of earnings quality, Dechow [11] summarized the past literature and pointed out that the Modified Jones Model has the best explanatory power good. Kothari [12] further pointed out that company performance is related to discretionary accruals, so it is suggested to add performance variables (current ROA) and intercept items to the Modified Jones model to measure discretionary accruals to adjust performance factors. Therefore, this study adopts the method of Kothari [12], and incorporates the intercept item and the current ROA into the model to adjust the performance factors to estimate the discretionary accruals as proxy variables for the quality of financial statements.

The implementation of corporate social responsibility is a basic part of strategic management. Integrating social and environmental concerns into the essence of corporate operations has become one of the most important issues facing corporate operations. Commonwealth Magazine tracked the performance of corporate social responsibilities of 40 listed (cabinet) companies that won the “Commercial Citizen Award” and found that from the beginning of January to the end of November 2011, 38 companies performed better than Taiwan’s stock market shows that companies that fulfill their corporate social responsibilities can not only improve their reputation and create social value, but also win positive evaluations from the investing public[1].

Past literature pointed out that companies that implement corporate social responsibility can receive positive comments from the public and bring intangible reputation assets and strong competitive advantages to companies [13-18]. And then create a higher corporate value; there are also literatures pointing out that corporate social responsibility will increase additional cost input, which will weaken the competitiveness of the company, and because of excessive corporate social responsibility Investing while ignoring the goals of business operations will damage the interests of shareholders and damage the value of the company [19,20]. There are also many discussions on the impact on corporate value, but there is no consistent conclusion.

The main function of the accountant is to check and verify the company’s financial statements to ensure that the company’s financial statements are correct, and to fulfill the obligations of financial supervision and internal control assessment of the company. Therefore, accountants can be regarded as an important role in checking the quality of financial statements. There have been many discussions in the past literature on the relationship between the professionalism of accountants and the quality of financial statements. For example, Solomon [21] pointed out that if an accountant is an industry expert, he will have richer knowledge to prevent fraud by management authorities. Krishnan [22] took the customers of the six major accounting firms as a sample to explore the relationship between the industry specialization of accountants and the absolute value of the adjudicated accruals of the surveyed companies. The results of the study found that the surveyed companies audited by non-industry expert accountants, The absolute value of its adjudicated accruals is significantly higher than that checked by industry experts, indicating that the industry expertise of accountants helps limit earnings management through accruals. Chin and Chi [23] used Taiwan listed (cabinet) companies as research samples, and pointed out that no matter whether the individual accountant and the firm are industry experts, or only the accountant is an industry expert, the surveyed customers all have higher earnings quality, the possibility of reprogramming is also low.

Whether the implementation of corporate social responsibility strategy and management can achieve a balance in the competitive environment where corporate social responsibility and corporate profit goals are inseparable and have a positive impact on corporate value. Therefore, this study extends past literature and finds that by combining companies that fulfill corporate social responsibility, if a company can implement social responsibility, it will not only reflect the nature of business operations, but also allow the investing public to better understand the company’s operations and explore social responsibility impact on the company’s financial statements.

RESEARCH METHOD

This study takes companies listed on the Taiwan Stock Exchange from 2018 to 2021 as the research object and explores whether the fulfill corporate social responsibility by listed companies in Taiwan has an impact on the quality of financial statements. The research data required for this article mainly come from the websites of sample companies to extract information related to corporate social responsibility; this study also searches the annual reports of each company from the Market Observation Post System (MOPS) and collects whether the company discloses the fulfillment of social responsibility information. Next, the financial variables come from the Taiwan Economic Journal (TEJ) financial database, corporate governance database, company basic database, accountant visa database, and some variables are obtained after self-organization and calculation. From the sample data analysis table in Table 1, it can be known that the total number of samples is 1,561 samples.

Research Design and Proxies

Empirical Models

In order to detect the correlation between corporate social responsibility and corporate value, the discretionary accruals as proxy variables to measure corporate value. This paper first establishes a regression model (1) for analysis. The regression model (1):

(1)

Where TTA: Discretionary Accruals; TCSR_S: Dummy Variable, 1 If the Company Fulfills Corporate Social Responsibility and 0 Otherwise; SIZE: Company Size; ROA: Return on Assets; LEV: Debt Ratio; BDSIZE: Number of Board Members; DUA: Dummy Variable, 1 If the Chairman is also the General Manager; Otherwise, 0.

Dependent Variable: Discretionary Accruals (TTA)

Generally accepted accounting principles give managers the flexibility to choose accounting methods and discretionary accruals. Past literature has indicated that discretionary accruals provide a complete and appropriate variable for measuring financial statement quality [24,25]. Therefore, this article uses discretionary accruals (TTA) as a variable to measure the quality of financial statements and according to Kothari [12] added performance variables (current ROA) and intercept items to the Modified Jones model to measure discretionary accruals to adjust performance factors.

Independent Variable: Corporate Social Responsibility (TCSR_S)

The implementation and development of corporate social responsibility, and further examine the nature of corporate operations through the fulfill corporate social responsibility, and convey the sustainable management concept of “taken from the society and used in the society” to the investing public. Especially after a series of corporate frauds severely damaged investor confidence, why did the investing public pay more attention to corporate social responsibility [5].

Control Variables

This paper refers to past related research and adds control factors to reduce possible interference with the results of this study. The company size (SIZE), return on assets (ROA), debt ratio (LED), number of board members (BDSIZE), and whether the chairman is also the general manager (DUA) are included as control factors. This study adds company size (SIZE) as a control variable and does not predict the direction of the SIZE coefficient. Past studies have found that companies with a higher level of profitability (ROA) have more incentives to engage in earnings management [12]. When a company is growing at an excellent level of profitability, the higher the level of profitability, the more likely it is to expand its earnings to Earnings management is carried out in order to control the impact of return on total assets on discretionary accruals. DeAngelo [26] pointed out that when the company’s debt ratio is higher, in order to avoid financial crisis, managers have the incentive to increase the company’s earnings. Therefore, this study includes the debt ratio (LEV) as a control variable, and the direction of its coefficient is expected to be just. The size of the board of directors (BDSIZE) and whether the chairman is also the general manager (DUA) are included in the regression model as the control factors of corporate governance.

EMPIRICAL RESULTS

Descriptive Statistics

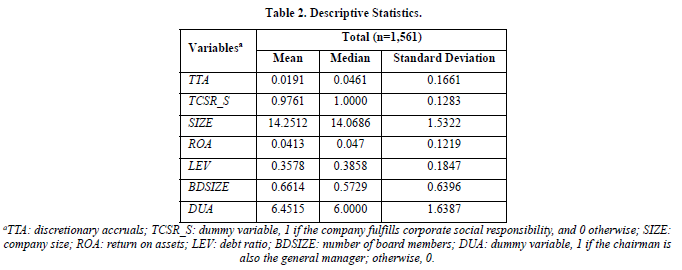

Table 2 is the descriptive statistics. In order to understand all samples, we observe discretionary accruals (TTA), fulfill corporate social responsibility (TCSR_S), company size (SIZE), return on assets (ROA), debt ratio (LED), number of board members (BDSIZE), and whether the chairman is also the general manager (DUA). It can be found that the average of discretionary accruals (TTA) is 0.0191, the median is 0.0461, and the standard deviation is 0.1661 fulfill corporate social responsibility (TCSR_S) that the mean is 0.9761, the median is 1.0000 and the standard deviation is 0.1283.

Correlation Matrix

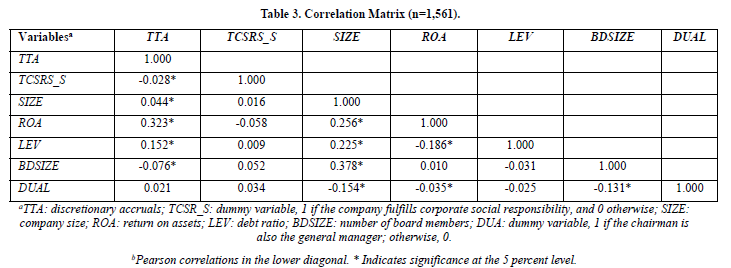

Table 3 shows the correlation coefficients among the variables discretionary accruals (TTA) are significantly negatively correlated with fulfill corporate social responsibility (TCSR_S), with a Pearson coefficient of 0.028, indicating that when a company fulfills corporate social responsibility, there is a lower discretionary accrual. In terms of control variables, correlation analysis shows that discretionary accruals are significantly related to company size (SIZE), return on assets (ROA), and debt ratio (LEV).

Multivariate Analysis: Corporate Social Responsibility and Corporate Value

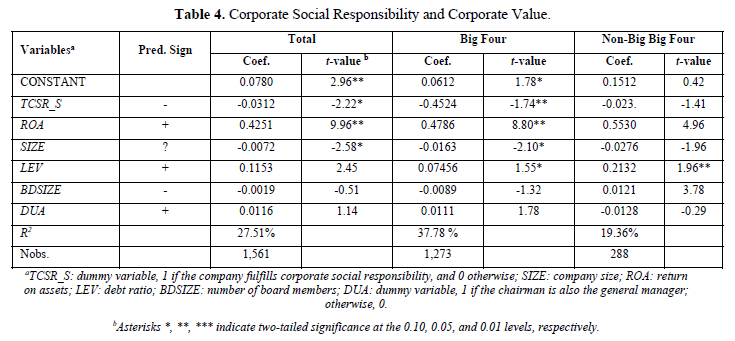

Table 4 shows the impact of testing the fulfill corporate social responsibility (TCSR_S) and corporate value. This article first considers the impact of the sample test companies audited by the Big Four and Non-Big Four accounting firms. What is the impact of corporate social responsibility and corporate value? The empirical results of all samples that shows that the estimated coefficient of the dummy variable TCSR_S is significantly negative, and the coefficient value is -0.0312 (t=-2.22, p<0.10). This result indicates that companies that fulfill corporate social responsibility have lower discretionary accruals. This paper further divides the research samples into whether the impact of discretionary accruals is different for companies audited by the Big Four and Non-Big Four. The empirical results show that the estimated coefficient of the dummy variable TCSR_S belonging to the Big Four is -0.4521 (t=-1.74, p<0.10), which is negative and significant. The above information shows that only the quality of information disclosed by companies that implement corporate social responsibility can have a positive impact on the overall value of the company, reflecting the company’s own internal earnings quality, and thus more able to restrain earnings management behavior.

CONCLUSION

This paper mainly discusses the correlation between corporate social responsibility and corporate value, using discretionary accruals as a proxy variable for corporate value. This study takes Taiwan listed companies from 2018 to 2021 as the research object.

This article first considers the influence of sample test companies audited by the Big Four and Non-Big Four accounting firms on the fulfillment of corporate social responsibility and corporate value. The empirical results of all samples show that companies that fulfill corporate social responsibility have lower discretionary accruals. This paper further divides the research samples into whether the impact of discretionary accruals is different for companies audited by the Big Four and Non-Big Four firms. The empirical results show that fulfills corporate social responsibility belongs to Big Four s with a negative and significant level of assessment. The above information indicates that only the quality of information disclosed by companies that implement corporate social responsibility can have a positive impact on the company’s overall value, reflecting the company’s own internal earnings quality, thus more able to inhibit the behavior of earnings management.

No Files Found

Share Your Publication :