-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Ukangwa Jane Uchechi* and Onyenze Ndubueze Justice

Corresponding Author: Ukangwa Jane Uchechi, Ph.D., Economics Department, Clifford University, Owerrinta, the Campus, Abia State Nigeria.

Received: November 16, 2023 ; Revised: January 08, 2024 ; Accepted: January 11, 2024 ; Available Online: February 01, 2024

Citation:

Copyrights:

Views & Citations

Likes & Shares

The study looked at how Nigeria's standard of life was affected by changes in currency rates. The explanatory variables included exchange rate (EXCR), inflation (INF), interest rate (INTR), and money supply; secondary data covering the years 1990-2021 was used. The variables measuring standard of living were gross domestic product per capita (GDPPC), per capital income, and unemployment proxied standard of living. The stationarity of the variables was determined using unit root tests, and the parameters were estimated using Autoregressive Distributed Lag (ARDL) as they were integrated in the sequence of 1 and 0. The results show that there is a substantial long- and short-term association between Nigeria's GDP per capita, per capita income, and unemployment rate and fluctuations in exchange rates. This implies that changes in the currency rate have a significant impact on the level of life in Nigeria. Because the productive sector is the main driver of the economy and provides the essential commodities needed to produce goods and services, the study advised, among other things, that the government should enhance this sector in order to lower unemployment and raise living standards. They ought to try to implement constructive economic changes designed to improve economic performance and lessen the negative effects of exchange rate swings regarding the living standards in Nigeria.

Keywords: Fluctuations, Exchange rate, Inflation rate, Interest rate, GDPPC, Stationarity, Unemployment, Standard of living

INTRODUCTION

One of the most hotly debated topics in Nigerian finance right now is exchange rate volatility. This is because it plays a significant role in macroeconomic policy and aids in the optimal growth and development of nations. The value of one nation's currency in respect to another is known as its exchange rate. In terms of another currency (or collection of currencies), it is the relative price of one currency. It is a significant economic indicator that directly affects a number of other macroeconomic factors, including trade in products and services, employment rate, poverty alleviation, and price stability. The impact of Oladipupo and Onataniyouwo [1] exchange rate movement has a cascading influence on other microeconomic variables like the rate of inflation, the money supply, and unemployment. The impact of exchange rates on living standards and the health of the nation's economy as a whole is highlighted by the domino effect they described. Exchange rates play a critical role in developing countries' ability to achieve both short- and long-term goals for economic growth and development. Despite the fact that these economies have grown successfully in recent years, the targeted growth rate has not always been reached. By implementing suitable exchange rate management, many established and emerging economies aim to achieve sustainable growth and development. As a result, exchange rates have established themselves as significant macroeconomic indicator of an economy's success since changes in the exchange rate often tend to have a multiplicative impact on macroeconomic variables [4]. Exchange rate policy, a crucial component of macroeconomic policy, is supposed to choose the exchange rate regime that minimizes the possibility of exchange rate imbalances. Elbadawi and Kamar [3] define the exchange rate regime as the government's decision about the particular behavior of its currency in relation to other currencies during a given period of time. Making the incorrect choice, however, might lead to sudden, significant changes in the exchange rate as well as real financial and economic harm. Every economy aspires to have a consistent exchange rate with its trading partners. It is evident that this goal has remained a mirage in Nigeria, despite the country's repeated devaluation attempts to promote exports and stabilize the currency. The country's failure to meet this objective has continuously resulted in worse living standards and household welfare, as well as a detrimental effect on the macroeconomy. Nigeria uses the floating exchange management system in an effort to boost output overall and in the real sector in particular, as well as trade balances. "However, there are tendencies for the economy to be exposed to numerous imbalanced shocks that could lead to economic imbalances and the need for exchange rate adjustment policy, regardless of the exchange rate regime a country chooses [4-7] throughout time. This is due to the fact that fluctuations in exchange rates have, over time, created uncertainty and impeded international trade. Changes in exchange rates are a significant cause of uncertainty in business dealings, which can result in a number of problems, including inflation. Additionally, a lot of small and medium-sized businesses have closed as a result of the poor naira to dollar exchange rate. As a result, it is necessary to address exchange rate variations in order to develop better macroeconomic policy solutions that can be applied in society, enhancing population well-being and boosting economic success as a whole. Sachs and Warner (2005) pointed out that volatility in exchange rates can reduce the level of living for a household by needlessly increasing living expenses and depreciating the value of the local currency. In the fields of economics and finance, the idea of the living standard is not new. It is a gauge of the material components of the economy in a country or region. It determines how much is generated and made accessible for purchase by an individual, family, organization, or nation. It serves as a gauge of a nation's citizens' standard of living. It focuses on the amount of products and services that individuals or groups of individuals generate and consume in a specific amount of time. GDP per capita is the most used indicator of standard of living. It's an A nation's gross the country's population divided by its GDP. GDP is the entire amount of products and services generated annually by everyone inside the nation's boundaries. Real GDP is a more accurate indicator of living standards than nominal GDP since it accounts for inflation and other price increases. Therefore, a nation with high levels of production will be able to pay higher wages, which will encourage further growth in that sector and lower the rate of unemployment among the general public.

Since the majority of heavy machinery and raw materials in Nigeria are imported, unfavorable exchange rates may result, discouraging investment and lowering welfare. According to Mckillop (2004), an increase in exchange rates might result in an increase in interest rates. of causing a recession in an economy. Regular fluctuations or an inappropriate exchange rate have been a major hindrance to economic growth in many African countries, including Nigeria. In contrast, having an appropriate, stable, and more effective exchange rate has been one of the most important factors for economic growth in the economies of most developed countries. Desperate to raise standards of living, cut back poverty and acquire political and economic clout as well as stability and prestige in Nigeria. Since the nation's independence in October 1960, the authorities have been aggressively pursuing goals of internal and foreign balancing. They accomplished this administratively by adjusting the foreign exchange rate of the local currency in accordance with the specific and present economic circumstances [8]. As a result, currency rate management has been extremely difficult in Nigeria because to the numerous issues with both the operators and the authorities. Considering the aforementioned, the purpose of this study is to determine, using empirical means, how exchange rate changes affect Nigerians' standard of living and to attempt to offer policy implications of the findings on the country's economic well-being.

A REVIEW OF RELATION LITERATURE

The Standard of Living Concept

The amount of wealth, comfort, material possessions, and necessities that members of a particular socioeconomic class or geographic location can access is referred to as their standard of living. It truly has nothing to do with the arbitrary idea of life quality, which is a measure of happiness. Numerous metrics, such as comfort levels, wealth levels, and the availability of goods and necessities level of living is commonly measured by comparing individuals in a given location who belong to different socioeconomic classes. Standard of living is measured using some easily quantifiable factors, such as income, work opportunities, the price of goods and services, and rates of poverty. Other items on the list are things like life expectancy, inflation rate, and the amount of paid time off those individuals receive each year. Other factors that are frequently linked to a person's standard of living include class inequality, the poverty rate, the affordability and quality of housing, the gross domestic product, the cost of accessing high-quality healthcare and/or education, and the availability of adequate infrastructure. Furthermore Politics, the economy, and the preservation of people's lives and property are all measures of stability and Living condition. The focus is on the fundamental material elements of standard of living, which include GDP, income, life expectancy, and economic opportunity. The definition of the standard of living, according to Anyawuocha (2000), is "the degree of welfare attained by people in a country at a specific time." A person's income level, the quantity and quality of food and water they consume, their access to reasonably priced and high-quality housing, good education, a healthy environment, work opportunities, life expectancy, and the cost of goods and services are just a few factors used to measure this level of welfare

Review of theory

The Theory of Purchasing Power Parity

The Purchasing Power Parity (PPP) idea is among the most widely accepted and ancient theories pertaining to exchange rates. This theory dates back to the 1918 research of Swedish economist Gustav Cassel, who postulated that the relative buying power of two currencies affects the exchange rate between them. This theory states that when the purchase power of two irredeemable paper currencies is equal, the equilibrium rate of exchange is created. This suggests that the internal price levels have an impact on the exchange rate between two non-convertible paper currencies. of two countries. This suggests that the purchasing power of $1 in the United States is equal to the purchasing power of N80 in Nigeria if certain items cost $1 in the United States and a comparable number of goods costs N80 in Nigeria. Thus, $1 = N80 will be the exchange rate based on the purchasing power parity hypothesis. Absolute PPP is a common phrase for this PPP idea. Relative PPP is defined as the difference between the rates of inflation of all prices in the two countries and the pace at which the value of one currency depreciates relative to another. The cost of one currency in relation to another, known as the nominal exchange rate, so becomes the actual exchange rate after accounting for the difference in price levels.

The Theory of Balance of Payment

According to the balance of payment theory, in an environment with open exchange rates, a nation's currency's exchange rate is determined by its balance of payments. The market determination of exchange rate, also referred to as the free-floating system, is the foundation of the balance of payment model. The foundation of this model presupposes that the different balance of payment positions across the nations are a result of the trade countries' currencies' convertible and exchangeable values. This implies that this stance would lead to an increase in the currency rate in the case of a positive balance of payments, and vice versa. As a result of this, the currency rate based on the laws of supply and demand.

The Theory of the Optimal Currency Area

Another early and important theoretical basis for the selection of exchange rate regimes is the Optimal Currency Area. In 1961, Mundell [9] and McKinnon devised the optimal currency area (OCA) theory (1963). The primary subjects of these 37 works of literature are trade and the stability of the business cycle. It is based on concepts like labor market mobility, openness, and shock symmetry. According to the concept, by lowering exchange rate uncertainty and, hence, the cost of hedging, a fixed exchange rate regime might increase trade and output growth. It further asserts that by lowering the currency premium over interest rates, a fixed exchange rate regime might encourage investment. Conversely, though, by in addition to impeding, delaying, or stalling the necessary process of relative price adjustment, it can also reduce trade and output growth. In a similar vein, Hossain (2002) agreed that the exchange rate affects import and export figures, the nation's balance of payments, and facilitates international trade by linking the pricing systems of two different nations.

Empirical Studies

Undoubtedly, the level of living and fluctuations in exchange rates have taken center stage in discussions about economics and finance, particularly in Nigeria in recent times. Numerous academics and researchers have looked into this from both the established and emerging economies viewpoints. The issue of how fluctuations in exchange rates impact Nigeria's standard of living has sparked debate among decision-makers over the years, and research has tried to show the extent to which an exchange rate influences a high or low standard of living. Oyedepo, Rasaki, and Onasokhare [10] evaluated the effect of exchange rate swings on the manufacturing sector's performance in Nigeria in 2023. In their study, they examined how Nigeria's manufacturing sector performed in relation to changes in currency rates between 1990 and 2020. The World Development Indicators and the Statistical Bulletin of the Central Bank of Nigeria provided the data for the annual time series. The most accurate estimates of the co-integrating regression were provided by the long and short run versions of the autoregressive distributed lag model (ARDL), which was employed for the data analysis. The model's explanatory variables included manufacturing capacity utilization (MACU), exports (EXP), imports of raw materials (IMP), exchange rate fluctuations (EXRF, EXCR), interest rate (INT), and inflation rate (INFR). The results of the research demonstrated that, with an adjusted R2 value of 96%, the model fit the data quite well. The long-term correlation between the variables was shown using the ARDL model, which also shows that the variables (IMP) and (EXRF) significantly decreased Nigerian manufacturing output. Conversely, there was a significant positive correlation between MGDP and MACU. In the short run, there were significant negative correlations between MGDP and EXRF, IMP, INT, and INFR. The analysis concludes that exchange rate changes have a considerable impact on Nigeria's MGDP. The study's recommendations state that the government ought to put policies in place to assist in stabilizing Nigeria's currency rate system. Import restrictions should apply to domestically produced raw materials, and resources that can increase the manufacturing sector's capacity utilization should be made available. Nigeria's manufacturing sector production will rise dramatically as a result, boosting its competitiveness internationally. Ani and Udeh [3] examined the impact of exchange rate fluctuations on Nigeria's economic growth. An extensive analysis was conducted on the impact of exchange rates on unemployment, GDP, and GNP. Secondary data from the Central Bank of Nigeria Statistical Bulletin, which was compiled during a ten-year period from 2009 to 2018, were used. The study methodology employed was ex post facto. While certain diagnostic procedures were performed to verify the accuracy of The Ordinary Least Square method was used to evaluate the hypotheses based on the data and their relationship over both the short and long terms. The exchange rate was shown to have a considerable impact on GDP and GNP but not on unemployment. This suggests that the GDP and GNP microeconomic indices could be utilized to intentionally modify the inhabitants' standard of life. Among other things, the report suggests implementing policies that will influence GDP in a way that will enhance the wellbeing of the populace. It states that in order to prevent needless oscillations that could have disastrous economic effects on the Nigerian people, exchange rates should be regulated extremely carefully by professionals in the sector. In 2021, Iheanachor and Ozegbe [12] evaluated the effects of currency rate swings on the state of Nigeria's economy. The study's objective was to ascertain why, over the course of the investigation, the concerted efforts of the Nigerian monetary authorities to pursue internal and external balances produced little to no progress. The study employed the autoregressive distribution lag (ARDL) technique to investigate the short- and long-term effects of exchange rate fluctuations on economic development using annual time series data from 1986 to 2019. The empirical result demonstrated that Nigeria's economic growth was substantially hampered over the long run by the inflation rate, net foreign direct investments, and currency rate. The study's overall conclusion was that excessive fluctuations in exchange rates are detrimental to Nigeria's economic growth. This essay offers Nigerian farmers advice on agro-investment and agricultural export diversification. the foundation of the empirical discoveries. To mitigate the adverse effects of an unstable foreign exchange system on the Nigerian economy, the state had to exert influence over the foreign exchange system through dependable modifications. In Nigeria, Toriola, Folami, Afolabi, and Ajayi [13] evaluated the direction of causality between exchange rate and human welfare measures as well as the impact of exchange rate variations on these indicators. Data from the World Bank Development Index (WDI) and the Central Bank of Nigeria (CBN) Statistical Bulletin between 1981 and 2017 were used in this ex post facto research project. The Ganger causality test and Ordinary Least Squares (OLS) were used in the actual estimation. The results showed that while currency rate fluctuations and inflation have a negligible impact on human welfare in Nigeria, interest rates have a large beneficial impact. The Granger causality test found that human welfare has a unidirectional causal relationship with changes in the currency rate in Nigeria. According to the report, the government should forbid the importation of any goods that can be produced domestically and that the nation has the resources to do so. Nigeria’s economy relies heavily on imported goods in order to survive. The craze for imported goods has over time exerted pressure on the exchange rate. This has in turn brought about a decline in the Nigerian productive sector causing spiral unemployment leading to a drop in the standard of living of most Nigerians. To explain this, Nwobia, Ogbonnaya-Udo and Okoye [14] have out research on the effect of currency rate variations on Nigeria's external trade between 2000 and 2019. The study used secondary data from the Nigerian Central Bank's Statistics Bulletin on a range of topics from 2000-the year the variable exchange rate monetary authority regime began-to 2019. Ordinary Least Square (OLS) regression analysis and correlation were used to analyze the data. The outcome demonstrates that Nigeria's GDP and foreign trade are significantly impacted by the three variables: exchange rate, balance of payments, and inflation rate. The GDP is negatively impacted by exchange rates because rising exchange rates have a negative impact on external commerce. They suggested that in order to sustain export growth, the government should fund export promotion programs. Also, good trade balance of payments and a stable exchange rate, both of which would boost the nation's GDP. Ogbebor, Oguntodu, and Oyinloye [15] contend that the standard of living is essential to any economy. It offers a thorough overview of how the global economy is performing. When a person's purchasing power is restricted and they are unable to buy basic necessities, their marginal propensity to spend (MPC) rises, making it more difficult for them to live comfortably and lowering their standard of living. To bolster this, their research examined the impact of inflation on Nigeria's standard of living. Time series data between 1998 and on the living standard and inflation rate, as measured by the Human Development Index (HDI) For this study, 2017 was the year. The data was tested for stationarity using the enhanced Dickey Fuller and Phillip-Perron unit root tests, and the Auto Regressive Distributed Lagged (ARDL) model was selected for inferential investigations. Skewness, kurtosis, the Durbin-Watson test, the Jarque-Bera test, the Godfrey serial correlation LM test, and the Breuch-Pagan test for heteroscedasticity are a few of the descriptive statistics that are employed. The findings showed a long-term relationship between inflation and standard of living. Inflation demonstrated a negative and substantial influence, with a coefficient of -0.034 and a P-value of 0.017, indicating that over the study period, a 0.034 unit decrease in quality of living is caused by every unit increase in inflation. Based on the results, it was suggested that an appropriate combination of financial and fiscal measures ought to be implemented in order to enhance Nigerians' standard of living. Differences in trade exposure between US states were found by House, Proebsting, and Tesar [16], who took advantage of the effects of exchange rate fluctuations on economic activity at the business cycle frequency. They found that a decline in the state-specific trade-weighted real exchange rate is associated with an increase in hours worked, a decrease in unemployment, and an increase in exports. The effect is particularly apparent when the economy is struggling. A multi-regional model was developed that included labor mobility and interstate trade. It was calibrated to align with state export orientations, trade volumes, and labor migration patterns accurately representing the relationship between unemployment and exchange rates. The high amount of interstate trade in the first year largely transmits shocks across states, but in future years, cross-sectional patterns are shaped by interstate migration. According to the model, a 25% import tariff on goods from China would affect the entire nation, even the states with very weak direct linkages to China, and would cause a 0.2-0.7 percentage point short-term increase in unemployment rates. Akpanke [17] employed annual time series data from 1986 to 2016 to examine the effects of currency exchange rate variations on Nigerian economic growth. Akpanke [17] acknowledged that the relationship between the exchange rate and economic growth has been questioned for a variety of reasons. The secondary information came from were used, as was the statistical bulletin from the Nigerian Central Bank. The Nigerian economy ran on fixed exchange rates until 1986. After that year, a flexible system of currency rates was implemented. To analyze the data, the Ordinary Least Squares (OLS) approach is employed. The result shows that GDP growth and exchange rates are negatively correlated. A shift in GDP growth rates will cause EXC to decrease by 0.324593. It was decided to adopt the null hypothesis, which states that the exchange rate has little to no significant effect on the economy of Nigeria, because the probability value of GDP growth does not reach statistical significance at 5%. The study's conclusions suggest that stringent foreign exchange control laws should be implemented in order to assistance in the accurate computation of the exchange rate's value. Ogunmuyiwa and Adelowokan [18] measured the effect of exchange rates on industrial output in Nigeria. They pointed out that scholars from both wealthy and poor countries have long examined the significance of exchange rates in determining industrial output. However, because of its continued relevance and significance in influencing the production of the industrial sector, they expanded their analysis and added to the body of literature. Several econometric techniques were applied to time series data from 1986 to 2016, including the Chow break point test, the Box Jenkins O.L.S methodology, and the Augmented Dickey Fuller unit root test. Despite the fact that there is no sustained relationship between exchange rate Regarding industrial output, the empirical findings demonstrate that the exchange rate has a significant and favorable influence on Nigeria's industrial output. Furthermore, the results of the Chow break point test verify that, indeed, from the beginning of the 4th republic in 1999, there has been a structural shift in the pattern and direction of Nigeria's industrial output and exchange rate. The exchange rate affects Nigeria's industrial output, but because of its infectious effects, this study suggests that it be carefully managed to prevent an inflationary spiral in the price of products and services. In order to establish a causal link between exchange rate fluctuations and household wellbeing in Nigeria, Edeme and Okafor [19] also looked into the effects of these fluctuations on household welfare. Family Unit Welfare was defined as the exchange rate, which was based on the per capita household consumption spending to determine a dollar's value in naira. The Granger causality test, the linear regression strategy, and the Ordinary Least Squares (OLS) estimate technique were applied to annual time series data from 1980 to 2014. The results of the investigation demonstrated that exchange rate variations positively and significantly affect household welfare. Exchange rates are Granger causes of household wellbeing, as demonstrated by the results of the Granger causality test. Changes in exchange rates may benefit households, but household welfare is diminished because more naira may be spent on fewer goods. Changes in currency rates therefore have a negative overall impact on household wellbeing in Nigeria. The idea was for the government to create an exchange rate management plan that, given the exchange rate's positive impact on household consumption expenditure and its ensuing consequence of depleting savings in order to smooth consumption, will strengthen the naira versus the dollar. Similarly, Oniore, Gyang, and Nnadi [20] empirically studied the connection between exchange rate volatility and private domestic investment in Nigeria. Descriptive statistics and the econometric approach were applied. Therefore, the Error Correction Model (ECM) technique within the Ordinary Least Square estimation and simple averages of descriptive statistics were employed to evaluate the various patterns in the data. The very large standard deviation of the exchange rate variable illustrates the enormous variations in the variables, as shown by the descriptive statistics of the variables that are part of the model. This demonstrates how erratic the currency rate was during the course of the inquiry. The findings suggest that devaluation of currency and interest rates does not stimulate private domestic investment activities in Nigeria. On the other hand, Nigerian private domestic investment was positively impacted by infrastructure, government size, and inflation. In order to highlight the success of private domestic investment through a stable macroeconomic environment, it is advised that monetary authorities adopt proper policy in appreciating the value of the naira, as devaluation has been a mistake since 1986. They should also lower borrowing and lending costs.

To submit suggestions to Nigerian decision-makers about how to attain the right exchange rate that would hasten industrialization and the impact of currency rate stability on industry output in Nigeria was examined by Ilechukwu and Nwokoye [21] using annual time series data spanning from 1980 to 2013. The method of ordinary least squares was applied. The study's findings showed that significant determinants of industrial output included GDP growth, real exchange rates, population growth rate, foreign direct investment, and local capital. The external balance and inflation adjustments had little to no effect on industrial output. The researchers concluded that in order to foster an environment that supports industrial output and ultimately economic growth, the government should deliberately work to modify the various macroeconomic parameters. Every country's economy is linked to the global goods and asset markets, either directly or indirectly or tangentially. This relationship is made possible by trade and foreign exchange. Understanding the foreign exchange rate-also referred to as the price of a foreign currency relative to a local currency-is essential to figuring out the direction of global growth. Profound misalignments in exchange rates can have detrimental impacts on production and lead to extreme financial difficulties. These prompt the question of what exchange rate is necessary to achieve a variety of different objectives. The main objectives are to maintain international competitiveness, manage inflation, and expand the economy.

METHODOLOGY

Data Sources

The majority of the data used in this came from secondary sources. These are time series data that were gathered from relevant statistical publications, journals, online articles, the CBN statistics bulletin, and other sources using a desk survey method. The exchange rate was the independent variable along with other likely variables (inflation (INF), interest rate (INTR), and money supply (MS) that have an impact on the relationship between the exchange rate and standard of living. The proxy variables used to measure standard of living were GDP per capita (GDPPC), per capita income (PCI), and unemployment rate (UNEMP). The time frame for the research was 1990-2021.

Model Specification

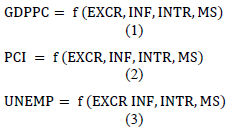

The relationship subsisting between the independent and dependent variables was represented functionally as

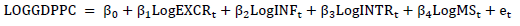

Transforming the above functional representation to an econometric form with the intention of analysis is stated thus;

Where; GDPPC: Gross domestic product per capita proxy for Standard of Living; PCI: Per capita income (standard of living index); UNEMP: Unemployment rate (measure of living standards); EXCR: Exchange rate; INF: Rate of inflation; INTR: Interest rate; MS: Money Supply 𝞫0; : Intercept; 𝞫1- 𝞫4 : Regression Parameters/Coefficient of the independent variables; et: Stochastic error

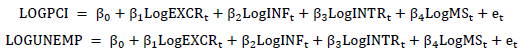

A-priori Expectation

Data Analysis Method

Time series data from 1990 to 2021 were used for the estimation. The results of the unit root pre-estimation test were utilized to analyze the collected data and determine the precise method that was employed to prevent false regression. To determine the variables' integration order, the stationarity of the variables was tested using the Augmented Dickey-Fuller (ADF) test of unit root. The result displayed a mixed order of 1(0) and 1(1), requiring the short- and long-term correlations between the variables to be ascertained through the application of the Error Correction Model (ECM) and the Autoregressive Distribution Lag (ARDL) analysis technique. Additionally, descriptive statistics were used to determine the degree of normalcy in the data set under examination. The study employed of the econometric technique in determining the relationship between shifts in exchange rates and Nigerian living standards. The three models will utilize the Ordinary Least Square (OLS) technique to obtain numerical estimations of the co-efficient in various equations.

DATA DISPLAY AND ANALYSIS OF OUTCOMES

Display of Data

The data used in this section was obtained in both natural and logged form from World Bank databases, CBN statistics bulletins, and publications from the National Bureau of Statistics. See Table 1 for the logged form. Refer to Appendix for the natural form of the variables.

Analysis of Data

E-Views 10 was used to help with the data analysis, which is shown in the following sections:

Statistical descriptions

Descriptive statistics for the two dependent variables.

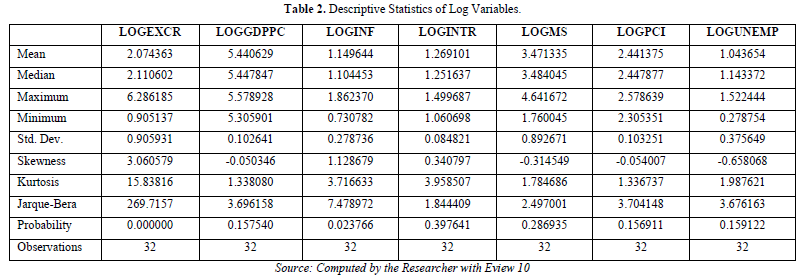

The results of the descriptive statistics, or summary statistics, were displayed in Table 2 for the independent variables, exchange rate (LOGEXCR), inflation (LOGINF), and interest rate (LOGINTR), and the dependent variables, gross domestic product per capita (LOGGDPPC), per capita income (LOGPCI), and unemployment (LOGUNEM). The fundamental features of the data collection were quantified, described, and possible correlations between variables were highlighted using these summary statistics. The metrics of central tendency, dispersion, and normalcy of the data set are the fundamental properties as indicated by the outcome.

LOGEXCR, LOGGDPPC, LOGINF, LOGINTR, LOGMS, LOGPCI, and LOGUNEMP had average values of 2.07436, 5.440629, 1.149644, 1.269101, 3.471335, 2.441375, and 1.043654, respectively, as can be seen from the results. The dispersion measure, such as the minimum value, the maximum value and standard deviation considered the degree of dispersion of the data set with respect to its mean values. Each variable's values and corresponding metrics are shown in Table 2. The variables that indicate whether or not the data set is regularly distributed are also very important. In this study, skewness and kurtosis were used as indicators of normalcy. Kurtosis values that fall between -2 and +2 are seen to be appropriate for asymmetry and to demonstrate a normal distribution. However, skewness between -7 and +7 is regarded as normal in data. All save the exchange rate dataset complied with this general guideline, which demonstrated the skewness and kurtosis of 15.83816 and 3.060576, respectively.

With a null hypothesis indicating that the series is not normally distributed, the Jarque-Bera (JB) statistic test compares the series' skewness and kurtosis to those from the normal distribution. The JB values for EXCR, INTR, INF, MS, UNEMP, PCI, and GDPPC are 269.7151, 1.844409, 7.478972, 2.497001, 3.676163, 3.704148, and 3.696158, respectively, based on the results shown in Table 2. With the exception of EXCR and INF, all the variables had a likelihood of their JB statistics being non-significant, meaning that their p-value was larger than 0.05, indicating that the null hypothesis was rejected and that the null hypothesis of EXCR and INF was sustained.

Unit Root/Stability Test

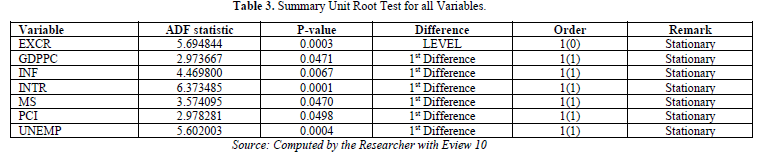

There was a unit root test conducted on the data set to determine the degree of stationarity of the variables under investigation and to prevent conducting a misleading regression. This was accomplished using the Augmented Dickey-Fuller (ADF) unit root test. The null hypothesis data sample (non-stationary) for the ADF test is the absence of a unit root in a time series. The null hypothesis of non-stationarity is not upheld in cases where the critical value of the chosen level of significance is represented by an ADF statistics value greater than one. Table 3 shows the summary of the ADF unit root test.

The first test needed to determine the individual stationarity of the variables used in the study is shown in Table 3. The results of unit root testing with the Augmented Dickey-Fuller (ADF) can be analyzed using the p-value or the t-statistic. If the p-value is less than or equal to 0.05, or if the ADF t-statistic in absolute term is greater than the ADF 5% critical value, the variable is considered stationary. Table 3's result output showed that all the variables (UNEMP, GDPPC, INF, INTR, MS, PCI, and EXCR) except for the EXCR are stationary at the first difference, whereas the EXCR is stationary at level. Differentiating a non-stationary time series variable can make it stationary, according to Gujarati and Porter (2007).

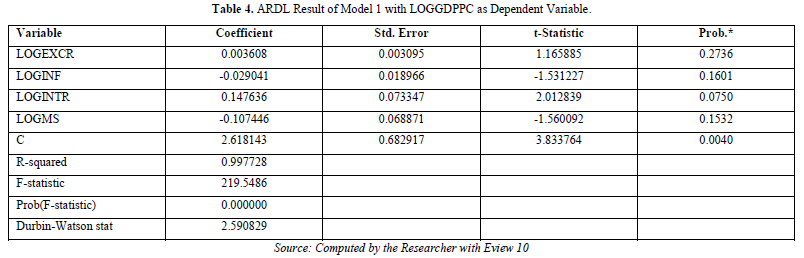

ARDL Result for Model 1

The ARDL result for Model 1 is presented in Table 4. It demonstrates that the GDPPC has a positive, meaningful constant of 2.618143. With coefficients of 0.003608 and 0.147636, respectively, LOGEXCR and LOGINTR were likewise positive but not statistically significant. The LOGMS and LOGINF coefficients (-0.107446, -0.029041) were both negative and not statistically significant. The R-squared value indicated a very high goodness of fit of 99%, suggesting that the explanatory factors in the study could explain the majority of variations in LOGGDPPC. The dataset's lack of serial correlation was further demonstrated by the DW value of 2.590. As demonstrated by the F-statistics with a p-value of 0.0000 Significant at a 1% level, the model's overall fitness was likewise good.

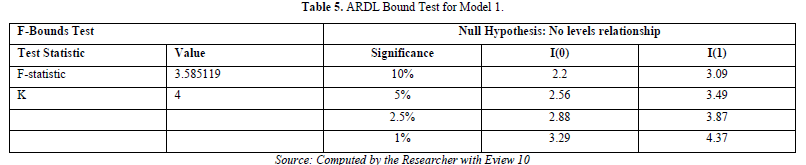

ARDL Bound Cointegration Test

The requirements that the variables be integrated at the zero and one order must be met in order to perform the ARDL bounds test. Since all of the variables in the data set under consideration were integrated in that sequence, an ARDL bound test estimate was required. The alternative of ARDL bound cointegration argues in favor of cointegration, whereas the skewed hypothesis holds that the variables are not cointegrated. If the F-statistic is greater than the upper and lower bound values at the 5% significance level, the null hypothesis is refuted. Table 5 shows that, at a 5% significance level, the F-statistic (3.585119) is greater than the 1(0) (2.56) and 1(1) (3.49) bounds. Therefore, we declare that the null hypothesis is not viable and draw the conclusion that a long-term collaboration exists in relation to Nigeria's level of living and exchange rate. As a result, we move forward and estimate the variables' short-term association.

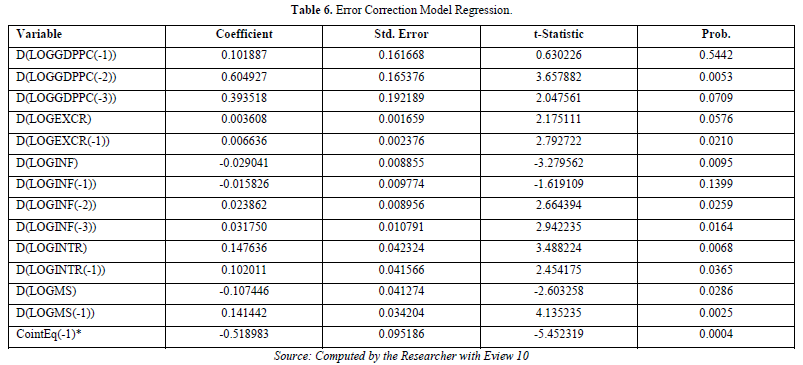

Short Run ARDL Result

The short run parsimonious result is the one shown in Table 6. An improvement in the recent past condition of LOGGDPPC will raise the current LOGGDPPC in the nation. The lag value of LOGGDPPC is large and beneficial in the recent past years, therefore impacting the current value of LOGGDPPC. The calculated explanatory variables show a substantial positive association between GDP per capita and the interest rate (LOGINTR, 0.47636) and exchange rate (LODEXCR: 0.00360). While the money supply (LOGMS, -0.107446) and inflation (LOGINF, -0.02941) are both significantly and inversely correlated with the gross domestic product.

By default, the error correction term's coefficient, which gauges how quickly short-term disequilibrium transitions to long-term equilibrium, ought to be significant and negatively signed. The table's ECM (CointEq(-1)) values, which are -0.518983 and 0.0004, respectively, meet the significance and negativity requirements. This suggests that each year, around 52% of the disequilibrium in a nation's quality of living is corrected.

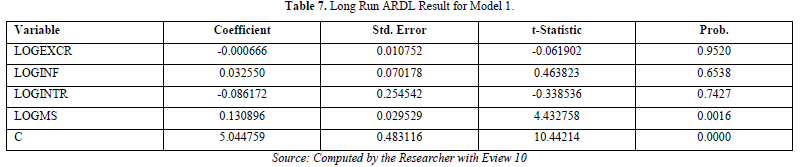

Long Run ARDL Result

The Table 7 is the result for the long run ARDL for the model as stated. An examination of the coefficients of the variable reveals that LOGEXCR and LOGINTR present a negative and insignificant relationship with LOGGDPPC and are not significant. While LOGINF and LOGMS are both negative but only LOGMS is significant.

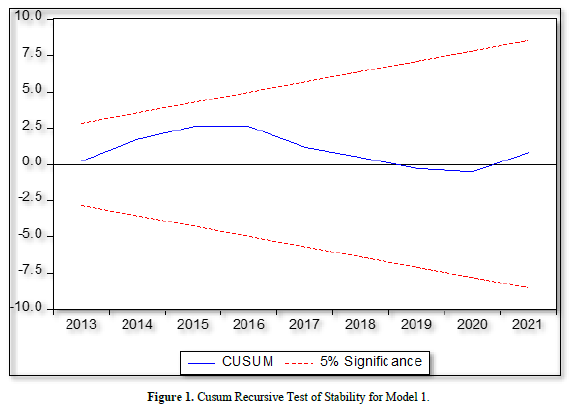

Testing for stability of the Model 1

A Look at Figure 1 reveals the outcome of the cumulative sum of residuals which measure if coefficients of regression are changing systematically and whether the model is stable. The two red lines represent the bounds of testing and the blue line are the parameters. In this figure the blue line lies safely within the two red bounds which implies that the parameters of the model 1 are stable and can be used for inference.

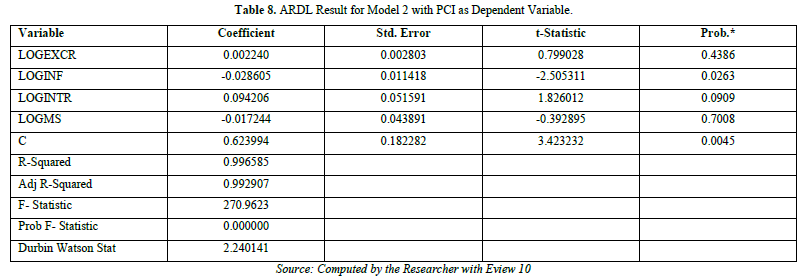

ARDL Result for Model 2

Table 8 shows the outcome of the ARDL estimation for Model 2. It shows that PCI has a constant of 0.623994, positive and significant. LOGEXCR and LOGINTR were also positive with coefficients of 0.00224 and 0.094206 and insignificant. LOGINF and LOGMS coefficient were negative (0.028605, -0.017244) with LogINF significant the level of significance is 5%. The R-squared determined showed a very high goodness of fit at 99%, implying that most changes in LOGPCI could be clarified by the explanatory variables in the study. The DW value of 2.240141 also evidenced the absence of serial correlation in the dataset. The overall fitness of the model was also good as revealed by the F-statistics with a p-value of 0.0000 significant with a 1% level of significance.

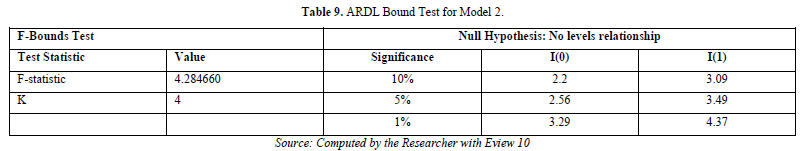

ARDL Bound Cointegration Test for Model 2

The limits test of ARDL for model 2 reveal that the criteria for variables to be integrated at the zero and one order was satisfied. For model 2 the data set was integrated in that order hence the need to estimate the ARDL bound test. The bare assumption of ARDL bound cointegration is that the variables are not cointegrated while the alternative argues for cointegration. We disprove the null theory if the F-statistics is higher than the upper and lower bound value at level of significance of 5%. From the Table 9, the F-statistic (4.284660) is higher than the 1(0) (2.56) and 1(1) (3.49) bound at level of significance of 5%. We thus state that the null hypothesis cannot be sustained and conclude that there is a long-term connection between the exchange rate and standard of living in Nigeria. We therefore go ahead to estimate the short run relationship between the variables.

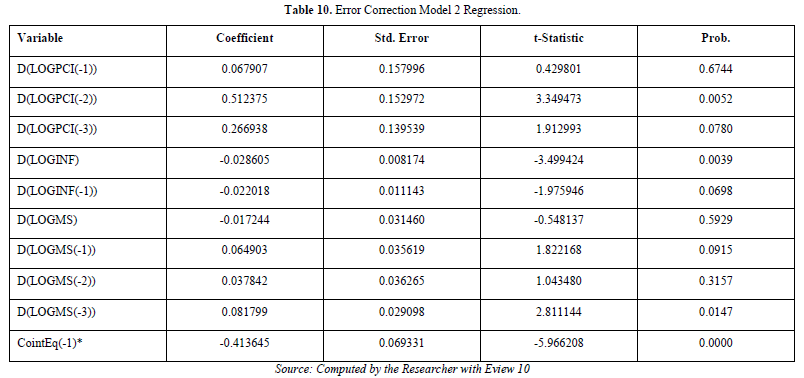

Short Run ARDL Result

Table 10 shows the outcome of the short run parsimonious result. After 1st differences the adjustment coefficient (CointEq (-1)) value of -0.413645 show that the previous period deviation from long run equilibrium is corrected in the short at an adjustment speed of -0.41365(41%) and level of significance at 1%. This value is at the average and not likely to cause disruption at this speed. In the near future a decrease in LOGINF -0.022018 increases in is connected to LOGPCI while an increase in LOGMS is with a decrease in LOGPCI.

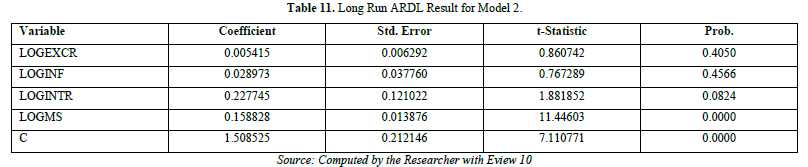

Long Run ARDL Result

The Table 11 is the result for the long run ARDL for the model 2 as stated. An examination of the coefficients of the variable indicate that LOGEXCR (0.005415), LOGINF (0.028973), LOGINTR (0.227745) and LOGMS (0.158828) are all positively associated with LOGPCI with only LOGMS being significant at a p-value of 0.0000.

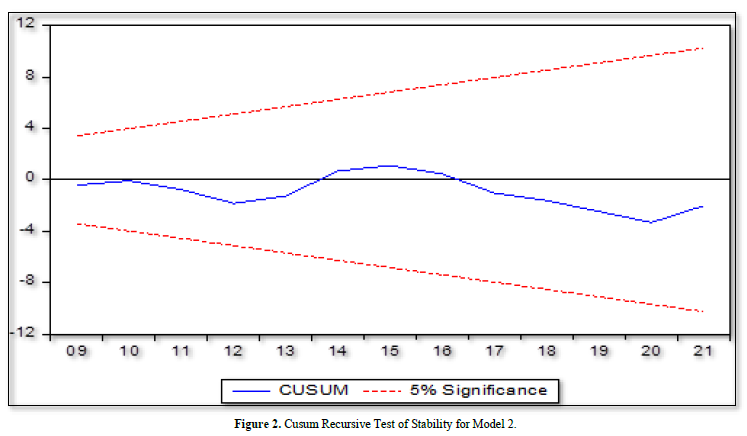

Testing for Parameter Stability for Model 2

Figure 2 reveals the outcome of the cumulative sum of residuals for model 2 which measure if coefficients of regression are changing systematically and whether the model is stable. Both of the red lines represent the bounds of testing and the blue line, as well represents the parameters. In this figure the blue line lies safely within the two red bounds, which suggests that the model 2's parameters are reliable and suitable for inference.

ARDL Result for Model 3

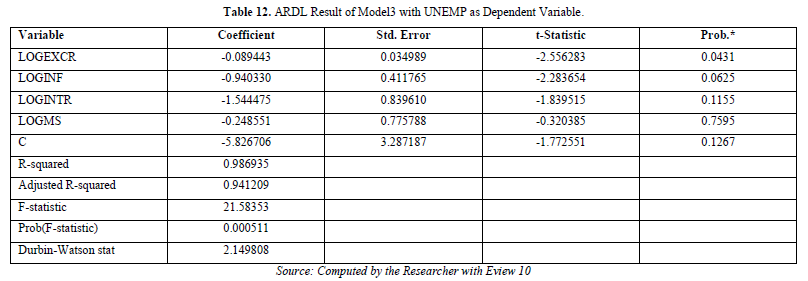

Table 12 shows the outcome of ARDL estimation for Model 3. It shows that UNEMP has a constant of -5.826706, negative and insignificant. The explanatory variables of LOGEXCR, LOGINF, LOGINTR and LOGMS were all negatively associated with LOGUNEMP with only LOGEXCR and LOGINF significant at 5% (0.0431) and 10% (0.0625) level of significance respectively. The R-squared measuring the goodness of fit was very high at approximately 99%, implying that most changes in LOGUNEMP could be clarified by the explanatory variables in the study. The DW value of 2.149808 also evidenced the absence of serial correlation in the dataset. The overall fitness of the model was also good as shown by the F-statistics with a p-value of 0.0005 significant when significance level is 5%.

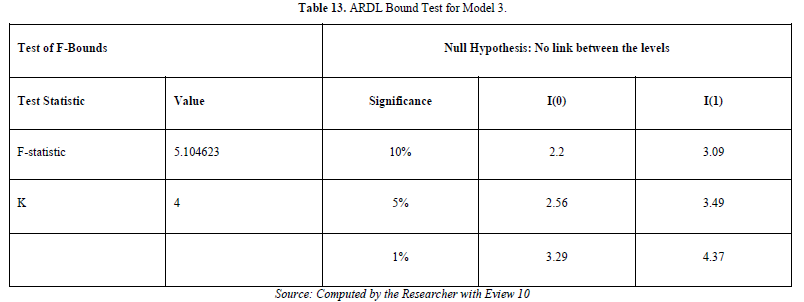

ARDL Bound Cointegration Test

The boundaries test for ARDL model 3 reveal that the criteria for variables to be integrated at the zero and one order was satisfied. For model 3 the data set were integrated in that order hence the need to estimate the ARDL bound test. Evaluation of the null hypothesis ARDL bound cointegration is that the variables are not cointegrated while the alternative argues for cointegration. We disprove the null theory if the F-statistics is higher than the upper and lower bound value at level of significance of 5%. From the Table 13, the F-statistic (5.104623) higher than the 1(0) (2.56) and 1(1) (3.49) bound at 5% significance level. We thus state that the null hypothesis cannot be sustained and conclude that there is a long-term correlation between the Exchange rate and standard of living in Nigeria. We therefore go ahead to estimate the short run relationship between the variables.

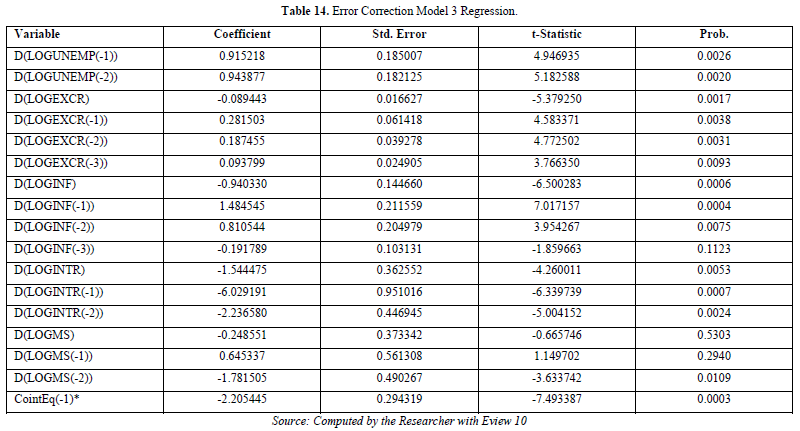

Short Run ARDL Result for Model 3

In Table 14 the short run parsimonious result is displayed. The explanatory variables predicting LOGUNEMP are all negatively signed and significant at 5% level of importance with exception of LOGGMS that was insignificant. After 1st differences the adjustment coefficient (CointEq (-1)) value of -2.205445 show that the previous period deviation from the long-term equilibrium has been restored in the short at a very high adjustment speed of -2.205445(220%) and significant at 5% level of significance. This value will often result from implementation of efficient policies aimed at benefitting the economy and populace. In the short term, an increase in LOGEXCR (-0.089943), LOGINF (-9.940330), LOGINTR (-1.544475) and LOGMS (-0.248551) is associated with a decrease in LOGUNEMP.

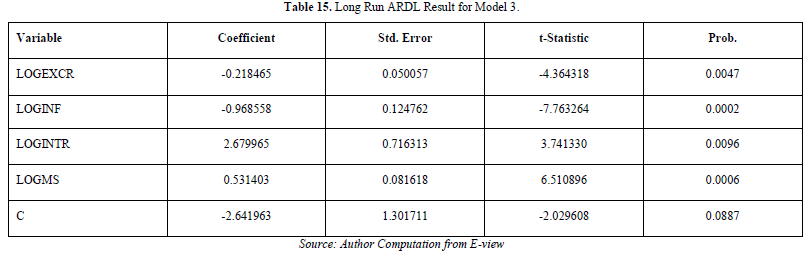

Long Run ARDL Result

The Table 15 shows the result for the long run ARDL for the model 3. It can be observed that the coefficients of the independent variables of LOGEXCR and LOGINF are negatively signed indicating a negative association between them and the dependent variable is statistically significant at a level of 5%. The independent variables of "LOGINTR" and "LOGMS" show a positive correlation with the dependent variable "LOGUNEMPL" and are also statistically significant at 5%.

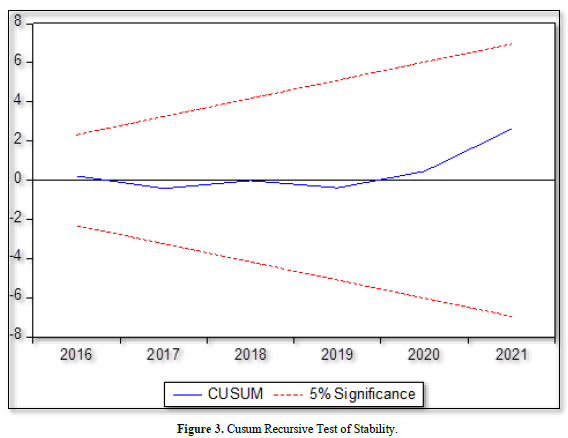

Testing for Parameter Stability for Model 3

Figure 3 reveals the outcome of the cumulative sum of residuals for model 3 which measure if coefficients of regression are changing systematically and whether the model is stable. Both red lines represent the bounds of testing and blue line represents the parameters. In this figure the blue line rest safely within the two red bounds. This means that the model 3's parameters are stable and we can use them to make inferences.

Test of Hypothesis

H01: The exchange rate fluctuations do not have any impact on GDP per capita in Nigeria.

To test the hypothesis that:

H0: β1 = 0 i.e the slope of coefficient is simultaneously equal to zero

H1: β1 ≠ 0 i.e the slope of coefficient is not simultaneously equal to zero

If the probability of the F statistic result is less than 0.05, The null hypothesis should be rejected, for this test, Table 4 was used.

The F statistics with value of 219.5486 and p-value of 0.0000 below 5% level of significance. The study rejected the null hypothesis and therefore concludes that it cannot be sustained. The impact of exchange rate fluctuations is significant on gross domestic product per capita. The regression equation for this relationship is as stated below.

Hypothesis 2

H02: Exchange rate fluctuation has no significant effect on per capita income in Nigeria. To test the hypothesis that:

H0: β1 = 0 i.e the slope of coefficient is simultaneously equal to zero

H1: β1 ≠ 0 i.e the slope of coefficient is not simultaneously equal to zero

If the probability of the F statistic result is less than 0.05, the study would fail to sustain the null hypothesis, for this test, Table 8 was used.

The F statistics with value of 270.9623 and p-value of 0.0000 below 5% level of significance. The study rejected the null hypothesis and concludes that it cannot be sustained. We therefore conclude that exchange rate fluctuation has a significant effect on per capita income. The regression equation for this relationship is as stated below.

Hypothesis 3

H03: There is no significant impact of exchange rate fluctuations on gross domestic product per capita of Nigeria. To test the hypothesis that:

H0: β1 = 0 i.e the slope of coefficient is simultaneously equal to zero

H1: β1 ≠ 0 i.e the slope of coefficient is not simultaneously equal to zero

If the probability of the F statistic result is less than 0.05, the study would fail to accept the null hypothesis, for this test, Table 12 was used.

The F statistics with value of 21.583 and p-value of 0.0005 below 5% level of significance. The study rejected the null hypothesis and therefore concludes that it cannot be sustained. Hence exchange rate fluctuation has a significant effect on gross domestic product per capita. The regression equation for this relationship is as stated below.

DISCUSSION OF FINDINGS

Exchange rate fluctuation has no significant effect on gross domestic product per capita of Nigeria

The findings from the hypothesis one indicates that there is a long run relationship between exchange rate and the living standard in Nigeria measured as gross domestic product per capita. This relationship was negatively signed indicating that if the exchange rate goes up by one unit, it will bring about a decrease in the standard of living in Nigeria. This finding is consistent with that of Toriola, Folami, Afolabi and Ajayi [13] who examined the effect of exchange rate fluctuations on human welfare indicators. Furthermore having found a long run relationship from the ARDL long run bound test, the ARDL short run Error Correction Regression estimated showed that the error correction term [CointEq(-1)] is rightly signed. The coefficient of the error term is -0.518983 with probability value of 0.0004. Since the p-value is less than 0.05, it implies that the error term is statistically significant. This indicates that changes in the trend of standard of living of an average Nigerian citizen will eventually be corrected over time. The coefficient indicates that about 51% of the deviations on standard of living of an average Nigerian citizen due to fluctuations in exchange rate can be corrected within a year. This implies that exchange rate fluctuations can be used to stabilize standard of living in Nigerian, suggesting that exchange rate has a significant policy adjustment effect on standard of living of an average Nigerian citizen within the period under review.

Exchange rate fluctuation has no significant effect on per capita income in Nigeria

From hypothesis two the results reveal a long run relationship subsisting between exchange rate and the standard of living in Nigeria measured by per capita income. This finding is consistent with that Ogini (2022) who examined the effect of Selected Macroeconomic Variables and Per Capita Income in Nigeria. The short run parsimonious ARDL or error correction term [CointEq(-1)] is also rightly signed at a value of 0.413645 at a p-value of 0.0000 which is less than 0.05 level of significance, thus is significant. Any distortion in the per capita income would therefore be corrected at the rate of 41%.

Exchange rate fluctuation has no significant effect on unemployment index of Nigeria

The findings from the hypothesis one revealed that there is a long run relationship between exchange rate and standard of living in Nigeria measured with unemployment rate. This relationship was negatively signed and significant indicating that a unit increase in the exchange rate will result in a decrease in the standard of living in Nigeria measured as unemployment rate. This finding is not consistent with that of Ani and Udeh [3] who examined the effect of exchange rate on economic growth and found that exchange rate has no significant effect on unemployment rate. The ARDL short run Error Correction Regression estimated showed that the error correction term [CointEq(-1)] is rightly signed. The coefficient of the error term is -2.205445 with probability value of 0.0003. Since the p-value is less than 0.05, it implies that the error term is statistically significant. This indicates that shift in the trend of standard of living of an average Nigerian citizen will eventually be corrected over time. The coefficient indicates that about 2.21% of the deviations on standard of living of an average Nigerian citizen due to fluctuations in exchange rate can be corrected within a year. Thus implying that, exchange rate fluctuations play a very important role in the policy stabilization of welfare of the Nigerian citizen.

SUMMARY OF FINDINGS

The main conclusions of this investigation, which were reached by testing the study's hypotheses, are summarized as follows.

CONCLUSION

Examining the impact of exchange rate fluctuations on Nigeria's level of life was the main goal of the study. The living standard was quantified using the Gross Domestic Product Per Capita (GDPPC), Per Capita Income (PCI), and Unemployment Index (UNEMP), and the exchange rate served as the independent variable. The money supply, inflation rate, and interest rate are all factors that can impact the standard of living. The study questions looked for relationships between changes in exchange rates and Nigeria's GDPPC (gross domestic product per capita); per capita income and the country's unemployment rate. This study helps government agencies formulate macroeconomic policies that would propel Nigeria's economy forward by focusing attention in that direction and offering guidance. This would help the current economic discussions and initiatives aimed at reviving Nigeria's economy and raising the country's residents' standard of living. This has significant effects on the nation's research, development issues, and economic analysis. According to the results of the study's test of the hypothesis, the researcher has concluded that variations in exchange rates have a noteworthy impact on Nigeria's standard of living.

RECOMMENDATIONS

In light of the study's conclusions, the government ought to promote the export of goods and services that could bring in foreign investment and strengthen Nigeria's balance of payments while discouraging the import of goods and services that have domestic substitutes that could put pressure on the exchange rate and lower living standards. The primary sector of the economy, which is the productive sector, should be improved by the government. This will result in the creation of necessities, which will propel the economy of the country and lower unemployment while raising standards of living. The Nigerian government ought to endeavor to implement constructive economic changes that are aimed at improving the country's economic performance and mitigating the adverse effects of exchange rate volatility on the country's standard of life.

No Files Found

Share Your Publication :